Next predicts surprise profit as shop price decline eases

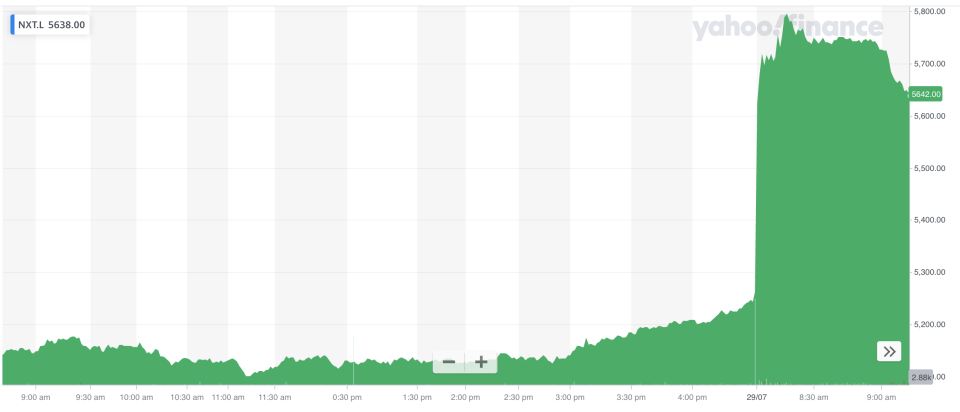

Shares in Next (NXT.L) jumped over 9% on Wednesday after the retailer said it expected to make a small profit this year, confounding expectations of investors and analysts.

It came as new data suggested downward pressure on high street prices was beginning to ease as shoppers returned, although it remained acute in some quarters.

Next said in a trading update on Wednesday that full price sales were down 28% in the second quarter, which was “much better than we expected and an improvement on the best-case scenario given in April.”

Online sales rose 9% in the quarter while in-store sales were down 32% compared with last year. Next said it now expects to make a profit of £195m for the year.

“The company is in a much better position than we anticipated three months ago,” Next said. “Consumer demand has held up better than expected and our Online warehouses have achieved much higher capacities than we thought possible. Costs have been well controlled, and we have taken steps to ensure that our balance sheet is secure.”

Next’s upbeat assessment came as the British Retail Consortium (BRC) and consumer measurement company Nielsen said pressure on high street prices eased slightly in July.

Average shop prices fell by 1.3% in July, a slowdown from the 1.6% slump seen in June, which was the fastest decline in prices for 14 years.

Shop prices continued to fall in July, according to a closely watched high street monitor, although record declines seen in the prior month eased.

“Despite firms facing increasing costs, shop prices continued to fall in July, albeit at a reduced pace compared with the previous month,” said Helen Dickinson, chief executive of the OBR.

“Falling prices at tills is good news for shoppers, and will hopefully tempt more people onto our high streets and retail destinations.”

BRC and Nielsen’s data pointed to a two-speed economy on the high street. The average price of food at supermarkets and grocers in fact rose by 1.5% in July, whereas the price of non-food items like clothing, electricals, and homeware fell by 2.9%.

Dickinson said sectors such as health and beauty remained “under significant pressure.” She called for targeted support for the retail sector from the government, suggesting rent relief and actions to boost consumer demand similar to the ‘Eat Out to Help Out’ scheme in the retail sector.

“Deflationary pressures remain one of many challenges for much of the non-food trade to contend with at this time whilst we see 1.5% food inflation as stable and largely manageable for shoppers and the trade alike,” Clive Black and Darren Shirley, retail analysts at stockbroker Shore Capital, wrote in a note to clients.

Yahoo Finance

Yahoo Finance