Boot Barn (BOOT) Is Staying Ahead of the Curve: Here's Why

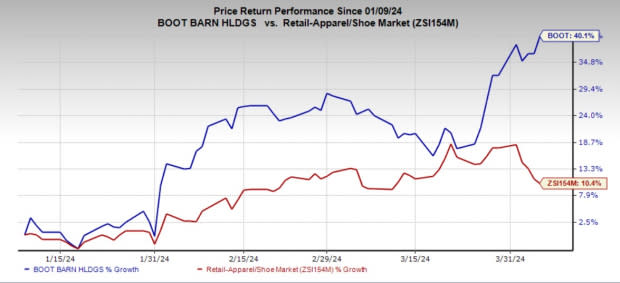

Boot Barn Holdings, Inc. BOOT has not only navigated market challenges but also showcased remarkable resilience and growth potential. Based in Irvine, CA, BOOT remains a beacon of resilience, adaptability and growth, with its stock surging an impressive 40.1% in the past three months compared with the industry's rise of 10.4%.

The cornerstone of Boot Barn Holdings’ success lies in its effective merchandising strategies, robust omnichannel capabilities, meticulous expense management and customer-centric approach. These, coupled with a strategic expansion of its store base, have enabled this Zacks Rank #3 (Hold) company to steadily gain market share.

Let’s Delve Deep

Boot Barn Holdings has emerged as an attractive investment prospect, driven by its robust fundamental drivers and strategic initiatives. In the third quarter of fiscal 2024, BOOT demonstrated its resilience with a 1.1% increase in total sales, primarily driven by the successful integration of new stores. With 11 new stores added in the quarter, Boot Barn Holdings concluded the quarter with 382 stores spanning 44 states.

BOOT's focus on customer segmentation has yielded results. The introduction of artificial intelligence in both in-store and online interactions exemplifies the company’s commitment to enhancing customer experience, fostering brand loyalty and consequently driving sales.

Image Source: Zacks Investment Research

A pivotal aspect of Boot Barn Holdings’ success lies in its exclusive brand penetration, which increased 310 basis points to 37.3% of sales in the last reported quarter. This strategic move not only enriches product offerings but also significantly boosts the company's margin profile.

Boot Barn Holdings’ focus on merchandise margin expansion, driven by a combination of factors such as freight improvement and product margin expansion, signals operational efficiency and prudent cost management. During the quarter, Boot Barn Holdings achieved a remarkable 300 basis points of merchandise margin expansion.

Management anticipates fiscal 2024 total sales between $1.654 billion and $1.664 billion. The gross profit is projected to land between $605.7 million and $610.6 million or approximately 36.6% to 36.7% of sales, indicating an estimated 170-basis point increase in the merchandise margin.

Wrapping Up

With an expanding store network, a growing and loyal customer base and a focus on high-margin exclusive brands, Boot Barn Holdings stands poised for sustained growth.

3 Stocks Looking Hot

Here, we have highlighted some better-ranked stocks, namely American Eagle Outfitters AEO, Abercrombie & Fitch ANF and Deckers Outdoor Corporation DECK.

American Eagle Outfitters is a leading global specialty retailer offering on-trend clothing, accessories and personal care under its American Eagle and Aerie brands. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal sales and EPS suggests growth of 3.3% and 12.5%, respectively, from the year-ago reported figure. AEO has a trailing four-quarter earnings surprise of 22.7%, on average.

Abercrombie & Fitch, a leading, global, omnichannel specialty retailer of apparel and accessories for men, women and kids, sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 715.6%, on average.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales and EPS suggests growth of 5.6% and 19.1%, respectively, from the year-ago reported figure.

Deckers, a global leader in designing, marketing and distributing innovative footwear, apparel and accessories, carries a Zacks Rank #2 (Buy). DECK has a trailing four-quarter earnings surprise of 32.1%, on average.

The Zacks Consensus Estimate for Deckers’ current fiscal sales and EPS suggests growth of 15.8% and 38.7%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance