Brexit uncertainty is hurting easyJet

One of Europe’s biggest budget airlines, easyJet (EZJ.L), warned that Brexit uncertainty is hurting the airline.

The group said in a statement that “whilst easyJet will deliver H1 results in line with expectations, macroeconomic uncertainty and many unanswered questions surrounding Brexit are together driving weaker customer demand in the market, such that we are seeing increasing softness in ticket yields in the UK and across Europe. Given this uncertainty our outlook for H2 is now more cautious.”

Ticket yield is the measure of money an airline makes from journeys. easyJet said it was set to report a headline loss of £275m ($359.2m) for the six months to the end of March. That amount is in line with its expectations.

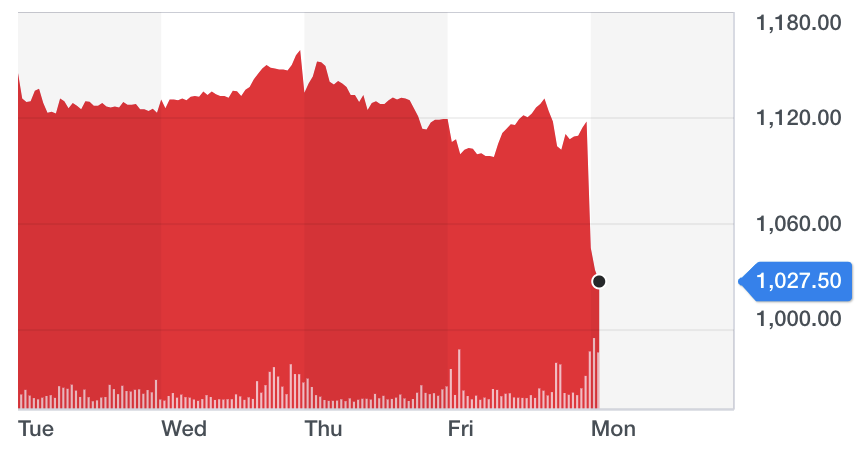

Shares plunged by over 8% in early trading on the update.

Despite the gloomy report, easyJet CEO Johan Lundgren emphasised that “whatever happens” with Brexit, “we’ll be flying as usual.”

“We are operationally well prepared for Brexit. Now that the EU Parliament has passed its air connectivity legislation and together with the UK’s confirmation that it will reciprocate, means that whatever happens, we’ll be flying as usual. I am pleased that we have also made progress on our European ownership position which is now above 49%,” Lundgren said in a statement.

“For the second half we are seeing softness in both the UK and Europe, which we believe comes from macroeconomic uncertainty and many unanswered questions surrounding Brexit which are together driving weaker customer demand.”

Yahoo Finance

Yahoo Finance