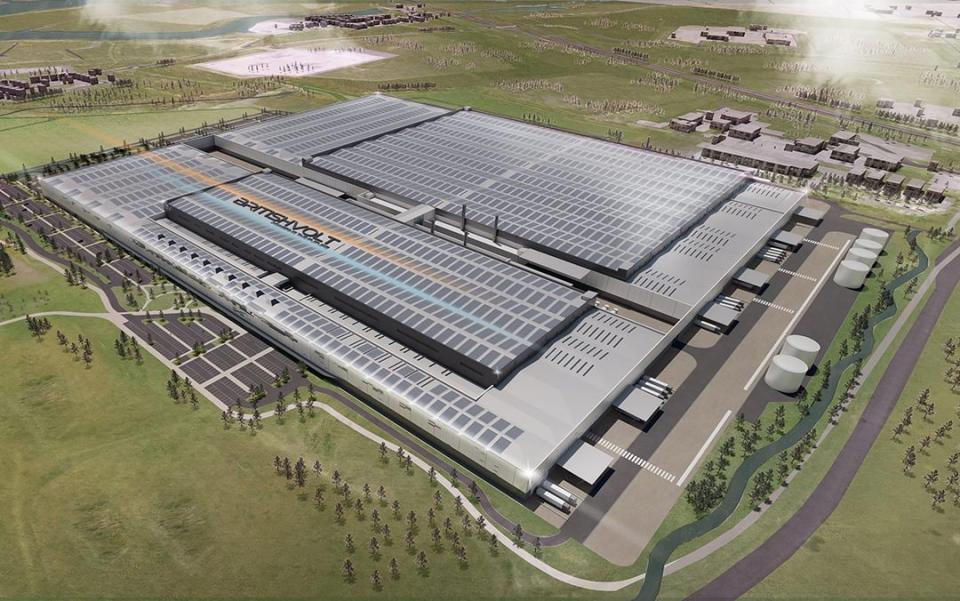

British gigafactory builder becomes $1bn ‘unicorn’

A company seeking to power Britain's electric car revolution with a battery “gigafactory” in Northumberland has won new investment in a funding round which values it at $1bn (£720m).

Britishvolt secured a $70m cash injection from businesses including the mining behemoth Glencore; the European green investment fund Carbon Transition; and NG Bailey, an engineering business.

The fundraising, which was run by Barclays, means that Britishvolt has now achieved $1bn “unicorn” status.

It comes after a groundbreaking ceremony staged by Britishvolt on July 27 at Blyth, where it aims to build its gigafactory on the site of a former power station.

Kasra Pezeshki, chief investment officer, said: “We are seeing huge demand from the investment community for environmental, social, and governance propositions and Britishvolt is one of the few offerings built from the ground up with sustainability at its core.”

The company needs to raise more than £2.7bn to complete the project, which will be key to power Britain’s car manufacturing industry as it makes the switch to electric vehicles.

Ministers are banning sales of new cars powered solely by petrol or diesel engines from 2030 and companies are racing to build a domestic supply chain which can provided components such as batteries, electric drivetrains and electronics for their replacements.

Batteries' weight makes them more expensive to transport, so building several British gigafactories will be vital if the plan is to succeed.

Britishvolt aims to be capable of making enough battery packs for 300,000 vehicles a year by 2027, although initial production at lower volumes is hoped to begin in 2023.

The company has agreed provisional deals with major car manufacturers to supply them with batteries, which will account for about two thirds of its initial production capacity.

Glencore’s investment in Britishvolt, first reported by the Financial Times, is part of a wider tie-up between the two businesses.

Last month they revealed a long-term agreement for the mining giant to supply cobalt for use in the construction of batteries.

Glencore is the world’s largest producer of the material and Britishvolt said the scheme “significantly de-risks operations by obtaining long-term security of supply”.

In May The Telegraph revealed how the British Government is investigating creating a national stockpile of rare earth minerals - such as cobalt - which are key to the transition to electrical power.

The International Energy Agency (IEA) warned Western governments that they could need to build up stores of the materials as China is cornering the market in production of rare earth minerals.

Up to 3,000 jobs are expected to be created at the Blyth factory and 5,000 more in the supply chain.

Yahoo Finance

Yahoo Finance