Booking Holdings (BKNG) Acquires Getaroom, Bolsters Priceline

Booking Holdings Inc. BKNG has completed the acquisition of U.S.-based Getaroom in exchange for $1.2-billion cash.

The company signed a definitive agreement with private equity firm Court Square Capital Partners for the buyout of Getaroom.

Getaroom is a leading B2B distributor of hotel rooms, mainly for travelers within or traveling to North America. The company provides an advanced solution to global partners who want to deliver hospitality experiences to employees and customers. It also aims to simplify the cost of global distribution for hotels. Further, the company has more than 150 affiliates, which remains a positive for Booking Holdings.

Getaroom will join Booking Holdings’ subsidiary, Priceline’s Strategic Partnerships team named Priceline Partner Network. Thus, the buyout has added strength to Priceline’s offerings.

Combining solutions of both Getaroom and Priceline, BKNG strives to make enhancements in B2B distribution for hotel partners. It also focuses on providing accommodation-related technological capabilities to affiliate partners.

On the back of this acquisition, Booking Holdings is expected to gain momentum among travelers planning to book hotel rooms, majorly in North America. This, in turn, is likely to generate more bookings and hence drive top-line growth.

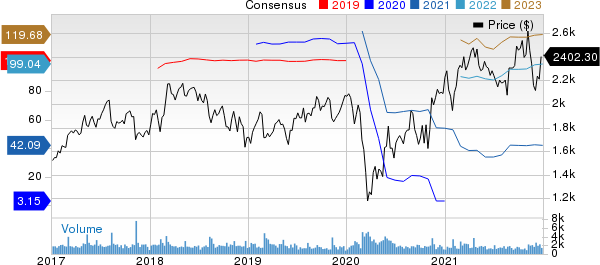

Booking Holdings Inc. Price and Consensus

Booking Holdings Inc. price-consensus-chart | Booking Holdings Inc. Quote

Priceline Division in Focus

Priceline is a leading online travel agency, known best for finding discount rates for travel-related purchases such as airline tickets and hotel stays.

The company has been executing strong growth, primarily in the U.S. domestic travel market, as the country has recovered significantly faster than the global travel market from the impacts of the coronavirus pandemic.

Further, Priceline, in collaboration with the United States Armed Forces, the National Guard, and the Office of the Secretary of Defense, introduced a leisure travel site, namely American Forces Travel. The website is aimed at offering great deals and benefits to the current and retired members and families of the armed forces as well as civilians working in the U.S. Department of Defense (DoD). Further, the DoD recently expanded the benefits of the website to all Veterans of the country’s armed forces and added 16 million users to the booking platform. This shows the U.S. defense department’s trust in the brand, which remains a major tailwind.

Apart from this, Priceline keeps bringing attractive deals to grab more travelers to its platform. It recently announced the Black Friday Sales Event and Cyber Monday Sale and provided travelers with extra savings on hotels, rental cars, flights, cruises, and more. It also announced the Seasons of Savings event on Nov 30 and rolled out newer deals.

Competitive Scenario

Growing initiatives in Priceline are expected to help BKNG — carrying a Zacks Rank #3 (Hold) — gain a competitive edge against other online travel agencies like TripAdvisor TRIP, Expedia EXPE and MakeMyTrip Limited MMYT.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TripAdvisor has been gaining momentum in the travel industry on the back of its subscription-based program, TripAdvisor Plus, which offers many perks and benefits to subscribed members. Further, the company partnered with four hotel technology providers, namely SiteMinder, Roiback, Derbysoft and WebHotelier. With this collaboration, thousands of hotels connected to TripAdvisor Plus to gain more customers.

Meanwhile, Expedia is focusing on making strong initiatives to gain traction across travelers. The company along with its subsidiaries, Hotels.com and Vrbo, recently released the holiday gift guide featuring nearly 100 travel experiences with great savings.

MakeMyTrip has been forming strategic partnerships to gain an edge in the travel market. The company signed a Memorandum of Understanding with India’s Ministry of Tourism to promote hotels and stay properties that have been self-certified on the platform of SAATHI (System for Assessment, Awareness & Training for the Hospitality Industry). Further, MMYT collaborated with a travel booking app, Hopper, to help travelers save money with personalized recommendations and flexible booking capabilities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance