Boeing Secures a Contract to Support F/A-18 E/F Aircraft

The Boeing Company BA recently clinched a deal to support its F/A-18 E/F aircraft. The award has been provided by the Naval Supply Systems Command Weapon Systems Support, Philadelphia, PA.

BA’s New Deal: Details to Note

The deal, valued at $44.7 million, is slated to be completed by March 2029. According to the agreement, Boeing will provide 31 cylinder and piston spares for the F/A-18 E/F aircraft.

The work related to this deal will be carried out in Ajax, Ontario, Canada and St. Louis, MI.

What’s Favoring BA Stock?

Nations are strengthening their military capabilities in response to the world's expanding threat environment. In such circumstances, military aircraft that play an important part in military operations have been witnessing a major increase in demand. This is likely to have led the Mordor Intelligence firm to predict that the global fighter aircraft market will witness a CAGR of 3.7% during the 2024-2029 period. These projections indicate significant growth opportunities for leading combat jet manufacturers like Boeing.

Its F/A-18 Block III Super Hornet is the most advanced, cost-effective and readily accessible combat aircraft in the U.S. Navy arsenal. It provides cutting-edge, next-generation multi-role strike fighter capabilities that will outperform existing and new adversaries for many years to come. The Super Hornet comes in two versions — the single-seat E model and the two-seat F model — and it can perform almost any tactical mission, such as air superiority, day and night strikes with precision-guided weapons, fighter escort and close air support.

The company’s military jet portfolio also includes other combat-proven aircraft, such as the F-15, P-8, T-7A Red Hawk, EA-18 Growler and C-17 Globemaster III.

Opportunities for BA’s Peers

Other aerospace companies that are likely to reap the benefits of the global fighter aircraft market are as follows:

Northrop Grumman Corp. NOC: It is a leading provider of manned and unmanned air systems. It builds some of the world’s most advanced aircraft like the E-2C Hawkeye 2000, A-10 Thunderbolt II, F-5 Tiger Fighter Jet, F-35 Lightning II and many more.

Northrop has a long-term (three to five years) earnings growth rate of 8.7%. The Zacks Consensus Estimate for NOC’s 2024 sales calls for an improvement of 5.4% from the prior-year reported figure.

Embraer ERJ: The company offers a comprehensive portfolio of the most advanced aircraft in the combat market, which includes the A-29 Super Tucano light attack and advanced trainer and the C-390 Millennium military multi-mission aircraft.

Embraer delivered an average earnings surprise of 52.28% in the last four quarters. The Zacks Consensus Estimate for ERJ’s 2024 sales implies an improvement of 19.1% from the prior-year reported figure.

Lockheed Martin Corp. LMT: The company is among the leaders in the combat aircraft space, with its product portfolio constituting some of the most advanced military aircraft like the F-35 Lightning II, C-130 J Super Hercules, F-16 Fighting Falcon and a few more.

Lockheed Martin boasts a long-term earnings growth rate of 4.7%. The Zacks Consensus Estimate for LMT’s 2024 sales suggests an improvement of 5.3% from the prior-year reported figure.

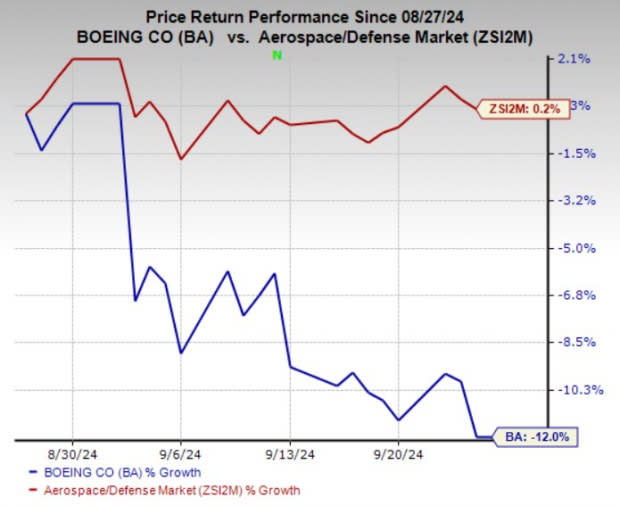

BA Stock Price Movement

In the past month, shares of Boeing have fallen 12% against the industry’s growth of 0.2%.

Image Source: Zacks Investment Research

Zacks Rank

Boeing currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report