Brexit touted to have caused London to lose $1bn from secretive Saudi oil firm

Impending Brexit for Britain has apparently hurt the chances of London raking in potentially $1bn (£821m) in fees from state-owned oil titan Saudi Aramco, which is looking to list on a foreign stock exchange.

According to a report by The Wall Street Journal, Aramco is allegedly considering Tokyo, Japan instead of the initial front-runner cities for its IPO — New York, London, or Hong Kong. Mass protests in Hong Kong was also cited in the report as a reason for Aramco shunning it for a listing.

Both Aramco and Japan’s relevant authorities have not commented on the WSJ report.

Saudi Arabia hopes to raise about $100bn from a 5% stake in the company via a local and international listing, with a company valuation of at least $2 trillion. The listing would make it the largest IPO in the world.

However, Aramco’s earnings have come under greater scrutiny over the last three years, after Prince Mohammed bin Salman said in 2016 he wanted to move the company from being full state-owned.

READ MORE: Saudi's huge secretive oil company unveils earnings amid IPO talk reignition

Over the last few years, the Prince’s valuation of the state-owned oil giant at $2tn has been repeatedly touted by industry experts as unrealistic. A survey by regional investment bank EFG Hermes showed fund managers and institutional investors expect Aramco to have a market cap of $1tn to $1.5tn. Global consultants Sanford C Bernstein & Co and Rystad Energy AS, have also suggested a valuation closer to $1tn.

After initially wanting to launch an IPO in 2019, CEO Amin Nasser said in January this year that Aramco would be ready to float by 2021.

Recently it made a major move to gather more transparency over its financials by disclosing its earnings.

READ MORE: A Saudi Aramco IPO halt or cancellation could be a blessing for New York and London

Earlier in August Aramco reported a 12% slide in profit in its first half results statement.

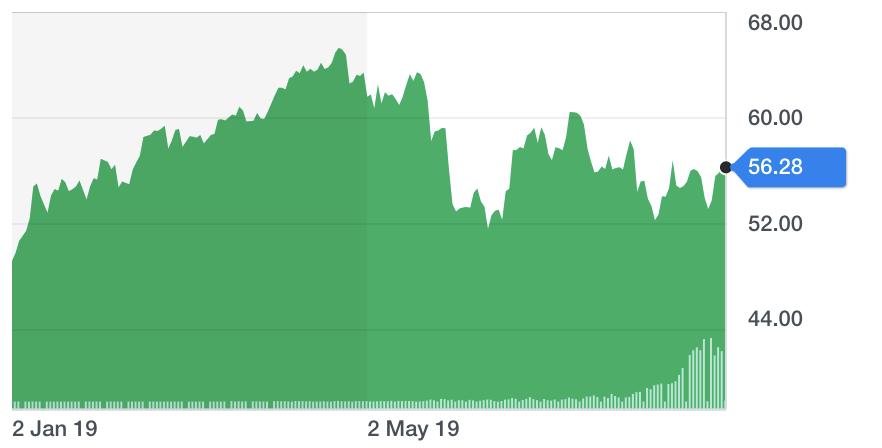

The oil price has fallen to about $56 per barrel (CL=F; BZ=F), down from $69 to $66 per barrel in the same period in 2018. The energy titan says this is a key reason for why net income has dropped 4%, to $46.9bn.

Despite the oil price hitting its profits, what the results did show was that it still makes more money than any other company in the world. As a point of comparison, tech giant Apple (AAPL) raked in $31.5bn in the first half of this year.

Yahoo Finance

Yahoo Finance