How Britain was overtaken in the mini-nuke revolution

With little international fanfare, a landmark decision was made in the US at the start of the year.

A new design for a nuclear reactor won final approval from regulators. The decision unlocked a market worth $10bn (£8.1bn) per year for the reactor’s developers and presented a potential solution for gigawatts of green energy demand.

While the small group of scientists who crafted the design no doubt cheered the decision, rivals in Britain were exasperated.

Eight years ago, then chancellor George Osborne declared an ambition to “position the UK as a global leader in innovative nuclear technologies”.

But since that 2015 speech, no UK design has been greenlit, much to the frustration of the handful of British firms – including top engineer Rolls-Royce – that are desperate to build a new generation of smaller power plants.

Regulatory approval in the US made NuScale, the company behind the new reactor design, the frontrunner in the market.

Policymakers and industrialists alike hope a new generation of factory made, small-scale reactors will turbocharge the decarbonisation of industry and set up an export opportunity with well-paying jobs.

Around the world, dozens of companies are developing Small Modular Reactors (SMR) as a way to rein in the overspending associated with full-sized nuclear power plants and offer carbon-free electricity around the clock.

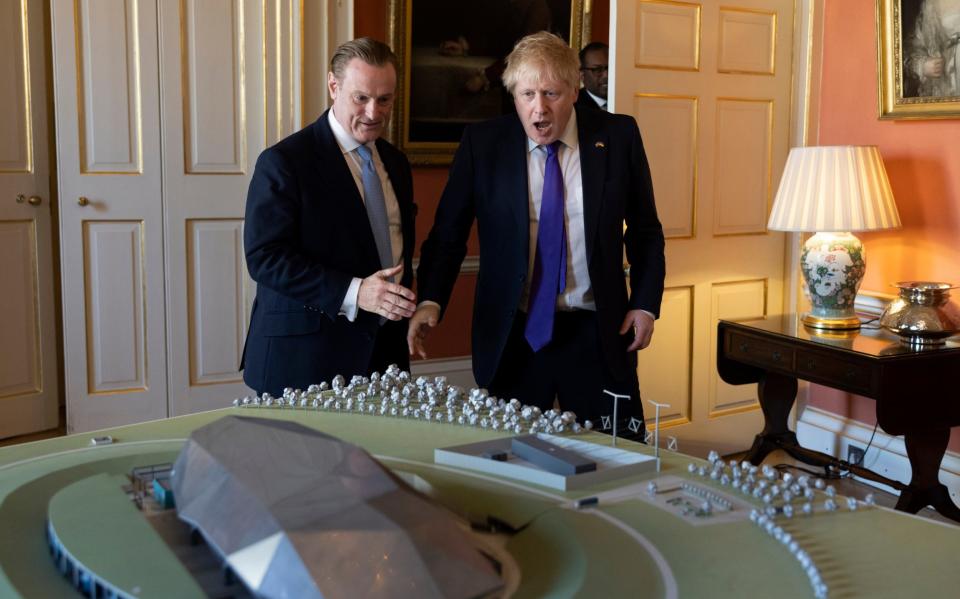

British developers include Rolls-Royce SMR, a division of the FTSE 100 engineering giant that is also backed by Qatar, billionaire French oil dynasty the Perrodo family, US nuclear giant Exelon Generation and £210m of taxpayer money. It has been in development since 2015.

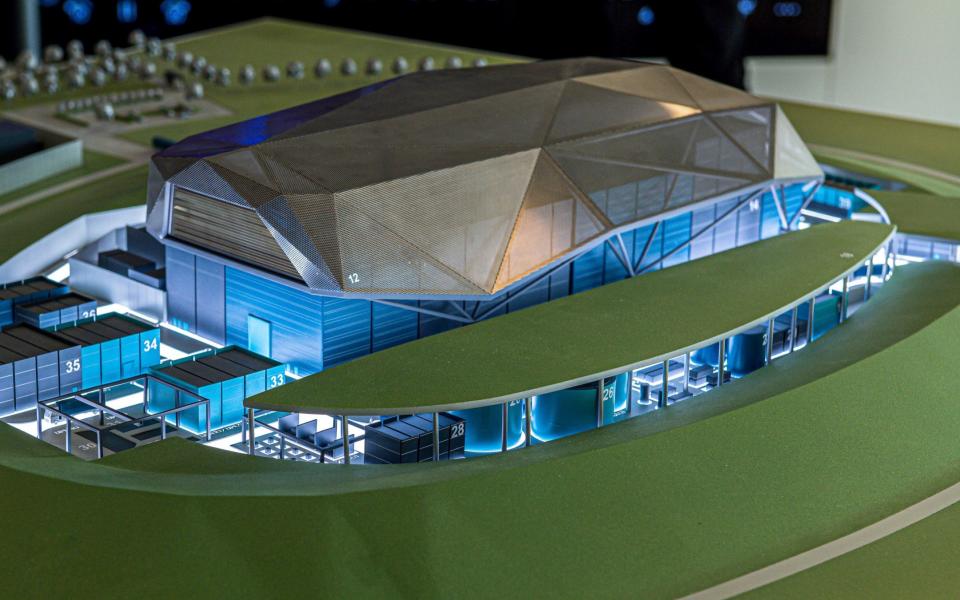

Rolls-Royce has proposed a design about a seventh the size of a traditional power station, but at a fraction of the cost per megawatt.

