Boyd Gaming (BYD) Q2 Earnings & Revenues Beat Estimates

Boyd Gaming Corporation BYD reported decent second-quarter 2022 results, with earnings and revenues beating the Zacks Consensus Estimate. Both the metrics surpassed their respective consensus mark for the ninth straight quarter. The top line rose year over year, while the bottom line declined year over year. Following the results, shares of the company moved up 3.7% during the after-hours trading session on Jul 26.

Earnings and Revenues

In the quarter under review, adjusted earnings per share (EPS) were $1.48, outpacing the Zacks Consensus Estimate of $1.38 by 7.3%. In the prior-year quarter, the company reported an adjusted EPS of $1.54.

Total revenues of $894.5 million beat the consensus mark of $871 million by 2.7%. The top line increased 1% on a year-over-year basis. The upside was primarily backed by a rise in non-gaming revenue (owing to improvements in hotel occupancy and ADR), solid customer spending and strong F&B business.

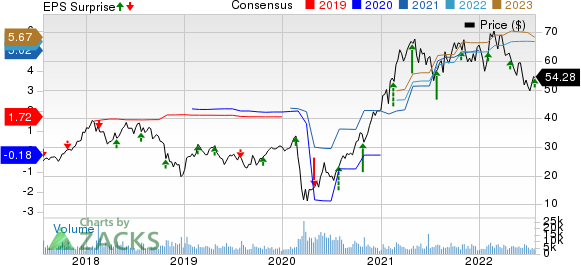

Boyd Gaming Corporation Price, Consensus and EPS Surprise

Boyd Gaming Corporation price-consensus-eps-surprise-chart | Boyd Gaming Corporation Quote

Total adjusted EBITDAR during the reported quarter amounted to $353.9 million compared with $385.4 million reported in the prior-year quarter. Property adjusted EBITDAR margins came in at 42.1%, compared with 45.8% reported in the year-ago quarter.

Segmental Detail

Las Vegas Locals

During second-quarter 2022, revenues in the segment amounted to $236.5 million compared with $236.1 million reported in the prior-year quarter. The segment’s adjusted EBITDAR totaled $125.3 million, down 6.2% from $133.6 million reported in the year-ago quarter’s levels.

Downtown Las Vegas

During the quarter, revenues in the segment increased 39% year over year to $53.9 million. Adjusted EBITDAR was $22.1 million compared with $15.4 million reported in the year-ago quarter.

Midwest and South Segment

During the second quarter, revenues in the segment amounted to $604.1 million, compared with $618.7 million reported in the prior-year quarter. The segment’s adjusted EBITDAR totaled $229 million, down 11.9% from $260 million reported in the year-ago quarter’s levels.

Operating Highlights

During second-quarter 2022, the company’s total operating costs and expenses came in at $649.4 million compared with $627.3 million reported in the year-ago quarter. During the quarter, selling, distribution and administration expenses came in at $95.7 million compared with $90.5 million reported in the prior-year quarter.

Balance Sheet

As of Jun 30, 2022, the company had cash on hand of $250.2 million compared with $403 million as of Mar 31, 2022. Total debt during second-quarter 2022 amounted to $2.9 billion compared with $3.1 billion reported in the previous quarter.

During the quarter, the company repurchased more than 3 million shares of its common stock worth approximately $168 million. As of Jun 30, the company stated the availability of approximately $481 million under its repurchase program.

Other Updates

During the quarter, the company reported progress with respect to its previously announced acquisition of Pala Interactive. Valued at $170 million, the company anticipates closing the deal by 2022 end, subject to regulatory approvals.

Apart from this, the company stated plans to open Sky River Casino (near Sacramento, California) by early September. Also, it initiated a seven-year management agreement to operate the property on behalf of the Wilton Rancheria Tribe.

Zacks Rank & Key Picks

Boyd Gaming currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Consumer Discretionary sector are G-III Apparel Group, Ltd. GIII, MGM Resorts International MGM and Bluegreen Vacations Holding Corporation BVH.

G-III Apparel sports a Zacks Rank #1. GIII has a trailing four-quarter earnings surprise of 97.5%, on average. The stock has declined 27.1% in the past year.

The Zacks Consensus Estimate for GIII’s current financial year sales and EPS indicates growth of 13.8% and 8.2%, respectively, from the year-ago period’s reported levels.

MGM Resorts carries a Zacks Rank #2 (Buy). MGM has a trailing four-quarter earnings surprise of 212.5%, on average. Shares of the company have declined 22% in the past year.

The Zacks Consensus Estimate for MGM’s current financial year sales and EPS suggests growth of 27.6% and 240.3%, respectively, from the year-ago period’s reported levels.

Bluegreen Vacations carries a Zacks Rank #2. BVH has a trailing four-quarter earnings surprise of 85.9%, on average. The stock has increased 44.3% in the past year.

The Zacks Consensus Estimate for BVH’s current financial year sales and EPS indicates growth of 11.2% and 35.1%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance