Booz Allen (BAH) Shares Barely Move Since Q3 Earnings Beat

Booz Allen Hamilton Holding Corp. BAH reported impressive third-quarter fiscal 2023 results, with both earnings and revenues beating the respective Zacks Consensus Estimate. However, the better-than-expected results failed to impress the market as there has not been any major price change since the earnings release on Jan 27.

Quarterly adjusted earnings (excluding 84 cents from non-recurring items) per share of $1.07 beat the Zacks Consensus Estimate by 4.9% and increased 4.9% on a year-over-year basis.

Revenues, Backlog & Headcount Increase Y/Y

Total revenues of $2.3 billion beat the Zacks Consensus Estimate by 4% and increased 12.1% on a year-over-year basis. Revenues, excluding billable expenses, were $1.6 billion, up 11.2% on a year-over-year basis. Billable expenses contributed 32% to revenues.

Total backlog increased 8.2% from the prior-year quarter’s reported figure to $30 billion. The funded backlog of $4.5 billion increased 12.5% year over year. The unfunded backlog was up 7.8% to $10.1 billion.

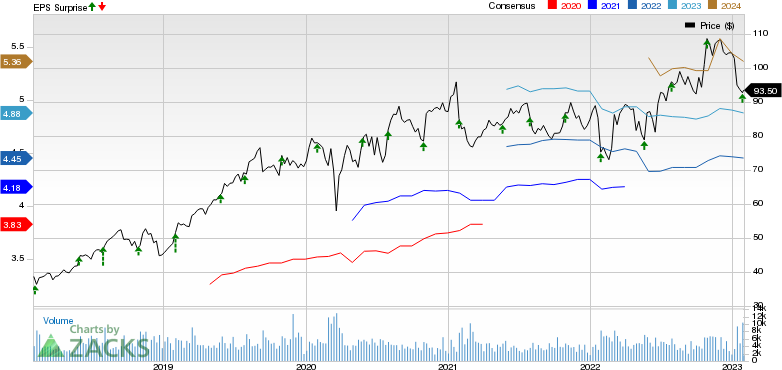

Booz Allen Hamilton Holding Corporation Price, Consensus and EPS Surprise

Booz Allen Hamilton Holding Corporation price-consensus-eps-surprise-chart | Booz Allen Hamilton Holding Corporation Quote

Priced options were up 7.7% to $15.4 billion. Book-to-bill ratio was 0.09, down 76.9% year over year. The headcount of 31,130 increased 5.7% year over year.

Margins Decline

Adjusted EBITDA amounted to $244.1 million, up 9.8% year over year. Adjusted EBITDA margin on revenues was 12.4%, down from the year-ago quarter’s 12.8%. Adjusted EBITDA margin on revenues, excluding billable expenses, decreased to 10.7% from 10.9% in the year-ago quarter.

Key Balance Sheet & Cash Flow Numbers

Booz Allen exited the quarter with cash and cash equivalents of $370.9 million compared with $756.5 million at the end of the prior quarter. Long-term debt (net of current portion) was $2.78 billion compared with $2.8 billion in the prior quarter.

The company generated $138.6 million of net cash from operating activities. Capital expenditures were $21.6 million and free cash flow was $116.9 million. The company paid out dividends worth $57.3 million and repurchased shares worth $10.8 million in the reported quarter.

Raised Fiscal 2023 Outlook

Booz Allen currently projects revenue growth in the range of 9.5-10.5% compared with the previous projection of 8-10%. It expects adjusted EPS in the range of $4.35-$4.5 compared with the prior expectation of $4.25-$4.5. The midpoint ($4.425) of the revised EPS guidance is below the current Zacks Consensus Estimate of $4.45.

Adjusted EBITDA is expected to be between $995 million and $1,015 million compared with the prior anticipation of $975 million and $1,015 million. Adjusted EBITDA margin on revenues are still anticipated in the range of high 10%-to-low 11%. Net cash provided by operating activities is still expected in the range of $875-$950 million.

Booz Allen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Earnings Snapshots

Robert Half International Inc. RHI reported mixed fourth-quarter 2022 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed the same.

Quarterly earnings of $1.37 per share beat the Zacks Consensus Estimate by 1.5% but declined 9.3% year over year. Revenues of $1.73 billion missed the Zacks Consensus Estimate by 0.6% and decreased 2.4% year over year.

Automatic Data Processing, Inc. ADP reported better-than-expected second-quarter fiscal 2023 results.

Adjusted earnings per share of $1.96 beat the Zacks Consensus Estimate by 0.5% and grew 19% from the year-ago fiscal quarter’s reading. Total revenues of $4.4 billion beat the Zacks Consensus Estimate by 0.3% and improved 9.1% from the year-ago fiscal quarter’s reading on a reported basis and 10% on an organic constant-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Robert Half International Inc. (RHI) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance