Blueprint Medicines (BPMC) Q1 Earnings Beat, Revenues Lag

Blueprint Medicines Corporation BPMC reported a loss of $1.72 per share in the first quarter of 2021, narrower than the Zacks Consensus Estimate of $1.80 and the year-ago quarter’s loss of $2.11.

Total revenues of $21.6 million were up significantly year over year, mainly due to higher collaboration and product revenues. However, the top line missed the Zacks Consensus Estimate of $24.7 million. Revenues include $7.1 million of net product revenues from the sales of Ayvakit (avapritinib) and $1.8 million from the newly approved Gavreto (pralsetinib). Collaboration revenues were $12.6 million, primarily drawn from the agreements with CStone and Roche RHHBY. In the year-ago quarter, Blueprint Medicines recorded $2.7 million as collaboration revenues.

Shares of Blueprint Medicines have plunged 11.8% so far this year compared with industry’s decrease of 0.6%.

Quarter in Detail

Research and development expenses were $79.7 million, down 5.2% from the year-ago quarter’s figure, mainly owing to the reimbursement received under the Roche collaboration deal for Gavreto.

Selling, general and administrative expenses were $42 million, up 17.6% year over year on account of higher costs related to the commercialization of Ayvakit/Ayvakyt (brand name of Ayvakit in Europe) and Gavreto.

Blueprint Medicines had cash, cash equivalents and investments worth $1.4 billion as of Mar 31, 2021, marginally lower than $1.5 billion as of Dec 31, 2020.

Ayvakit & Other Pipeline Updates

In March 2021, the European Medicines Agency validated Blueprint Medicines’ Type II variation marketing authorization application seeking approval for Ayvakyt for the treatment of advanced systemic mastocytosis (“SM”), a rare and debilitating disease.

In February 2021, the FDA accepted Blueprint Medicines’ supplemental new drug application (sNDA) seeking approval of Ayvakit for treating advanced SM. With the FDA granting a priority review to the sNDA, a decision from the regulatory body is expected on Jun 16, 2021. A potential label expansion should also drive sales in the days ahead.

Please note that Ayvakit was approved by the FDA for treating unresectable or metastatic gastrointestinal stromal tumor (“GIST”) harboring a PDGFRA exon 18 mutation, including PDGFRA D842V mutations in adults, in January 2020. Sales of the drug increased 18.3% on a sequential basis during the first quarter.

Please note that, last December, the FDA approved Gavreto (pralsetinib) for the treatment of patients with advanced/metastatic rearranged during transfection (“RET”)-mutant and RET fusion-positive thyroid cancer. In September 2020, the FDA approved Gavreto for the treatment of adults with metastatic RET fusion-positive non-small-cell lung cancer (“NSCLC”).

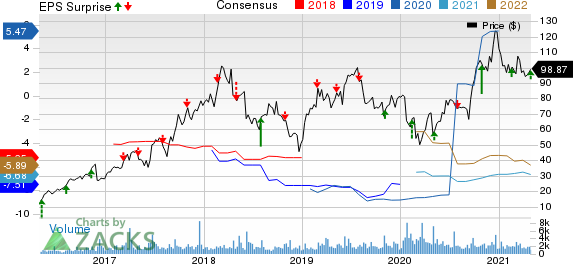

Blueprint Medicines Corporation Price, Consensus and EPS Surprise

Blueprint Medicines Corporation price-consensus-eps-surprise-chart | Blueprint Medicines Corporation Quote

Zacks Rank & Stocks to Consider

Blueprint Medicines currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include ASLAN Pharmaceuticals Limited ASLN and Nabriva Therapeutics AG NBRV , both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ASLAN Pharmaceuticals’ loss per share estimates have narrowed 26.3% for 2021 and 43.9% for 2022 over the past 60 days. The stock has surged 75.9% year to date.

Nabriva Therapeutics’ loss per share estimates have narrowed 40.9% for 2021 and 45.3% for 2022 over the past 60 days.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Blueprint Medicines Corporation (BPMC) : Free Stock Analysis Report

Nabriva Therapeutics AG (NBRV) : Free Stock Analysis Report

ASLAN Pharmaceuticals Ltd. (ASLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance