BOX Upgrades e-Signature Capability With Innovative Features

Box BOX updated its e-signature capability named Box Sign with a new set of innovative features.

The recent features include a ready-sign link, revise signature request, signature framing, enhanced sing-relay integration, signer navigation and API updates for webhooks and redirect flows.

With these features, Box Sign users can publish documents online for signature, edit signature requests in flight, avail visual evidence of a document signed using Box Sign, and more.

On the back of the recent Box Sign features, BOX aims to help all Box customers do more with the Box content cloud without additional costs.

This is expected to boost the adoption rate of Box Sign in the days ahead. More than half a million Box users are already leveraging Box Sign to speed up the digital transaction process.

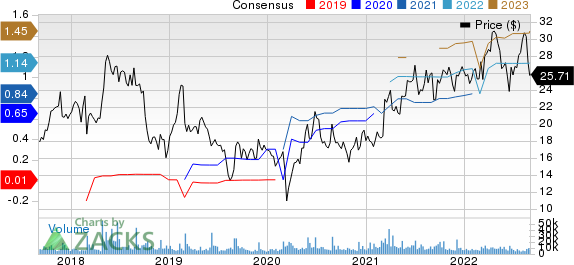

Box, Inc. Price and Consensus

Box, Inc. price-consensus-chart | Box, Inc. Quote

Portfolio Strength

With the introduction of these innovative features, Box added strength to the e-signature capability.

Further, BOX is consistently bringing advanced technological solutions to better serve its customers.

In April, Box introduced the Box App Center, which gives customers access to several applications. The App Center is an open platform that integrates with more than 1500 applications, such as Microsoft Teams, Slack, ServiceNow, Google Workspace and Salesforce.

Box also introduced virtual whiteboarding and visual collaboration experience solution named Box Canvas to offer a secure collaboration platform to hybrid teams.

This apart, Box enhanced the Box Admin Console by introducing monitoring and reporting tools. With these, BOX aims to help customers protect important data so that they can run their businesses securely.

Clientele Expansion

Box’s robust product portfolio is expected to continue helping it gain momentum among government and private organizations.

In June, Box was chosen by a clinical trial data management company Clario to centralize regulated and unregulated content in the cloud.

Box was selected by the Pan-American Life Insurance Group in May to facilitate a smooth collaboration and better digital experiences for its employees and customers.

In February, Box’s content cloud platform was selected by Japan Post to securely share critical information with both internal and external users.

Box’s growing customer base is expected to continue contributing well to its top-line growth in the days ahead.

This, in turn, is likely to help Box win investors’ confidence in the near and the long term.

Shares of Box have been down 1.9% in the year-to-date period, outperforming the Zacks Computer and Technology sector’s decline of 28.7%.

Zacks Rank & Stocks to Consider

Currently, Box carries a Zacks Rank #3 (Hold). Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Arista Networks ANET, ASE Technology ASX and Monolithic Power Systems MPWR. While Arista Networks sports a Zacks Rank #1 (Strong Buy), ASE Technology and Monolithic Power Systems carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks has lost 18.4% in the year-to-date period. The long-term earnings growth rate for ANET is currently projected at 18.6%.

ASE Technology has lost 28.3% in the year-to-date period. The long-term earnings growth rate for ASX is currently projected at 23.1%.

Monolithic Power Systems has lost 13.8% in the year-to-date period. The long-term earnings growth rate for MPWR is currently projected at 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Monolithic Power Systems, Inc. (MPWR) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance