Brexit is making the UK property market the best and worst place to buy right now

Rifts within the UK government are hindering a Brexit deal being passed through parliament and causing uncertainty over what the agreement will be when Britain leaves the European Union. But the effects on the UK property are making it the best and worst place to buy right now.

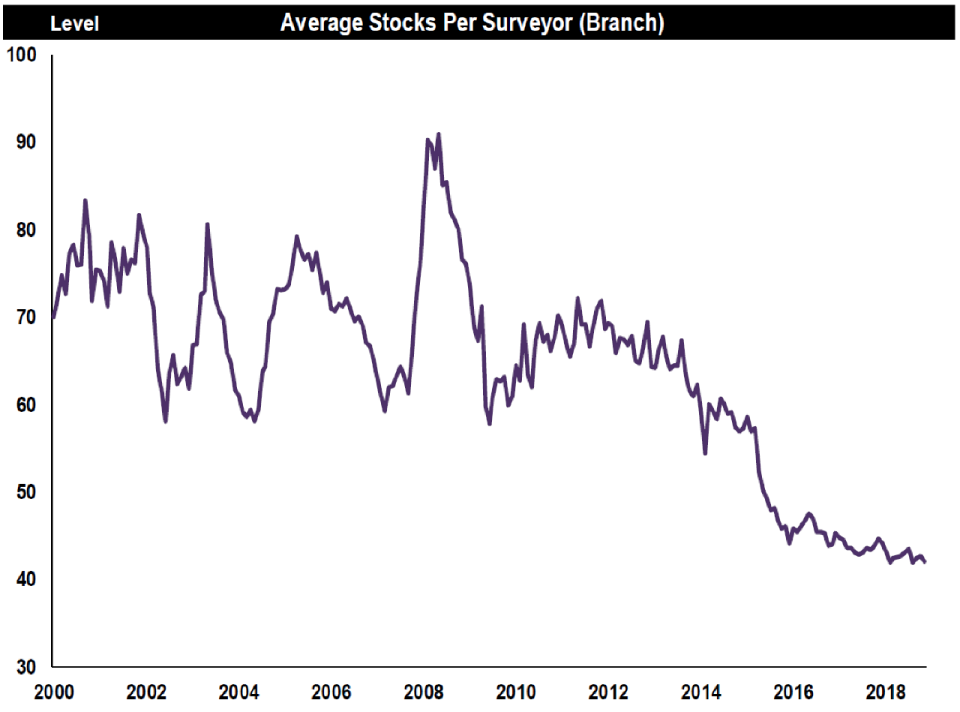

Usually, supply and demand will be a fundamental driver of whether prices will go up or down. The number of available properties, especially those that are affordable, is notoriously in short supply compared to the level of people seeking a new home. This has caused prices to rise wildly over the last 20 years, most notably over the last decade.

However, Brexit is causing both buyers and sellers to “sit tight,” says the Royal Institution of Chartered Surveyors.

In its latest data release, the professional body for the land and property industry said that Brexit was having a two-pronged effect. On the one hand, it said that the number of people looking for a new home fell again by 21% in November, compared with October, which was already down by 15%.

On top of that, sellers are not budging and restricting supply, draining the choices available for buyers. RICS said that the number of new properties listed for sale fell for the fifth consecutive report, with the fastest pace of decline in supply noted in 28 months.

“It is evident from the feedback to the latest RICS survey that the ongoing uncertainty surrounding how the Brexit process plays out is taking its toll on the housing market. Indeed, I can’t recall a previous survey when a single issue has been highlighted by quite so many contributors,” said Simon Rubinsohn, chief economist at RICS.

“Caution is visible among both buyers and vendors and where deals are being done, they are taking longer to get over the line. Significantly the forward-looking indicators reflect the suspicion that the political machinations are unlikely to be resolved anytime soon. The bigger risk is that this now spills over into development plans, making it even harder to secure the uplift in the building pipeline to address the housing crisis.”

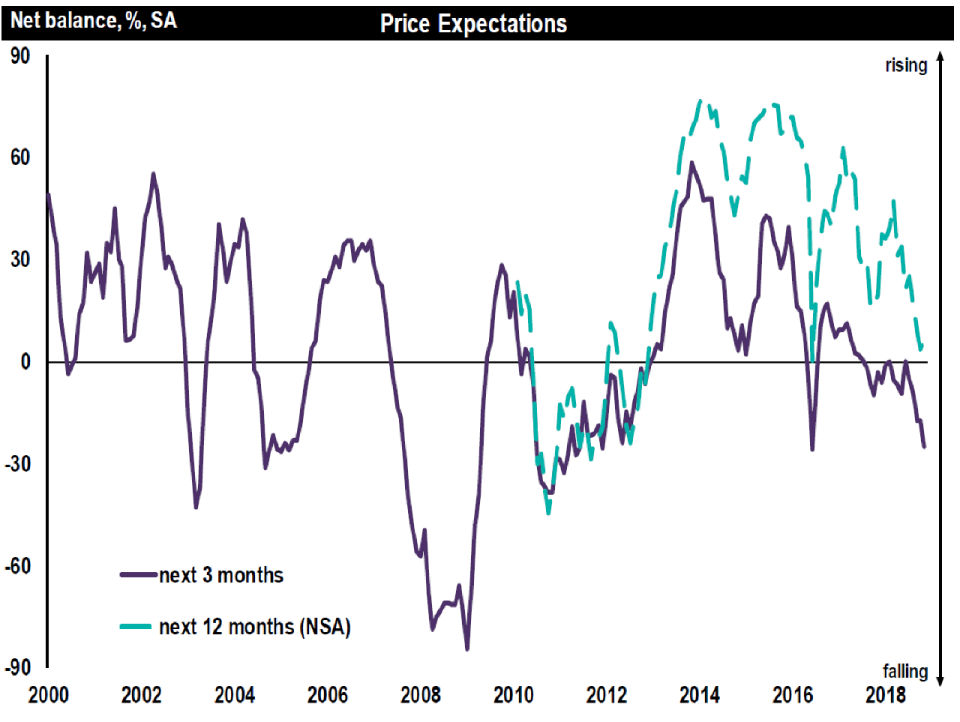

Both buyers and sellers expect prices to plummet post-Brexit, which is a leading cause for the pause in action:

But while Brexit is seemingly causing a terrible market to buy in, it is potentially one of the best times to get involved.

Why it’s time to either buy or sell before Brexit

Firstly, the UK interest rate is still relatively low at only 0.75%. This essentially means that borrowing money is cheaper, including servicing debt payments, which should put more pounds in your pocket. On the flip side, it’s a terrible time for savings.

However, what this means is that getting a decent mortgage rate, even if you were on a variable one (a mortgage that tracks the interest rate rather than you paying a fixed rate each month) is still pretty cheap.

Furthermore, if you are looking to buy a home and stay there for a long period of time (more than years), any fluctuations in house prices will not make a difference to you — as long as you can make your mortgage payments.

READ MORE: What would a no-deal Brexit mean for house prices and the economy?

Secondly, as a seller, if you are wanting to move within the next five years, selling before Brexit is the less risky action to take. Right now prices are buoyant. They have somewhat stagnated over the last few months due to Brexit uncertainty and fears of a no-deal scenario, but they are still healthily high from a seller’s perspective.

However, once Brexit happens on 29 March 2019, the country will be in unchartered territory and prices could crater massively depending on the level of economic impact Brexit has on the economy.

Yahoo Finance

Yahoo Finance