Brazil Preps Rate Hike That May Be Last in Cycle: Decision Guide

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Most Read from Bloomberg

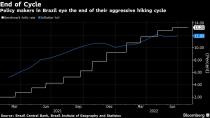

Brazil’s central bank is expected to raise its key interest rate by half a percentage point and signal whether it’s closing one of the world’s most aggressive monetary tightening campaigns in the wake of the pandemic.

Policy makers will lift the benchmark Selic to 13.75% on Wednesday, according to all but one economist who foresees a boost of 75 basis points in a Bloomberg survey.

There’s less consensus on the bank’s next move: it may either pause after 12 consecutive hikes that have lifted the key rate from a record low of 2%, or deliver one more boost in September, less than two weeks before the country’s presidential election.

While most expect Wednesday’s hike to be the last for this cycle, some economists say there could be at least another increase next month. Among them, those at JPMorgan Chase & Co. and BTG Pactual SA see the Selic at 14% at the end of the cycle, while peers at Credit Suisse, Santander and BNP Paribas SA see rates peaking at 14.25%.

The central bank led by Roberto Campos Neto is battling above-10% increases in consumer prices for nearly a year as shocks from food and fuel costs spread through the economy, posing a challenge for President Jair Bolsonaro’s re-election bid. Inflation eased in mid-July, signaling that rate hikes may be starting to take effect. Still, many investors see better-than-expected labor indicators and more government spending on social programs tempering an economic slowdown that would help rein in prices.

What Bloomberg Economics Says

“Ending the cycle now would mean policy makers are satisfied with the inflation outlook -- and that would be hard to justify. Inflation expectations remain unanchored and underlying inflation is still incompatible with the BCB’s targets. Equally important, recent fiscal measures will deliver not only short-term inflationary pressures from a pickup in demand, but also a blow to the credibility of Brazil’s fiscal rules. That can lead to a higher neutral interest rate.”

-- Adriana Dupita, Brazil economist

Click here for full report.

The decision will be published on the central bank’s website after 6:30 p.m. in Brasilia with a statement from its board. Here’s what to look out for:

September Guidance

First and foremost, investors will scour the statement to ascertain policy makers’ plans for their next rate-setting meeting in September.

Analysts have revised up their 2023 estimates for consumer prices for 17 weeks in a row, to 5.33%. Given that Campos Neto has said he wants inflation below 4% next year, it’s a compelling reason to leave the door open for more rate hikes.

“There have been important changes since the last rate decision meeting, especially on the fiscal side,” said Mauricio Oreng, head of macroeconomic research at Santander in Brazil. “The labor market is getting stronger. On top of that, inflation expectations are still rising.”

Alternatively, central bankers could shift their strategy and refrain from signaling future policy steps amid signs of near-term improvement in the dynamic of prices. Tax cuts helped reduce transportation costs in mid-July, when annual inflation eased to 11.39%, proving to be less widespread.

“If central bankers keep hiking until the inflation rate fully turns the corner, they will have overdone it,” said Caio Megale, chief economist at local asset manager XP Inc. He sees this week’s hike as final.

Fiscal Worries

Analysts will be on the look-out for any comments about the inflationary effects from increased government spending ahead of October’s election. Bolsonaro got the green light for a multibillion dollar fiscal stimulus program which included a boost of cash transfers to the poor.

More spending may sustain domestic demand, forcing central bankers to extend their tightening campaign, according to Andre Loes, economist for Latin America at Morgan Stanley. “Recently, inflation expectations have been very much related to the perspective of deteriorating fiscal accounts,” he said.

The bank targets inflation at 3.5% and 3.25% for this year and next, respectively.

World View

Investors will pay attention to the bank’s inflation estimates, along with comments on global financial conditions marked by higher U.S. rates. They could also detail the domestic impacts from lower growth in developed economies.

Most Read from Bloomberg Businessweek

Podcast Guests Are Paying Up to $50,000 to Appear on Popular Shows

South Asia Debt Woes Evoke Fears of Another 1997-Style Crisis

How an Abortion Changed My Life: 10 Women Share Their Stories

An Epic Bank Scandal in China Adds to Social Tensions Over Finance

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance