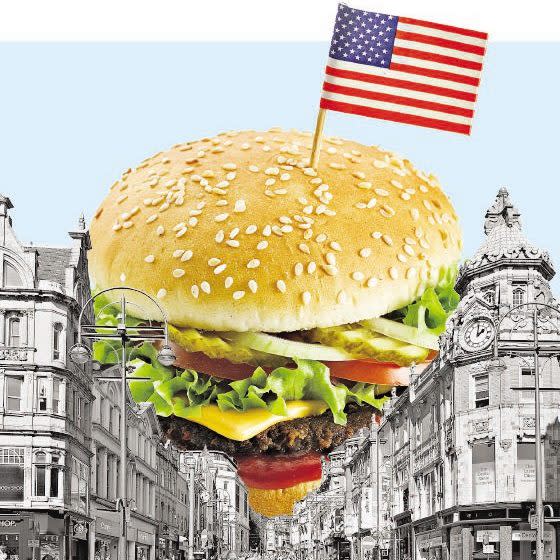

Britain proves its supersize appetite for American fast food

The first Popeyes Louisiana Kitchen store to open in London is barely more than a counter over which fried chicken passes.

But the site in Stratford’s Westfield Shopping Centre has been so popular with the British public that it required a complete redesign of the food court to accommodate the queues.

“We had three-to-four hour queues for the first three months,” says Tom Crowley, who heads up the chain’s UK operations. More recently, "at a weekend we could have up to 50 to 100 people waiting at any time”.

Popeyes, founded in the 1970s, is well known for its chicken sandwiches and American-style biscuits in the US. But over the years to come, it wants to become a UK high street staple with more than 300 sites.

And it’s well on its way. The Stratford branch, which opened in November 2021, is now the best-performing Popeyes restaurant in the world out of 3,500 sites. “It defies all thoughts that a fried chicken brand could be so busy,” says hospitality analyst Simon Stenning.

It isn’t the only US fast food giant drawing crowds. There’s Little Caesars, which is hoping to shake up the pizza market by offering freshly cooked pizzas to go for just over £5. And Wendy’s, which returned to the UK in 2021 and has embarked on a nationwide expansion.

American chains like Taco Bell, Shake Shack and Wing Stop are already staples across the UK. The $3.5bn (£2.95bn) Buffalo Wild Wings chain denied it was planning to open in the UK, but registered its trademark here nonetheless last week.

So why has Britain developed such a ravenous hunger for American fast food?

As a nation we are “generally becoming more Americanised in our eating habits,” says Stenning. According to Future Foodservice data, fast food sales in 2022 were 10pc higher than 2019, making it the fastest growing sector of food and drink in hospitality.

The UK is a logical next step for US brands looking for fast growth, says John Eckbert, UK chief executive of burger brand Five Guys. “[The UK] is culturally adjacent. We have the same music, a lot of common heritage and the same language.”

Five Guys is, compared to new entrants like Popeyes and Little Caesars, somewhat of an old hand in the UK market. Its UK launch, in 2013, is widely credited with sparking Britain’s love affair with American food - and signalling to businesses in the States that there was serious money to be made.

“We had a wave of franchises come over about 50 years ago - McDonalds, Burger King etc,” says hospitality consultant Peter Backman. “Then really nothing much happened until Five Guys pitched up. Five Guys showed there were still opportunities and has now encouraged these other US brands.”

Thanks to the combined effects of social media and globalisation, there is now a legion of young British people that, while they might not have ever been to the US or even seen an ad for a business like Popeyes or Little Caesars, are well aware of these brands.

“There is incredible demand from a younger audience that’s well aware of what these brands are and are keen to get hold of them,” says Stenning.

The UK is also often seen as a proving ground for international success. “Success in the UK means you can make it in Europe, which means you can make it in Asia and the Middle East. It’s like a domino effect,” says Eckbert.

“We see the UK within Europe as a powerhouse, a place to be and a place where certainly as an American brand there’s good brand recognition,” agrees Little Caesars chief development officer Jeremy Vitaro.

Which makes it all the more tempting for businesses looking to please hungry investors. “US chains are under pressure at home,” says Backman. “There is a lot of competition and the US consumer has got fed up with some of the brands, either where there’s no differentiation or the brand hasn’t changed.”

This isn’t just happening in the UK. “If you go to the UAE, or even India, there’s a lot of activity from US chains as well, driven by this need to become international.”

There’s a caveat: what you’ll get in some of these restaurants is not, strictly speaking, a completely accurate representation of their stateside offer. In fact, some dishes have had to be made healthier just to be able to be launched here.

“Some products on the US menu couldn’t be here because of salt levels,” says Crowley.

“That’s pretty normal for US brands - UK legislation is slightly different when it comes to nutrition and salt levels. And the UK palate doesn't like that much salt. It was an easy move.”

Popeyes also had to make its chicken spicier to please British diners. “The spice level we turned up for the UK - the UK really likes spicy food.”

And the chain nearly didn’t launch its signature biscuits - a bestseller in the US - over here for fears Britons wouldn’t know what to do with them. But now “people are mopping up their gravy as they do in the US”, he laughs.

Should established players be worried? Potentially, if they can’t match the American chains on price.

The appeal of these brands is likely to intensify as the cost of living crisis continues because fast food is generally a lot cheaper than traditional sit down meals.

“The average price for a Popeyes chicken sandwich meal is £7.99 and that’s really good value,” says Crowley. “We’ve seen it before in recessions where people just can’t afford the casual dining meal - therefore it becomes a QSR (quick service restaurant) occasion.”

Little Caesars, meanwhile, has launched by offering a whole ‘hot n ready’ pizza for £5. ”We’re making pizzas fresh throughout the day, consumers can walk in and the pizza is ready to go,” says Vitaro, adding it is able to offer such prices because it is a “high volume, high transaction model” that works in smaller spaces.

Stenning says mid-tier sit down restaurants and pubs are the most likely to be affected, because those with cash are not necessarily cutting down on high end restaurants..

He says while there will always be demand for these types of meals from older customers, there is currently a polarisation in the market, which means shoppers are either going for more sociable, value-driven meals or spending on up-market experiences.

“What happens if you get caught in the middle? You’ve got to fight for your life.”

Yahoo Finance

Yahoo Finance