Britain's Boohoo buys Debenhams brand while ASOS moves for Topshop

By James Davey

LONDON (Reuters) - Britain's two biggest online fashion retailers Boohoo and ASOS have moved to buy the brands of collapsed high street giants Debenhams and Arcadia, underlining how the COVID-19 pandemic has turbocharged growth in digital sales.

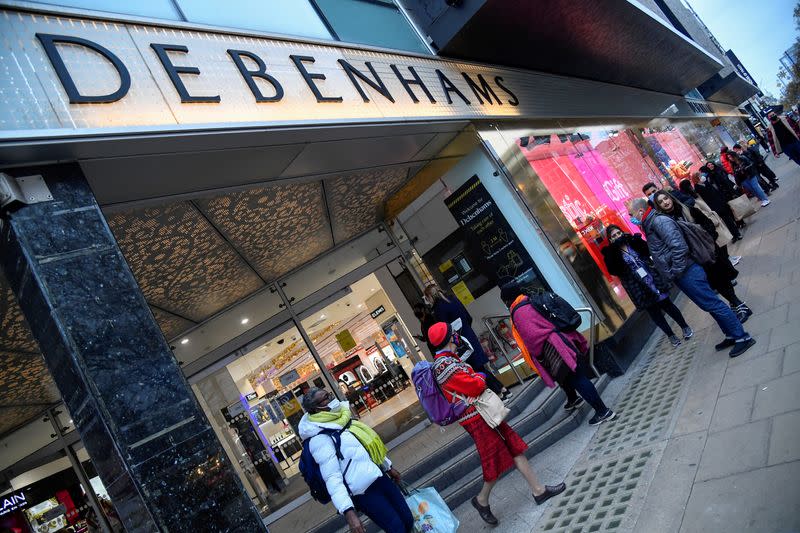

Boohoo on Monday acquired the Debenhams brand and other business assets, including all its in-house brands and websites for 55 million pounds ($75.4 million).

But the deal with Debenhams' administrators, FRP Advisory, does not include any of the chain's 124 stores or safeguard jobs.

The 243-year-old Debenhams has been in administration since April and last month FRP said it was starting a liquidation process, putting 12,000 jobs at risk.

Debenhams' stores are closed because of pandemic lockdowns, but once able to reopen FRP will conduct a stock liquidation before closing the sites permanently, the administrators said.

"The acquisition of the Debenhams brand is an important development for the group as we seek to capture incremental growth opportunities arising from the accelerating shift to online retail," said Boohoo Chief Executive John Lyttle, adding that the deal will enable it to grow into new categories including beauty, sport and homewares.

Shares in Boohoo were up 4.3% at 0830 GMT.

Meanwhile, ASOS said it was in exclusive talks with the administrators of Philip Green's fallen Arcadia group over the acquisition of the Topshop, Topman, Miss Selfridge and HIIT brands.

Arcadia collapsed into administration in November, putting more than 13,000 jobs at risk.

"The board believes this would represent a compelling opportunity to acquire strong brands that resonate well with its customer base," ASOS said, adding that any deal would be funded from cash reserves.

However, it cautioned that there was no certainty a deal would be sealed.

Sky News on Saturday reported that ASOS could pay more than 250 million pounds for the Topshop brand.

Next pulled out of the contest on Thursday, saying it did not want to overpay.

Shares in ASOS were up 3.7%, extending year-on-year gains to 56%.

($1 = 0.7294 pounds)

(Reporting by James Davey; Additional reporting by Paul Sandle; Editing by Kate Holton and David Goodman)

Yahoo Finance

Yahoo Finance