Brexit is making UK restaurants go bankrupt

Brexit is forcing more restaurants into bankruptcy as the pound falls and goods become more expensive.

Restaurant insolvencies were up by a quarter in 2018, with Brexit blamed for rising costs and consumer uncertainty.

Accountancy firm Moore Stephens calculated there were 1,219 insolvencies in 2018, compared with 985 in 2017 – now at their highest since the company began recoding the figures in 2010.

Restaurants face a number of difficulties as pressure hits the high street, consumer spending, and the cost of importing goods from abroad.

Brexit uncertainty has been blamed for the recent poor performance of the UK’s retail sector, and as retail increasingly moves online, there is less footfall for restaurants to generate custom.

The relative fall the in value of the pound after the Brexit referendum means that importing ingredients and drinks from the continent has put pressure on margins.

Another cost pressure comes from the national minimum wage for those aged 25 and over, which increased in April 2018 to £7.83 per hour, up from £7.50.

Moore Stephens also blamed restaurant troubles on Britons eating out less often, despite UK pay growth outstripping inflation for most of 2018, measured by the consumer price index.

There have been a number of prominent restaurants which have struggled with debts this year. Jamie’s Italian, Prezzo, Carluccios, and Gourmet Burger Kitchen all announced the closure of some sites.

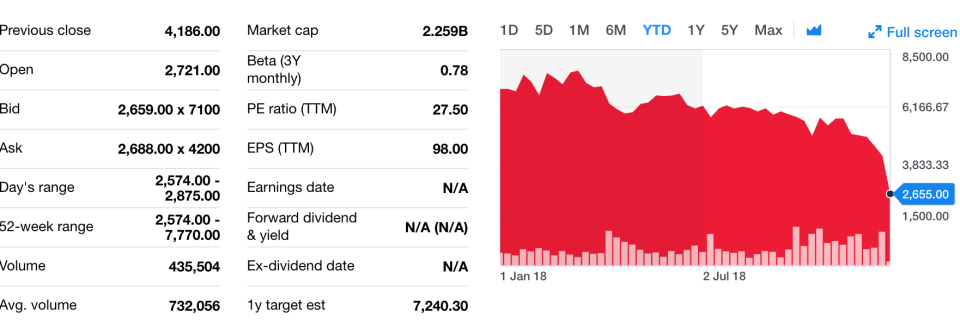

Earlier this month, credit ratings agency Moody’s announced a downgrade in Pizza Express debt, and Restaurant Group’s (RTN.L) share price sharply declined when shareholders approved a £550m takeover of restaurant chain Wagamama.

Private equity investment was also blamed for opening too many sites for chain restaurants, increasing capacity beyond consumer demand.

READ MORE: Asos issues shock profit warning after November downturn

Yahoo Finance

Yahoo Finance