Boston Scientific (BSX) Benefits From New Buyouts, FX Woes Stay

Boston Scientific BSX is gaining traction in emerging markets. Also, accretive acquisitions and significant progress in the company’s restructuring initiatives buoy optimism. However, unfavorable currency movement was a major dampener in the second quarter of 2022. Strong competitors in the large medical device market also pose a tough challenge for Boston Scientific. The stock carries a Zacks Rank #3 (Hold).

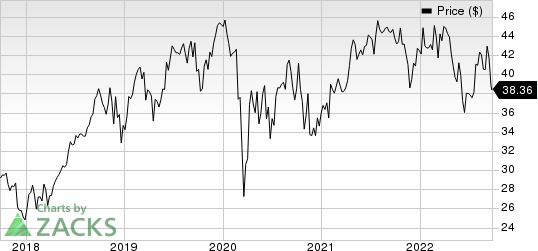

Over the past year, Boston Scientific has outperformed the industry it belongs to. The stock has lost 11.3% compared with the industry’s 31.3% fall. Boston Scientific ended the second quarter of 2022 on a bullish note, with adjusted earnings and revenues surpassing the Zacks Consensus Estimate. Total operational sales grew 10% from the prior year. Organic sales grew 7% compared with 9% organic growth in the year-ago period (versus 2019). The reported quarter’s organic revenues also exceeded the high end of the company’s guidance range of 3% to 6%. The company’s organic growth performance was strong across all regions where most of its businesses grew at the same pace or faster than their competitors in the respective markets.

In the United States, Boston Scientific delivered operational growth of 7% despite the issue of the contrast dye shortage primarily impacting the coronary therapies, WATCHMAN and PI business. In Europe, the Middle East, Africa, the business grew 12% on an operational basis on robust broad-based growth across the EMEA region, with five of eight business units posting double-digit growth. Key products in emerging markets within the region are driving growth across the portfolio with particular strength in electrophysiology, WATCHMAN and interventional cardiology therapies. In Asia-Pac, Boston Scientific grew 11% operationally with notable performance in Japan, India and the ASEAN countries.

Boston Scientific Corporation Price

Boston Scientific Corporation price | Boston Scientific Corporation Quote

We are also impressed with Boston Scientific’s several recent acquisitions that have added numerous products (though many are under development) with immense potential. This, in turn, should help boost the top line in the long term. The company is optimistic about its acquisition of Israel-based Lumenis, which develops and commercializes energy-based medical solutions. The acquisition expands Boston Scientific’s Urology portfolio with its differentiated laser technology.

Apart from this, the acquisition of Preventice Solutions (which offers new-generation detection algorithms, a broad portfolio with BodyGuardian MINI and establishes a strong position for Boston Scientific in the field of cardiac diagnostics) grew 20% on a full-year pro forma basis in 2021, driven by the company’s differentiated portfolio and strong execution. Within Electrophysiology, the early launch of Farapulse has been progressing well in Europe.

In February 2022, Boston Scientific purchased Baylis Medical Company. This business is expected to expand the company’s electrophysiology and structural heart product offerings with the addition of the radiofrequency (RF) NRG and VersaCross Transseptal Platforms as well as a range of guidewires, sheaths and dilators. In the second quarter, the Farapulse, Lumenis and Baylis acquisitions contributed 300 basis points to revenue growth.

Boston Scientific currently expects full-year 2022 operational revenue growth to include a 250-basis-point contribution from the acquisitions of Preventice, FARAPULSE, Lumenis and Baylis and $13 million of pre0divestiture specialty pharmaceutical sales in 2021.

On the flip side, during the second quarter, Boston Scientific’s total revenues reflected a $130 million or 420-basis point headwind from foreign exchange, higher than the company’s expectations, due to the strengthening of the U.S. dollar. Although the company currently expects some stabilization in the cost of freight, it anticipates incremental second-half headwinds of approximately $75 million versus the pre-COVID level, resulting from inefficiencies in manufacturing plants due to the availability of direct materials and the cost to procure them.

This incremental $75 million brings the total headwind versus 2019 to $375 million. This headwind is primarily due to inflationary pressure on direct materials, freight and labor costs, as well as inefficiencies in manufacturing plants due to material availability. The company now expects the full-year adjusted gross margin to be slightly below the second half 2021 adjusted gross margin of 70.8%. Due to the increased macroeconomic pressure on gross margin, the company now anticipates the full-year adjusted operating margin to be within the range of 26% to 26.2%.

Further, declining worldwide pacemaker sales over the recent past continued to weigh on Boston Scientific's CRM results. However, pacemaker sales should gradually improve with new product launches (including the launch of RESONATE platform) and easier comps.

Key Picks

Some better-ranked stocks in the broader medical space are ShockWave Medical SWAV, McKesson MCK and Semler Scientific SMLR. While ShockWave Medical sports a Zacks Rank #1 (Strong Buy), McKesson and Semler Scientific carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ShockWave Medical have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. SWAV stock has gained 41.4% so far this year.

ShockWave Medical delivered an earnings surprise of 180.1%, on average, in the last four quarters.

McKesson’s earnings per share estimates increased from $23.26 to $24.25 for fiscal 2023 and $25.41 to $26.04 for fiscal 2024 in the past 60 days. MCK has gained 38.1% so far this year.

McKesson delivered an earnings surprise of 13.00%, on average, in the last four quarters.

Estimates for Semler Scientific’s earnings per share increased from $1.37 to $1.58 for 2022 and $2.39 to $2.42 for 2023 in the past 60 days. SMLR has declined 59.9% so far this year.

Semler Scientific has an earnings yield of 4% against a negative yield for the industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Semler Scientific Inc. (SMLR) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance