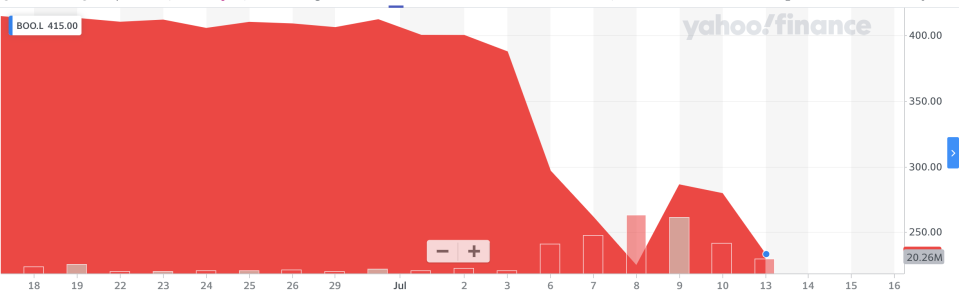

Fixing Boohoo could cost £20m as stock continues to slide

Fixing Boohoo’s (BOO.L) supply chain issues could cost £20m ($25.2m) top analysts have warned, as the fast fashion brand’s stock price continues to dive.

Bank of America said in a note sent to clients on Monday that costs at Boohoo could increase by between £10m and £20m as it tries to fix issues in its supply chain.

The company was last week accused of benefiting from illegal factory conditions in Leicester. The Sunday Times claimed workers in a factory that supplied Boohoo were paid just £3.50 an hour, far below the £8.72 minimum wage for over 25s.

Boohoo said last week its early investigations did not find evidence of people paid £3.50 an hour but did find other breaches of workplace regulation. The company has launched a full independent investigation into its supply chain.

“The key unknown is the extent to which underpayment of workers is prevalent,” a team at Bank of America, led by analyst David Holmes, wrote.

“If small scale, bad actors can be identified, relationships terminated and capacity shifted to abiding factories. The incremental cost in such a scenario should be limited.”

READ MORE: Boohoo slumps on factory exposé

However, the analysts warned: “Labour behind the Label has suggested issues are endemic in Leicester. If that's the case, it could be harder to terminate relationships. Wage increases may have to be passed on to Boohoo via higher buy-in prices. Currently, it's hard to completely rule out this scenario.”

The report from Bank of America came as Boohoo’s share price continued to plummet. The stock shed another 15% on Monday, meaning around £2bn has been wiped off the company’s value since allegations first broke almost two weeks ago.

On Friday, Standard Life Aberdeen, one of Boohoo’s biggest shareholders, sold off some of its holdings in the company and lambasted Boohoo’s response to the crisis as “inadequate”.

A spokesperson for Boohoo said the company was “disappointed” with Standard Life Aberdeen’s decision.

“We believe that our actions taken, including our recently announced independent review, make it very clear just how determined we are to ensure that our entire supply chain adheres to our Code of Conduct,” the spokesperson added.

Over the weekend, the Sunday Times followed up with a separate report alleging a Boohoo warehouse was a “breeding ground” for COVID-19 — 25 workers at the site in Sheffield were said to have contracted the virus.

A spokesperson for Boohoo said the warehouse, which was operated by a third party logistics provider, was “operated in accordance with government guidelines”. The spokesperson also said investigations by Public Health England concluded “transmission was more likely to have occurred within households”.

READ MORE: Boohoo launches independent investigation into Leicester factory allegations

“Boohoo is thankful that those who developed COVID-19 have now fully recovered or are well on the road to doing so,” the spokesperson said. “It will continue to monitor the situation on an on-going basis.”

Bank of America said continued negative headlines around Boohoo could slow revenue growth to 15% to 20% this year, compared to growth of 44% last year.

The American investment bank cut its target price for shares from 475p to 350p but kept a “buy” rating on the stock. Shares in Boohoo are currently changing hands for around 237p.

Analysts at stockbroker Shore Capital reiterated a “sell” rating on the stock on Monday morning, saying: “There will be growing difficulty for ESG [ethical, social, and governance] investors in this arena.”

Yahoo Finance

Yahoo Finance