It is the most advanced of UK designs, but still going through the approval process.

Yet despite the prowess behind Rolls, the nod from the US’s Nuclear Regulatory Commission has placed NuScale ahead of the competition.

Its status as an approved design is seen as a watershed moment and puts pressure on other firms to catch up.

“They have an SMR,” said one well-placed observer, pointedly adding: “Others have a powerpoint presentation.”

Meanwhile, US SMR designer Last Energy this week said it signed a deal to sell 24 of its power plants to UK customers, further highlighting the slow progress of homegrown providers.

Experts say British advances have been held back by lingering fears about the destructive potential of nuclear disasters and a historic overreliance on other sources of energy.

The arrival of cheap, abundant gas from the North Sea led to investment in methane-driven power stations that came online from the early 1990s, said Paul Norman, professor of nuclear physics and nuclear energy at the University of Birmingham. Cheap, safe and easy-to-burn natural gas made nuclear seem risky and expensive.

Nuclear's image was also tarnished by Chernobyl and Fukushima, and the cost of project overruns.

A fear of eye-watering costs and large upfront spending may well be what is putting the Government off, says Jim Watson, a professor of energy policy and director at UCL Institute for Sustainable Resources.

“We really don't know how much these things are going to cost once they build one, and how long they're going to take to build,” he says, pointing out that demonstrator plants are still some way off.

The next nuclear power plant to come online in the UK, Hinkley Point C, will cost as much as £32.7bn for 3,200 megawatts, or £10.2m a megawatt.

By comparison, Rolls-Royce’s 470MW SMRs are promised for £1.8bn, or £3.8m per megawatt.

However, the company is still offering larger – and more expensive – options than US rivals.

Last Energy’s £100m modular units, which are two-thirds the size of a football pitch, can output 20MW of electricity, enough to power 40,000 homes. They will be deployed in 2026 with no government funding required. NuScale’s reactors will offer 77MW of power apiece.

Rolls is joined by a clutch of other UK-based companies that are at various stages of development, including MoltexFLEX, a Warrington-based developer of so-called advanced modular reactors (AMRs), the next generation of the devices.

The company is developing what it claims is a safer reactor that would use liquid chemicals instead of high pressure gas. In any disaster, chemicals would solidify as they hit cool air, rather than blowing into the atmosphere as happens with gas.

Moltex is aiming to make electricity for about £30 per megawatt hour and heat for about £10/MWh, a fraction of today’s prices and also cheaper than before Russia’s war on Ukraine, by using off-the-shelf parts as much as possible.

Chief executive David Landon has said that he wants to be able to build a demonstrator for his reactor by 2029. Freeing up Britain’s old coal-fuelled power station sites for nuclear generation would help, since they are already attached to the grid.

Yet despite being based in Britain, the company is having more success abroad.

Working with regulators in Canada, the company’s sister operation has been able to move faster towards approval for its designs. Landon said last month that the UK government should consider how to speed up the deployment of AMRs, and requested earlier access to the Office for Nuclear Regulation, and early identification of suitable sites.

Pleas to speed up the approval process are likely to fall on deaf ears, said UCL’s Jim Watson, since safety must trump everything else.

Britain is up against a much larger competitor. The US, which is home to NuScale and Last Energy, has “deep pockets” and can “back a lot of horses at once,” Watson says.

“Whereas the UK, being a medium sized economy, we've really got to make some quite strategic choices.”

Last week, Chancellor Jeremy Hunt unveiled a competition for SMR designs, promising to open the Treasury’s coffers to the winners.

While this may sound like good news, there are fears that a competition open to international designs may do damage to the homegrown SMR industry. If the British Government won’t plump for its own companies’ designs, why should any other country?

Watson adds that while the promise of Treasury backing sounds enticing, the Chancellor’s announcement was vague.

“The question is, how long does it take a budget statement to actually turn into something which is real and that's still a question mark because what the budget said was pretty broad and brief.”

With a major update on Britain's green economy expected by the end of the month, dubbed Green Day, SMR developers are hoping for more concrete answers and commitments.

A government spokesman said: “We are launching Great British Nuclear to address constraints in the market and support new nuclear builds as we work towards energy security.

“We expect the competition to attract the best designs from both domestic and international vendors, and we are aiming to select the leading technologies by the end of this year.”

Yahoo Finance

Yahoo Finance