Boku (LON:BOKU) Shareholders Booked A 96% Gain In The Last Three Years

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Boku, Inc. (LON:BOKU), which is up 96%, over three years, soundly beating the market decline of 12% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 65%.

See our latest analysis for Boku

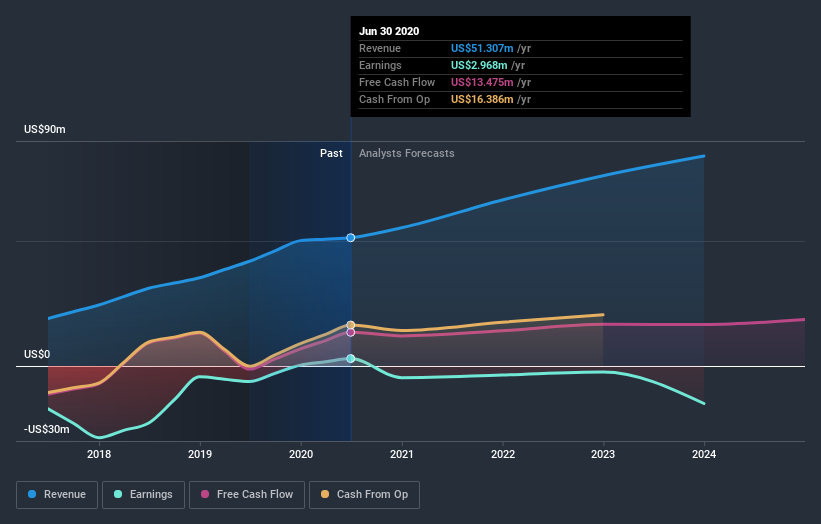

Given that Boku only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Boku's revenue trended up 32% each year over three years. That's well above most pre-profit companies. The share price rise of 25% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put Boku on your radar. If the company is trending towards profitability then it could be very interesting.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Boku in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Boku rewarded shareholders with a total shareholder return of 65% over the last year. That gain actually surpasses the 25% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Boku on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Boku better, we need to consider many other factors. Even so, be aware that Boku is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Boku is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance