British Land hit by fall in office leasing volumes

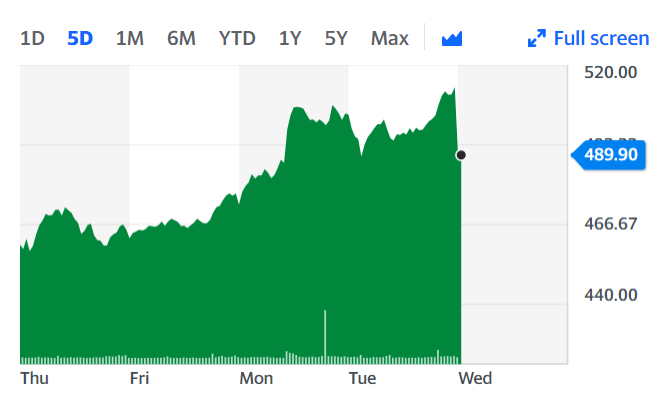

British Land (BLND.L) reported a fall in its underlying profit for the first half of 2020, with both its office and retail portfolio taking a hit due to lockdowns across the UK as a result of the coronavirus pandemic. Shares were down 4% as markets opened Wednesday morning.

Underlying profit for the six months ending 30 September was £107m ($142m), an almost 30% decrease year-on-year.

Loss after tax was £730m, up from £404m a year earlier.

“Leasing activity was understandably subdued, with occupiers more focused on the short-term operational challenges,” the company said in a statement.

It said its portfolio value was down 7.3%, with offices down 3.1% and retail down 14.9%.

Going forward, the company is worried that “as a result of COVID-19 and Brexit related uncertainty, leasing volumes are likely to be lower as we expect customers to continue to defer decisions and extend existing leases where they can.”

However, incoming CEO Simon Carter, was hopeful. He said: “Many of our customers have seen that their people can work more flexibly, but they are clear that great office space, such as we deliver at our mixed use campuses, will continue to play a crucial role in their success, by promoting innovation, collaboration, training and culture.”

“Investors are increasingly taking a similar long term perspective, looking through COVID, to acquire prime London offices at pricing close to pre-pandemic levels,” he added.

Carter set out his four priorities for the firm: realising the potential of mixed use, progressing value accretive development, addressing the challenges in retail, and active capital recycling.

In March, the company had temporarily suspended its dividend payments, which it said it has now resumed.

Watch: Why can't governments just print more money?

READ MORE: UK real estate investment trust banks on a Tesco Extra and Aldi for returns

Separately, British Land announced it had completed the sale of Clarges Mayfair for £177m, 7.6% above its September valuation.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “The slowdown in office leases and potential difficulties with retail rents reflects the nervousness about the commercial property market, even though a mass vaccine programme is now on the horizon.

“Defensive tactics at British Land though have increased its resilience and strengthened its balance sheet, making way for the dividend’s return at 8.4 pence per share. It’s offloaded £456m retail assets since the pandemic took hold.”

Watch: What is a budget deficit and why does it matter?

Yahoo Finance

Yahoo Finance