Wine prices set to rise as production nears 50-year low

Wine lovers should brace themselves – a the cost of a bottle of affordable plonk could soon be on the rise.

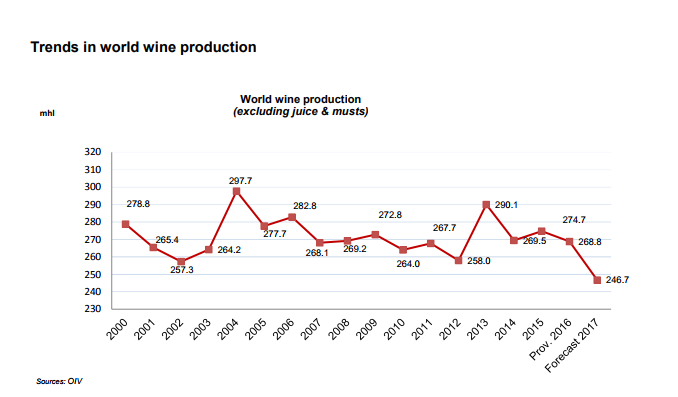

Global wine production is expected to fall to its lowest level in more than 50 years, new figures show.

Frosts and droughts across Europe this year have seen grape crops badly hit, the International Organisation of Vine and Wine reports.

MORE: See what posh nosh upmarket magazine Tatler selects from Aldi and Lidl

In the European Union, extreme weather events “significantly impacted 2017 wine production”, which was historically low, it says.

While Italy confirmed its place as the leading world producer for the third year running in 2017, its production will fall 23% to 39.3 million hectolitres.

France will see a 19% drop to 36.7m h/l, while Spain will see a 15% fall in production to 33.5m h/l.

A hectolitre is 100 litres, equivalent to about 133 standard 750ml bottles.

Portugal (6.6 mhl), Romania (5.3 mhl), Hungary (2.9 mhl) and Austria (2.4 mhl) were the only countries to record a rise compared with 2016. After two previous poor harvests, Romania returned to a high level of production.

MORE: The cost of Britain’s favourite tipple has increased 6%

Outside of Europe, however, the picture is less alarming, with Australian levels up 6% and substantial increases in South American wine production.

The US was expected to see a slight dip, although the figures were compiled before recent wildfires swept across the Californian wine country.

However, on a global scale, wine production will sink to levels not seen since 1961, the OIV says. Output is expected to fall to 246.7 million hectolitres in 2017, down 8% from last year.

The OIV says reduced global production may erode a surplus over demand seen in recent years, when consumption was curbed by the effects of the world financial crisis in 2008.

The impact of the slump on actual market supply and prices depends on levels of stocks from previous years and the quality of wine in landmark regions.

MORE: Cheers! This brewery wants to pay you to drink beer

Thierry Coste, chairman of the EU’s wine union, Copa-Cogeca, said: “The quality of the grape is nevertheless expected to be very good across Europe, which should make for an excellent wine.”

However, higher quality grapes could see prices rise at the lower end of the market.

A report last week from analysts at Rabobank warned of the knock-on impact of a fall in production.

“We still foresee a dramatic decline in wine availability going into 2018,” said Stephen Rannekleiv, a global beverages strategist at Rabobank. “We expect the decline [in consumption] to be felt most tangibly in the lower-priced tiers.”

Yahoo Finance

Yahoo Finance