Brexit divorce bill will hit at least £37.1bn - and we'll be paying until 2064

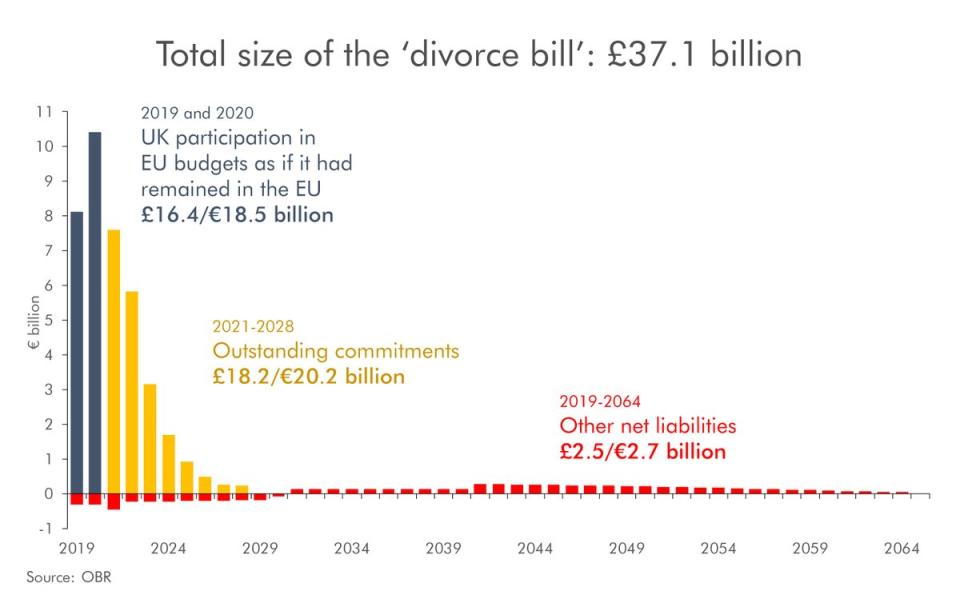

The Brexit divorce bill will cost taxpayers £37.1 billion – and we are likely to still be paying it off until 2064.

New figures released today by the Office for Budget Responsibility finally give an estimate on the initial cost to the UK of leaving the European Union.

As part of the economic forecasting behind chancellor Philip Hammond’s Spring Statement, the OBR tweeted that although its calculations were based on “broad brush assumptions” there was now “sufficient clarity” to estimate the size of the divorce bill.

The £37.1bn figure is the money that the UK has agreed to pay the EU for pre-signed budget commitments.

The OBR shows the UK will pay £16.4bn towards the EU budget to 2020 “as if it had remained in the EU”.

There is a further £18.2bn between 2021-28 for “outstanding commitments” and an additional £2.5bn between 2019 and 2064 for “other net liabilities”.

The OBR said: “The December 2017 joint report by the UK and EU negotiators detailed the components of this settlement. The Treasury estimated at the time that it would amount to £35bn to £39bn.

“Using assumptions consistent with our central economic and fiscal forecasts, we estimate the settlement would cost £37.1bn, with around 75% falling due within our five-year forecast period.”

As the economic cost of Brexit continues to bite, with falling real wages, slow growth and high inflation, and a huge divorce bill in return for a worse relationship with the EU, we are all entitled to ask whether this is the right path for the country. 4/4

— Chuka Umunna (@ChukaUmunna) March 13, 2018

It will be the fact that Britain will still be paying for Brexit for the next 45 years that will alarm many Leavers and voters.

MORE: NHS will be ‘decimated’ as Theresa May’s £50bn Brexit gamble is revealed

Labour Remain supporter Chuka Umanna said: “As the economic cost of Brexit continues to bite, with falling real wages, slow growth and high inflation, and a huge divorce bill in return for a worse relationship with the EU, we are all entitled to ask whether this is the right path for the country.”

Great chart this, emphasizing the ‘divorce bill’ is for commitments made which the UK would paid at some point as an EU member. So, a divorce settlement, but not a true Brexit cost. https://t.co/hRdw3swNRC

— Ian Mitchell (@EconMitch) March 13, 2018

Other commentators accused the chancellor of ignoring an opportunity to set a clear path on Brexit.

MORE: EU offers free trade deal after Brexit – but wants guaranteed access to UK fishing waters

“It is disappointing that free from the usual detailed changes in Budgets, the chancellor missed a perfect opportunity to set out a clear road map on how the UK will use tax policy to help with the UK’s competitiveness post-Brexit,” said Mark Abbs, partner at accountants Blick Rothenberg.

Yahoo Finance

Yahoo Finance