Britain to fight EU over power to raid London financial firms, despite Brexit White Paper concessions

Britain will fight moves by Brussels to secure the power to carry out raids on City of London firms after Brexit, despite a government White Paper conceding defeat on securing a European Union deal for smoother access for financial services to the Single Market.

Officials told The Telegraph that any EU efforts to impose market surveillance on British territory would be a red line in the Brexit negotiations, which resume next week. Meanwhile the British White Paper, published on Thursday, revealed that Theresa May would seek a soft Brexit for goods but was resigned to a far harder break for the City of London.

While accepting that financial services will take a hit after Brexit and not enjoy the same levels of market access as now, the White Paper points out that Britain will reserve the right to diverge from EU financial regulation after Brexit while still observing global international standards. Industry figures point to the ability to diverge from Brussels as a major Brexit advantage.

The EU fears that, after Brexit, Britain will slash the EU rules it did much to help draft after the Financial Crisis. Due to its proximity and links to the continent, this could pose a risk to financial stability, according to EU officials. Brussels has already begun legislation designed to keep the City shackled close to EU regulation after Brexit, while capitals such as Paris and Frankfurt look to exploit Europe’s leading financial centre’s weakness.

Brussels has ruled out financial services being granted special treatment as “cherry-picking” and refuses to include the sector in any future UK-EU free trade agreement. The prime minister has already conceded that British-headquarted firms will lose their “passport” to the EU after Brexit and in the long-awaited paper caved on her demand for “mutual recognition” of regulatory standards between London and Brussels, which would have smoothed market access.

The paper calls for: “New economic and regulatory arrangements for financial services, preserving mutual benefit of integrated markets, while respecting the right of the UK and the EU to control access to their markets – noting these arrangements will not replicate passporting regimes.”

Brussels insists that financial services’ access to the Single Market by governed by “equivalence”, which the City of London has warned denies firms the certainty they need to operate. Under equivalence, the Commission can unilaterally withdraw market access at just 30 days notice and there is no appeal process.

The 30 day notice period for withdrawing access created a “cliff-edge”, which also created a risk to financial stability given the size and worth of the financial institutions in London, a British official said.

The White Paper accepts a system of equivalence, which is used for non-EU countries such as the US, will be used but demands that the system is substantially reformed. The White Paper calls for a new bilateral mechanism to be created, with mediated solutions to disputes and cooperation between regulators. It also asks for process to allow for phased management of decisions to prevent the EU effectively being able to shut UK financial services out of the EU at the drop of a hat.

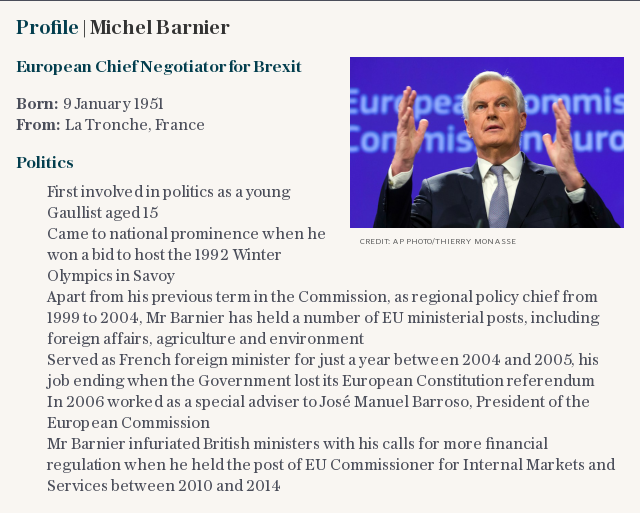

Michel Barnier, the European Union’s chief Brexit negotiator, boasted in New York this week that the commission had taken more than 200 equivalence decisions to date and asked why that system that was good enough for the US would not work for Britain.

He insisted that the EU was the most open jurisdiction for financial services in the world, as he moved to reassure UK-headquarted US firms.

The bloc is already moving to beef up its pan-EU supervisors and their ability to monitor non-EU countries, such as Britain after the 29 March 2019 deadline, for compliance with the “equivalence” system of regulatory recognition.

Among the powers it will seek to bestow on the regulators is the ability to carry out “on-site inspections” of firms on non-EU territory, which is a euphemism for raids.

Crucially the legislation, which will also allow the EU regulators to demand information from firms to pass to the commission, will be considered during the Brexit transition period, when the UK will have no voting rights.

British sources ruled out any prospect of such raids being agreed by London. They described the EU’s equivalence regime as “patchy” with different pieces of legislation having varying equivalence regimes.

“The existing autonomous frameworks for equivalence is not sufficient for the breadth or interconnectedness of UK-EU financial services provision,” the paper states.

“The UK and the EU will not have the current levels of access to each other’s markets. This is a hit,” one official said, “This is not enhanced equivalence as the EU understands it. It is much deeper than that”.

UK Finance, a trade for financial services firms, said that Britain was the second largest exporter of services worldwide. Chief Executive Stephen Jones said it was “entirely possible to use the tools and trust” established in 40 years of EU membership to construct a new arrangement.

This would protect billions of euros of banking and capital markets services reliant on London keeping its crown as Europe’s leading financial centre.

“However, as today’s paper makes clear simply relying on existing equivalence arrangments will not provide financial institutions with effective market access that enables them to serve their customers,” he said.

"“There were high expectations that there would be a greater focus on services and mutual recognition as the regulatory basis in this paper, but it has genuinely been difficult for the UK to get traction on the latter," said John McFarlane, chairman of TheCityUK.

Yahoo Finance

Yahoo Finance