Boston Beer (SAM) Stock Moving Up the Charts: What's Ahead?

The Boston Beer Co. Inc. SAM has been exhibiting consistent growth as evident from its stock movement, which has hardly witnessed a dip in quite some time. The company’s strong performance can be attributed to its three point growth plan focused on revival of Samuel Adams and Angry Orchard brands, cost saving initiatives and long-term innovation. Additionally, the company is poised to gain from industry growth trends.

Recent observations reveal that alcohol sales trends have been witnessing a change, with a rise in demand for more flavored products like the honey and cinnamon flavored whiskeys and higher-priced tequilas. The industry has recently witnessed the spirits segment gathering momentum, accounting for about 36% of the total alcohol market, seizing share from beer and wine sales.

However, beer still accounts for 47% of the market share as craft beer and Mexican imports remained popular throughout 2016 and into 2017. We believe Boston Beer is well-positioned to gain from these ongoing industry trends.

This largest craft brewer in the United States has seen its shares advance 30.9% in the last three months, outpacing the industry’s upside of 11%. Currently, the industry is placed at the top 39% of the Zacks classified industries (103 out of 265). In fact, the company’s shares have substantially outperformed the broader Consumer Staples sector’s gain of 1.4%, which is placed at the top 38% (6 out of 16) of the Zacks classified sectors.

These factors have aided the company to retain the Zacks Rank #3 (Hold), while carrying a VGM Score of A. That said, let’s find out more about the factors aiding this Boston, MA-based company’s performance.

Strong Brands Portfolio Provides an Edge

Boston Beer is the largest premium craft brewer in the United States, and commands a strong portfolio of globally recognized brands. Apart from selling alcoholic beverages in the United States, the company distributes beverages in Canada, Europe, Israel, Caribbean, Pacific Rim, Mexico, as well as Central and South America through a strong network of wholesale distributors. We expect the company’s continued focus on pricing, product innovation and brand development to boost operational performance and position in the market.

Robust Earnings Trend and Outlook Stirs Optimism

Boston Beer reported third straight earnings beat in second-quarter 2017, while sales returned to growth after three consecutive misses. Results benefited from top-line gains accompanied by gross margin improvement and lower operating costs owing to the company’s cost saving initiatives. Further, gross margins expanded in the quarter attributable to higher revenues per barrel that resulted from better pricing and package mix, along with lower brewery processing cost per barrel due to cost saving initiatives.

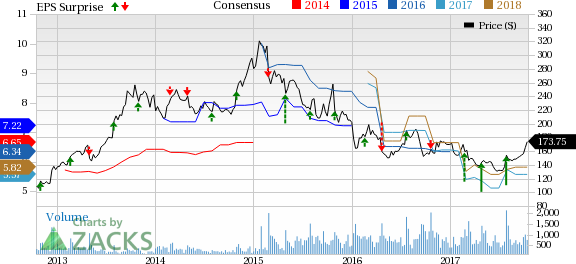

Boston Beer Company, Inc. (The) Price, Consensus and EPS Surprise

Boston Beer Company, Inc. (The) Price, Consensus and EPS Surprise | Boston Beer Company, Inc. (The) Quote

Moreover, the company raised the lower-end of its previously stated guidance range. The company now estimates adjusted earnings per share in the range of $5.00-$6.20 compared with the prior guidance of $4.20-$6.20.

Strategic Actions Keep it Going

Management remains committed to a three point growth plan focused on revival of its Samuel Adams and Angry Orchard brands, cost saving initiatives and long-term innovation. One, the company is keen on the revival of the Samuel Adams and Angry Orchard brands via its packaging, innovation, promotion and brand communication initiatives. Further, it targets maintaining momentum for the Twisted Tea brand.

Two, the company has accelerated focus on cost savings and efficiency projects, while ensuring that these savings are directed for further brand development. In this regard, the company has adjusted the organization to the new volume environment, while at the same time retained its capability to innovate and return to growth. This is reflected in the improved gross margin and increased spending on brands in second-quarter 2017. Based on this early success, the company continues to anticipate improving gross margin by one percentage point every year through 2019.

The company’s third priority is long-term innovation, wherein its focus currently revolves around maintaining the leadership of its Truly Spiked & Sparkling brand and ensuring it reaches full potential.

Additionally, Boston Beer always seeks strategic opportunities to expand business through inorganic means. The company’s past record reveals that it believes in reinvesting its profits toward capital expenditures rather than distributing the same to shareholders. Since its inception, the company has made significant investments toward acquiring brewing assets, enhancing research & development (R&D) as well as packaging and marketing of products. The company mainly focuses on acquiring assets which can fulfill its goal of enhancing brewing capacity as well as expanding into new geographic regions.

Possible Deterrents

While all is well with this renowned beer company, its depletion trends continued to be soft due to persistent decline in the Samuel Adams and Angry Orchard brands, as well as fall in Coney Island. Further, challenges related to a competitive retail backdrop persist. The company continues to project soft depletion trends for 2017.

Nevertheless, we suggest holding on to the stock at this time as the aforementioned concerns are mostly addressed by its strategic actions, which focuses on reviving the distressed brands.

Want More of Beverage Stocks? Check These

Some better-ranked stocks in the same industry include Brown-Forman Corp. BF.B, sporting a Zacks Rank #1 (Strong Buy), Constellation Brands Inc. STZ and Carlsberg AS CABGY, each carrying Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Brown-Forman has jumped nearly 15.9% in the last three months. Moreover, the company has delivered an average positive earnings surprise of 2.7% in the trailing four quarters.

Constellation Brands has gained nearly 6.1% in three months. Moreover, it has a long-term earnings growth rate of 14.8%.

Carlsberg has surged 31.5% year to date. Further, the company has a VGM Score of B.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown Forman Corporation (BF.B) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

Carlsberg AS (CABGY) : Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance