Brexit latest: Retail sales volumes fall at fastest quarterly rate in seven years

Retail sale volumes slumped in March, seeming to confirm doubts about the robustness of the consumer-led economy in the wake of last summer's Brexit vote.

According to the Office for National Statistics, sales were down 1.8 per cent in the month, against City expectations of a 0.2 per cent decline.

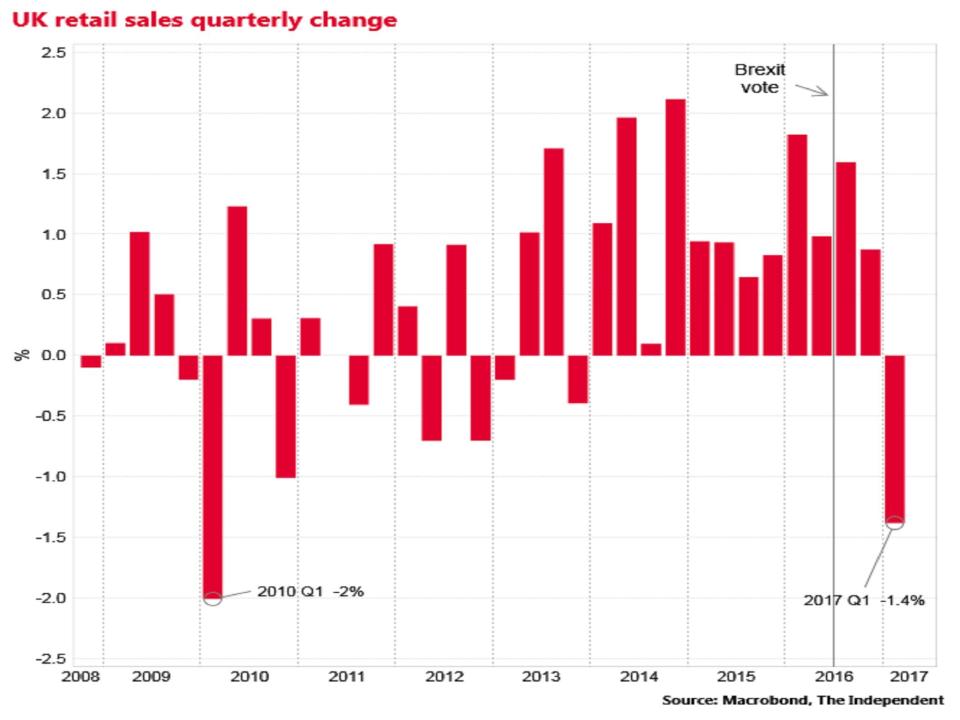

The monthly data can be volatile and March's decline follows a 1.7 per cent spike in February, but the ONS itself highlighted the weakening trend this year and noted that over the three months to March there was the first quarterly decline in volumes since 2013.

In the first quarter of 2017 sales were down 1.4 per cent, the biggest decline since the first three months of 2010 when they fell 2 per cent.

Retail sales performed much better than expected in the immediate wake of last June's Brexit vote, helping to boost overall GDP growth and confounding widespread expectations that the economy would fall into recession.

Biggest fall since 2010

But economists said the latest data suggested gravity was now asserting itself as inflation, stemming from the sharp depreciation of the pound since last June, eats into incomes and wage growth remains chronically weak.

“We should see these retail sales figures as the start of a period of much weaker consumer spending growth – which will act as a drag on the overall progress of the UK economy over this year and next,” said Andrew Sentance, senior economic adviser at PwC.

“This is the clearest indication yet that the expected slowdown in the UK economy has begun, and we should expect to see this confirmed in other economic data over the next few months.”

James Knightley, an economist at ING described the figures as “dreadful”.

“The story for the household sector isn’t great right now. Inflation is eating into household spending power with wages once again failing to keep pace with the rising cost of living. There is also a growing sense of job insecurity highlighted in some surveys, which may also be making households a little nervous,” he said.

Annual consumer price inflation in February was 2.3 per cent, cancelling out average pay growth, meaning that real wage growth is zero.

The household saving ratio, the gap between the sector's aggregate income and spending, fell to just 3.3 per cent in the final quarter of 2016, the weakest on record, prompting questions about the sustainability of the rate of consumer spending.

The waning consumer

Retail sales account for around 30 per cent of household consumption, which in turn accounts for 60 per cent of UK GDP.

GDP growth picked up to 0.7 per cent in the final quarter of 2016, but analysts are now expecting a slowdown in the first quarter of 2017 to between 0.4 and 0.5 per cent.

There was a decline in sales volumes across all the main categories of retailer in the first quarter.

Petrol station sales fell 3.1 per cent and food store sales by 0.8 per cent.

Volumes in non-food stores declined by 1.3 per cent and in non-specialised stores, including household goods vendors, by 2.4 per cent.

Store prices rose 3.3 per cent on the year, the fastest rate of inflation recorded since March 2012.

Fuel prices were up 16.4 per cent on a year earlier.

Yahoo Finance

Yahoo Finance