bluebird (BLUE) Posts Q1 Earnings, Focuses on Zynteglo, Skysona

bluebird bio BLUE reported revenues of $2.4 million in the first quarter, up from $1.9 million in the year-ago quarter. Revenues missed the Zacks Consensus Estimate of $20 million and our estimate of $3.5 million. The increase of $0.4 million was primarily due to product revenues from Skysona.

The company delivered earnings of 21 cents per share in the first quarter, due to a one-time gain from the company’s second priority review voucher sale (PRV) for $92.9 million. Excluding this gain, the loss per share was 69 cents.

The Zacks Consensus Estimate for the first quarter was a loss of 54 cents.

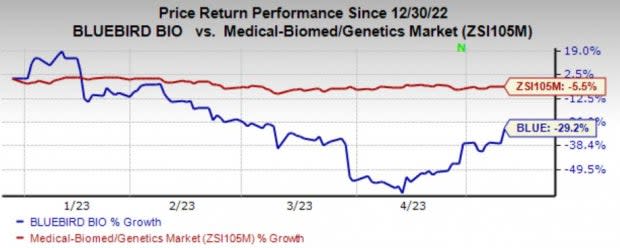

Shares of BLUE have plunged 29.2% so far this year compared with the industry’s 5.5% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development expenses were reduced by 40.7% to $46.1 million, primarily due to decreased employee compensation, benefits and other headcount-related expenses and a fall in R&D production costs in 2023.

Selling, general and administrative expenses increased slightly to $37.3 million from $36.1 million in the year-ago quarter.

As of Mar 31, 2023, bluebird had cash and cash equivalents, marketable securities and a restricted cash balance of approximately $364 million. Based on current operating plans, bluebird expects its cash, cash equivalents, restricted cash and marketable securities to be sufficient to meet its planned operating expenses and capital expenditure requirements into the fourth quarter of 2024. This runway includes approximately $45 million in restricted cash.

bluebird was granted two PRVs upon the FDA’s approval of Zynteglo (betibeglogene autotemcel) for the treatment of beta-thalassemia in adult and pediatric patients requiring regular red blood cell transfusions and Skysona (elivaldogene autotemcel) for the treatment of early, active cerebral adrenoleukodystrophy on Aug 17, 2022 and Sept 16, 2022, respectively.

The company entered into a definitive agreement to sell its first PRV for $102 million in November 2022. It entered a final agreement to sell its second PRV for $95 million in January 2023.

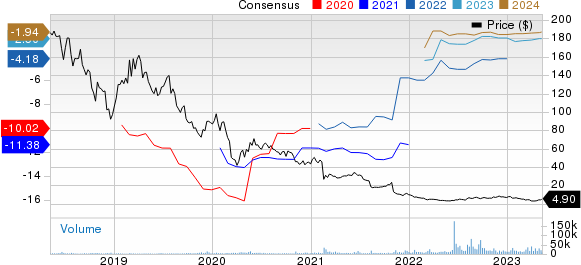

bluebird bio, Inc. Price and Consensus

bluebird bio, Inc. price-consensus-chart | bluebird bio, Inc. Quote

Other Updates

Last month, bluebird bio announced it submitted its biologics license application (BLA) to the FDA for lovo-cel for patients with sickle cell disease (SCD) who are 12 years and older and have a history of vaso-occlusive events. bluebird has requested priority review, which, if granted, would shorten the FDA’s review of the application to six months from the time of filing versus a standard review timeline of 10 months. The company continues to anticipate a commercial launch in early 2024.

bluebird has made significant progress in the launch of Zynteglo with six patient starts (cell collections) for patients with beta-thalassemia. The first commercial infusion has been completed and revenues from Zynteglo is expected to be recognized in the second quarter.

The first commercial infusion for Syksona was completed in March 2023. Cell collection has been completed for three patients to be treated with Skysona. bluebird continues to anticipate 5-10 patient starts this year.

Zacks Rank and Other Stocks to Consider

bluebird currently has a Zacks Rank #3 (Hold).

Some top-ranked stocks in the healthcare sector include Spero Therapeutics SPRO, Ligand Pharmaceuticals LGND and Pacira BioSciences PCRX. While Spero and Ligand sport a Zacks Rank #1 (Strong Buy), PCRX carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 60 days, loss estimates for SPRO have narrowed to $1.02 from $1.45 for 2023. SPRO topped earnings estimates in three of the last four quarters and missed in the remaining one, the average surprise being 56.37%.

Over the past 90 days, earnings estimates for LGND in 2023 have increased by 86 cents to $4.16. LGND topped earnings estimates in two of the last four quarters, missing the other two.

Over the past seven days, earnings estimates for PCRX have increased to $3.56 from $3.51 for 2023. PCRX shares have gained 11.5% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

bluebird bio, Inc. (BLUE) : Free Stock Analysis Report

Spero Therapeutics, Inc. (SPRO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance