Brexit is taking a 'considerable bite out of banking jobs'

Uncertainty over the Brexit deal is continuing to hurt banking jobs.

According to data sent to Yahoo Finance UK from global professional services recruiter Morgan McKinley, “Brexit is taking a considerable bite out of banking jobs and with an ambiguous Brexit deal on the table, the City’s bracing for more pain ahead.”

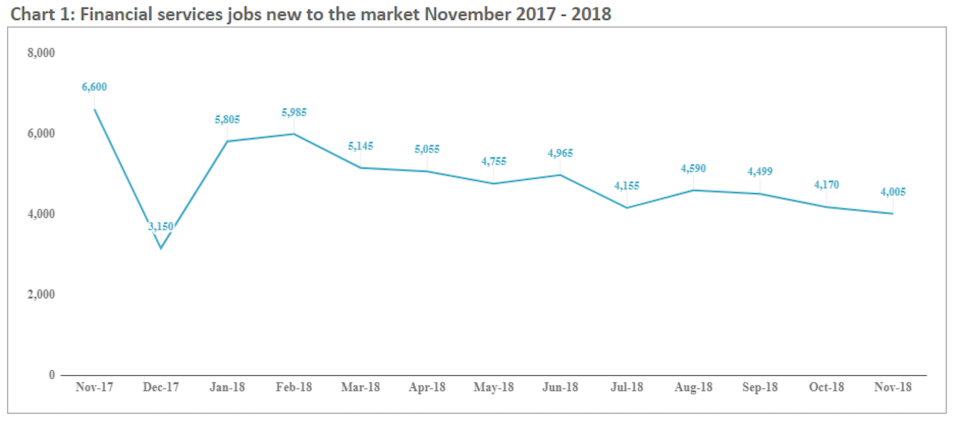

Month-on-month data in November, shows that there was a 4% decrease in jobs available and a 39% decrease in jobs available year-on-year.

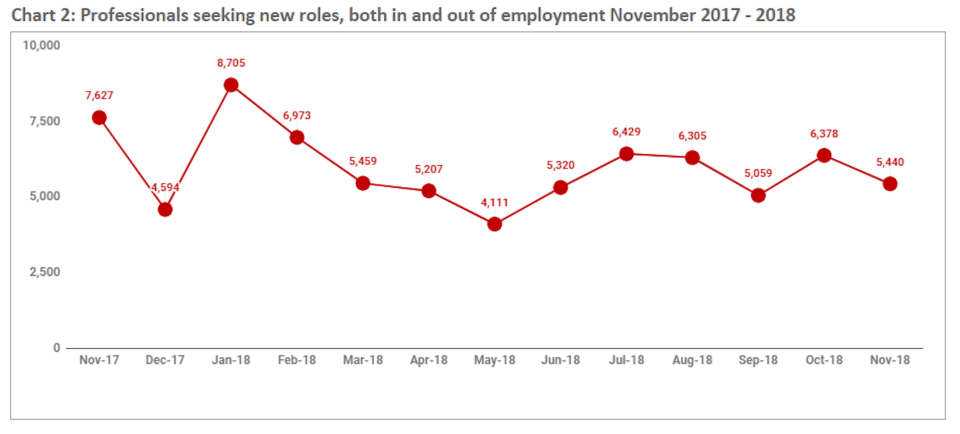

Meanwhile, there was a 14% decrease in professionals seeking roles month-on-month, equating to a 28% decrease year-on-year.

Britain has just under four months to go until it leaves the European Union. The likelihood of the UK crashing out of the bloc grows by the day.

This week, prime minister Theresa May delayed the crucial parliamentary Brexit vote on the agreement she sealed with the EU, as it was likely that she’d suffer a devastating defeat. The cancellation of the vote sent the pound into a downwards spiral.

The uncertainty is a huge issue as it makes it highly difficult for banks, businesses, and citizens to understand what the rules and regulations will be around trade and immigration when Brexit occurs on 29 March 2019.

McKinley noted that while Brexit is unlikely to stop “ambitious professionals” from around the world seeking out London for career advancement, clarity over immigration rules is essential for financial services to manage their future workforce.

“If visa regulations aren’t modernised, the government will shrink the City’s talent pool, effectively shrinking the economy,” said Hakan Enver, Managing Director, Morgan McKinley.

McKinley said it hopes that even if the UK government decides to curb migration from the EU, it will be offset by the easing of visa barriers for qualified professionals from highly competitive hubs in Asia and the United States.

“We are forced to think outside the EU paradigm, which is uncomfortable and disappointing, but also offers opportunities for a truly meritocratic visa system that would enable recruitment from top financial services cities and tech hubs worldwide,” said Enver.

Over the last two years, banks have been moving jobs and their European headquarters away from London, in a bid to prepare themselves for the worst case Brexit scenario. Most recently, Bank of America (BAC) completed the move of its European headquarters from London to Dublin while more than 100 British funds are seeking post-Brexit licences in Dublin.

In June, more than a third of the 222 large UK-based financial services firms tracked by global accounting firm EY said that they were either considering or had decided to move some operations or staff from the UK to elsewhere in the EU.

Yahoo Finance

Yahoo Finance