Brexit uncertainty hits UK car production again

UK carmakers saw a steep 4% drop in production in October, with the Society of Motor Manufacturers and Traders (SMMT) on Thursday warning that Brexit-related uncertainty made it “extremely worrying times” for the sector.

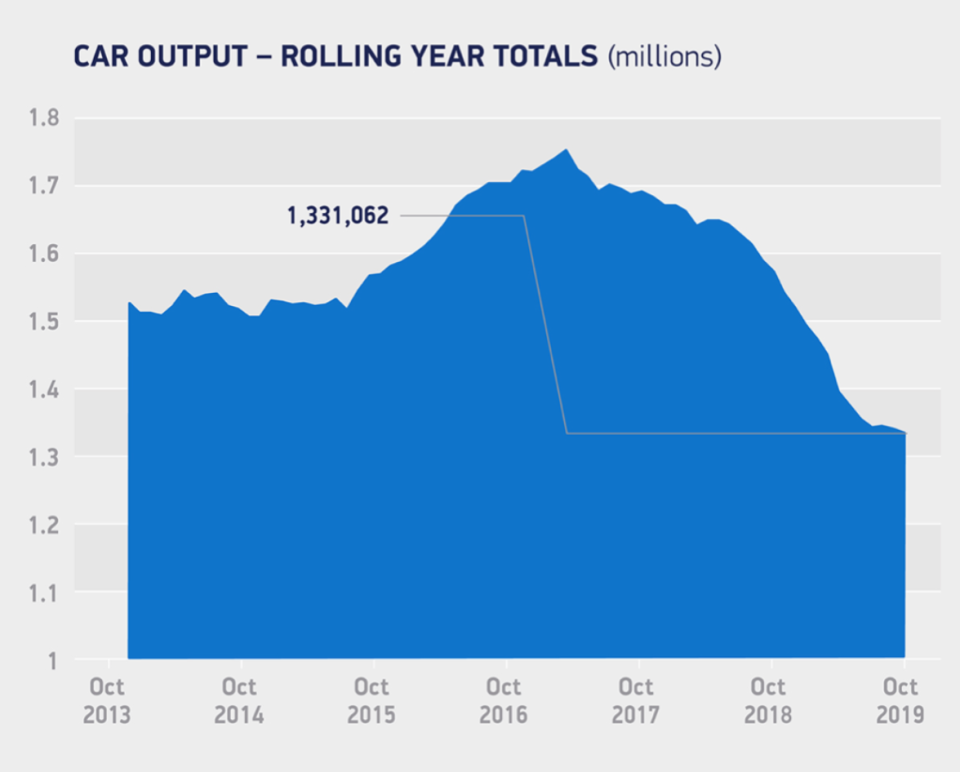

The data means that car production in the UK has now fallen in 16 of the last 17 months.

Manufacturing output fell to 134,752 last month, which meant that 5,000 fewer units rolled off production lines than did so in October 2018.

Production for the UK market itself fell sharply, with the SMMT blaming a waning in consumer and business confidence for the 10.7% fall off.

Overseas orders, meanwhile, fell 2.6%. The SMMT said that fewer model changeovers also played a part in the downturn.

In the year to date, car production is down 14.4% on 2018, with over 80% of cars being shipped overseas to locations such as the EU, US, China, and Japan.

“Yet another month of falling car production makes these extremely worrying times for the sector. Our global competitiveness is under threat, and to safeguard it we need to work closely with the next government to ensure frictionless trade, free of tariffs, with regulatory alignment and continued access to talent in the future,” said Mike Hawes, CEO of the SMMT.

READ MORE: Industry warns no-deal Brexit will cost UK car sector £40bn by 2024

“This sector is export led, already shipping cars to more than 160 countries, and in a period of unprecedented change a close trading relationship with the EU and preferential trading with all these other markets will be essential to keep automotive in Britain.”

The news comes after the SMMT warned on Tuesday that leaving the European Union without a Brexit deal would cost the British car industry £40bn ($51.7bn) in the next five years.

Independent research commissioned by the SMMT calculates that World Trade Organisation tariffs on both imported car components and exported cars would add over £3bn a year to manufacturing costs—an amount equal to the sector’s current annual research-and-development spending.

Yahoo Finance

Yahoo Finance