Brexit headwinds set to create rough ride for UK economy, major reports warn

The UK economy is in for a choppy ride over the coming months, two influential forecasting groups are warning.

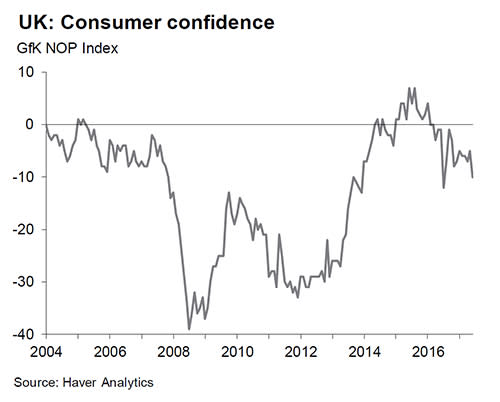

Anxiety over Brexit has hit business confidence – and consumer spending – and these two headwinds will see both investment and growth decline.

A report from information and analytics provider, IHS Markit, shows confidence among British firms at its lowest point for six years.

Meanwhile, the EY Item Club revised down its forecast of GDP growth from 1.8% to 1.5% in 2017.

Both reports will make sombre reading for Prime Minister Theresa May and Chancellor Philip Hammond as they try to reassure business leaders and consumers that the economy is still functioning well despite the Brexit uncertainty.

MORE: Sleepwalking to Brexit food chaos: consumers kept in dark about ‘looming crisis’

IHS Markit said the “net balance” of UK firms expecting a rise in business activity over the next 12 months stood at +35% in June, a big drop from +52% in February and the lowest reading since October 2011.

Chris Williamson, chief economist at IHS Markit, said: “Companies have become increasingly worried about the business outlook, largely as a result of heightened political uncertainties and the potential impact of Brexit.

“The drop in confidence pushed the level of UK optimism below that seen in the eurozone for the first time in seven years, and contrasts with multi-year high levels of optimism in the United States and Japan.”

MORE: France is actively seeking to punish the City of London during Brexit, a leaked memo reveals

Meanwhile, Peter Spencer, chief economic adviser at EY Item Club, said that although last month’s shock general election result could see a more business-friendly Brexit, the immediate outlook had “darkened”.

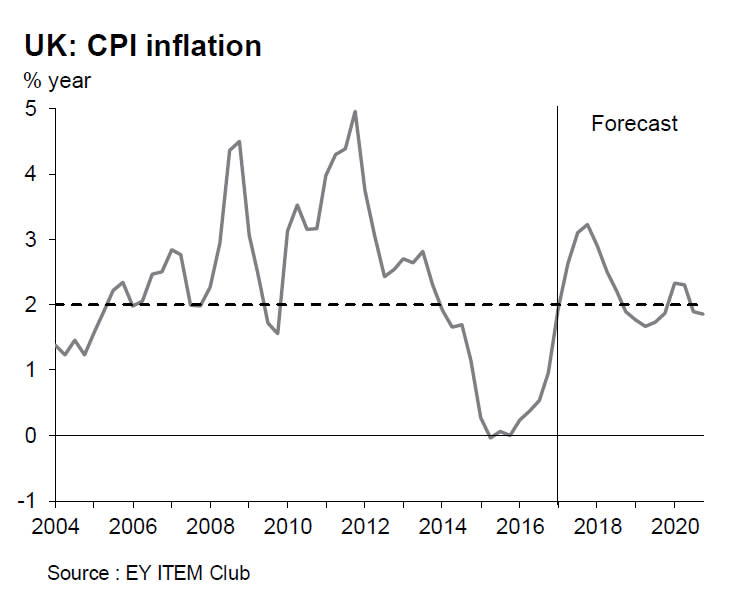

Surging inflation has hit consumers, and with investment and export failing to offset this effect, GDP fell back to just 0.2% in Q1 this year.

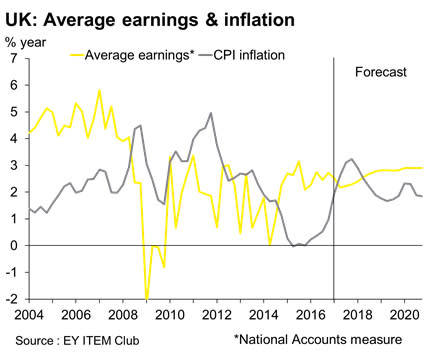

Spencer added: “When wages fail to keep pace with price rises, inflation saps the strength of consumption and pushes down demand, as we saw in the early years of this decade. With the economy slowing it seems unlikely that falling unemployment could now trigger a significant increase in wage inflation.

MORE: HS2 will be the ‘most expensive railway ever’ as final leg set to be announced

“We expect Consumer Prices Index (CPI) inflation to move above 3% by July and reach 3.2% to 3.3% in the autumn, maintaining the pressure on households.”

Spencer said that while there is pressure on the Bank of England to raise interest rates to peg inflation, the situation is not clear cut.

He believes that the economy will continue to struggle, and inflation will come back down, meaning rates will most likely be kept on hold until the autumn of next year.

Yahoo Finance

Yahoo Finance