Bread Financial Holdings, Inc.'s (NYSE:BFH) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

Bread Financial Holdings will host its Annual General Meeting on 14th of May

CEO Ralph Andretta's total compensation includes salary of US$1.16m

The total compensation is similar to the average for the industry

Bread Financial Holdings' three-year loss to shareholders was 56% while its EPS was down 3.1% over the past three years

Bread Financial Holdings, Inc. (NYSE:BFH) has not performed well recently and CEO Ralph Andretta will probably need to up their game. At the upcoming AGM on 14th of May, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Bread Financial Holdings

Comparing Bread Financial Holdings, Inc.'s CEO Compensation With The Industry

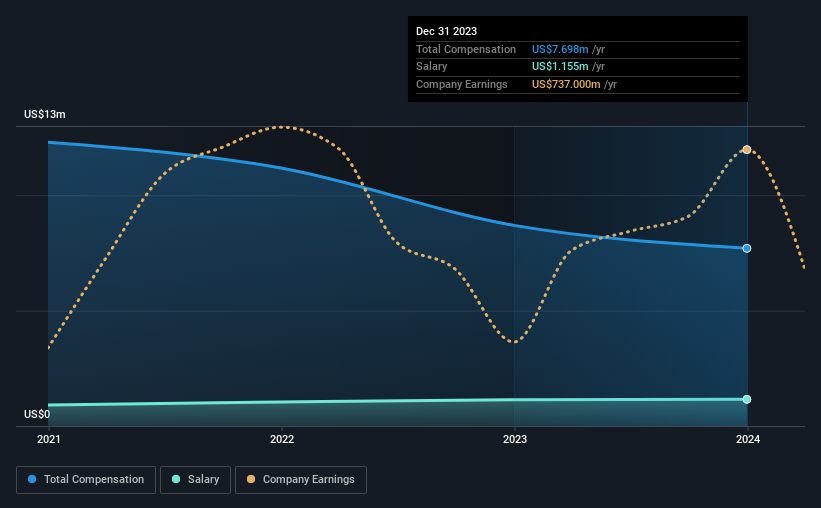

At the time of writing, our data shows that Bread Financial Holdings, Inc. has a market capitalization of US$2.0b, and reported total annual CEO compensation of US$7.7m for the year to December 2023. We note that's a decrease of 11% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.2m.

In comparison with other companies in the American Consumer Finance industry with market capitalizations ranging from US$1.0b to US$3.2b, the reported median CEO total compensation was US$7.1m. This suggests that Bread Financial Holdings remunerates its CEO largely in line with the industry average. What's more, Ralph Andretta holds US$4.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$1.2m | US$1.1m | 15% |

Other | US$6.5m | US$7.6m | 85% |

Total Compensation | US$7.7m | US$8.7m | 100% |

On an industry level, roughly 17% of total compensation represents salary and 83% is other remuneration. Bread Financial Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Bread Financial Holdings, Inc.'s Growth Numbers

Bread Financial Holdings, Inc. has reduced its earnings per share by 3.1% a year over the last three years. In the last year, its revenue is down 5.1%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Bread Financial Holdings, Inc. Been A Good Investment?

The return of -56% over three years would not have pleased Bread Financial Holdings, Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 2 warning signs for Bread Financial Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance