Brexit fallout: How the FTSE 100 can hold steady amidst the political chaos

Things feel like they’re falling apart in the UK as prime minister Theresa May cancels a vote in parliament on her Brexit deal and the pound crashes to its lowest level in over a year.

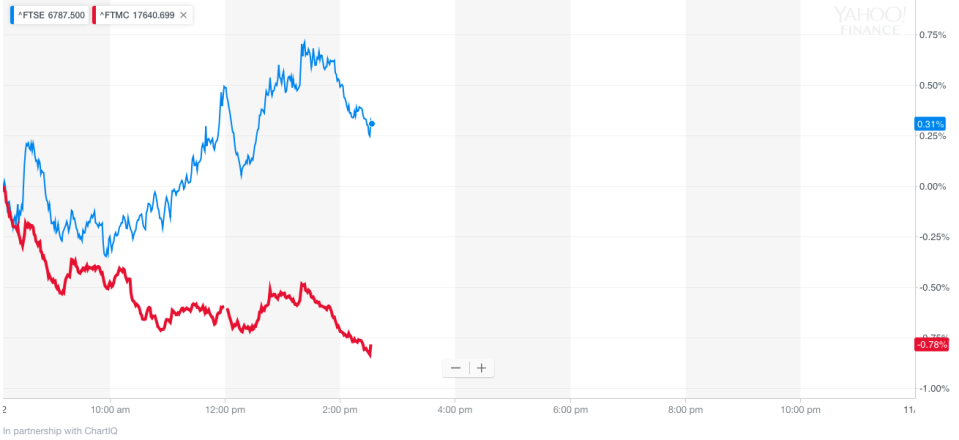

In the midst of if all, the benchmark London index – the FTSE 100 (^FTSE) – has been largely withstanding the shocks that are hitting other European markets. How is it defying gravity?

The London index confounds anyone who understandably expects stocks to fall in the midst of a widespread panic over the fate of the country. But the FTSE 100 is no ordinary index. Its fate is generally unshackled from the wider UK economy because so many of its powerful constituents are international companies with international sales.

“It is common to view the FTSE 100 as a UK index, but in reality it is an international index, mostly of banks, miners and oil firms, with a few UK-only names like … Tesco and M&S thrown in for good measure, but with only a small weighting,” noted Chris Beauchamp, chief market analyst at IG Group. “The big firms have large operations overseas, and weakness in sterling means these earnings are ‘flattered’ and go up when sterling falls.”

In other words, when these companies make global sales in international currencies and convert them back into pounds, the weak domestic currency helps jack up their UK-reported revenue and profits.

But that’s not the case for mid-sized public companies included on the FTSE 250 (^FTMC) index, which have a greater reliance on the UK market for their sales and profits. The FTSE 250 index tracks 250 companies that were not large enough to be included in the FTSE 100, but are still forces to be reckoned with.

The index was dropping by about 1.4% on Monday afternoon, led down by the travel group Thomas Cook (TCG.L) and home-builder Galliford Try (GFRD.L).

“FTSE 250 firms are focused on the UK, and will suffer with a weaker pound as it increases the costs of imports – house builders are a classic example here, seeing rising costs thanks to a weaker pound,” said Beauchamp. “The [FTSE] 250 is a much better representation of the UK.”

S&P Dow Jones Indices pointed out this trend earlier in the month, noting that its own in-house index, which tracks UK companies with primarily foreign revenue, had gained about 18% since 2016. Meanwhile, UK companies with primarily domestic revenue exposure had fallen by 24%.

“Part of the decline in revenue for UK companies with primarily domestic exposure may be attributed to currency movements … Currency cannot take all of the blame, however,” said Chris Bennett, a director of index investment strategy at S&P Dow Jones Indices. “Another driver of the decline could be an expectation that UK domestic consumer demand will decline (or at least not grow as fast) as equivalent demand from those abroad.”

Lower consumer demand can be seen in slower auto sales in the country, with British car registrations down 7% so far in 2018 versus the previous year, according to data from the Society of Motor Manufacturers & Traders (SMMT). The Office for National Statistics also noted retail sales had been softer in recent months after a strong summer season. This kind of data is a foreboding sign for FTSE 250 companies that depend on British consumers.

RELATED: Car factory shutdowns would cost over £100m a day with no Brexit deal

Yahoo Finance

Yahoo Finance