BNY Mellon (BK) Stock Gains 5.4% as Q1 Earnings Beat Estimates (Revised)

The Bank of New York Mellon Corporation’s BK first-quarter 2020 earnings per share of $1.05 surpassed the Zacks Consensus Estimate of 90 cents. Moreover, the figure reflects a rise of 11.7% from the prior-year quarter.

The stock rose 5.4% in pre-market trading, indicating that investors have taken the results in their stride. Notably, the full-day’s trading session will depict a better picture.

Results benefited from growth in revenues. However, a marginal increase in expenses along with a decline in assets under management (AUM) balance hurt results to some extent. Moreover, significantly higher provisions were an undermining factor.

Net income applicable to common shareholders was $944 million, up from $910 million recorded in the prior-year quarter.

Revenues Improve, Expenses Rise Marginally

Total revenues (GAAP basis), excluding income from consolidated investment management funds, increased 7% year over year to $4.15 billion. The figure surpassed the Zacks Consensus Estimate of $3.79 billion.

Net interest revenues, on a fully taxable-equivalent basis (non-GAAP basis), were $816 million, down 3.4% year over year. The decline resulted from lower interest rates on interest-earning assets and the impact of hedging activities, partially offset by the benefit of lower deposit and funding rates.

Also, non-GAAP net interest margin (FTE basis) contracted 19 basis points year over year to 1.01%.

Total fee and other revenues increased 9.9% year over year to $3.33 billion. The rise was driven by improvement in almost all fee income components except for investment and other income, and distribution and servicing fees.

Total non-interest expenses were $2.71 billion, up marginally from $2.70 billion recorded in the prior-year quarter. This reflects an increase in professional, legal and other purchased service costs, software and equipment costs, bank assessment charges, and other expenses.

Decent Asset Position

As of Mar 31, 2020, AUM was $1.80 trillion, down 2.4% year over year. This reflects the unfavorable impact of a stronger U.S. dollar.

Assets under custody and/or administration of $35.2 trillion grew 2% year over year, reflecting higher client inflows, partially offset by lower market values and the unfavorable impact of a stronger U.S. dollar.

Credit Quality: Mixed Bag

As of Mar 31, 2020, non-performing assets were $88 million, down 49.4% year over year. Moreover, allowance for loan losses as a percentage of total loans was 0.22%, down from 0.27% recorded at the end of the prior-year quarter.

However, in the reported quarter, provision for credit losses was $169 million, up significantly from $7 million recorded in the year-ago quarter.

Capital Ratios Worsen

As of Mar 31, 2020, common equity Tier 1 ratio was 11.3% compared with 11.5% as of Dec 31, 2019. Tier 1 Leverage ratio was 6%, down from 6.6% as of Dec 31, 2019.

Capital Deployment Update

During the first quarter, BNY Mellon bought back 21.7 million shares for $985 million. Further, it paid out dividends worth $282 million to common shareholders.

However, in mid-March, in response to the coronavirus outbreak, the company suspended share buybacks.

Our Viewpoint

The company’s organic growth strategy, global reach and strong balance sheet position will go a long way in supporting the bottom line. Also, expenses are expected to remain manageable in the upcoming quarters as BNY Mellon eliminates unnecessary management layers and automates processes. However, lower interest rates amid the Federal Reserve’s accommodative policy stance will likely hamper the company’s interest revenue growth in the near term.

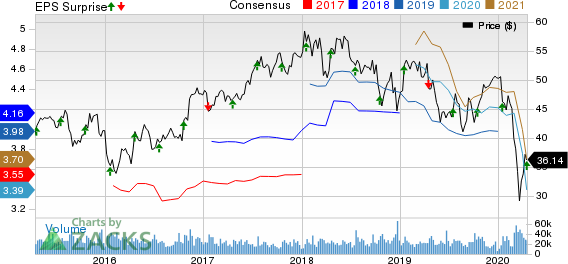

The Bank of New York Mellon Corporation Price, Consensus and EPS Surprise

The Bank of New York Mellon Corporation price-consensus-eps-surprise-chart | The Bank of New York Mellon Corporation Quote

Currently, BNY Mellon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Schedule of Other Banks

Among other banks, Community Bank System CBU is scheduled to release quarterly results on Apr 20, while Atlantic Capital Bancshares ACBI will report earnings on Apr 23. FB Financial Corporation FBK is scheduled to release results on Apr 27.

(We are reissuing this article to correct a mistake. The original article, issued on Apr 16, 2020, should no longer be relied upon.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Community Bank System, Inc. (CBU) : Free Stock Analysis Report

Atlantic Capital Bancshares, Inc. (ACBI) : Free Stock Analysis Report

FB Financial Corporation (FBK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance