British Pound’s Bull Run is influenced by Increase in Risk Appetite in Market

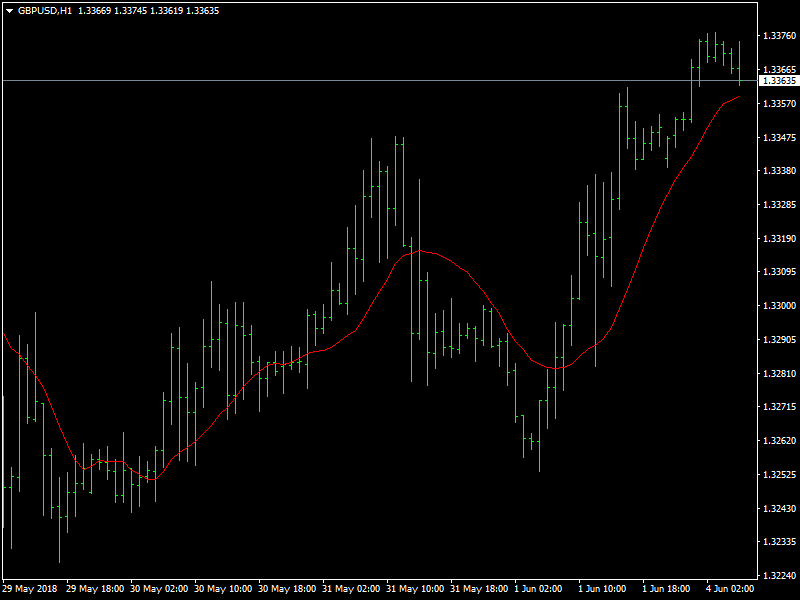

The GBP/USD is lifting in risk-on markets to kick off the new trading week, and the pair is trading into 1.3365 ahead of Monday’s London market session that brings the UK’s Construction PMI figures for May. The British Pound was the only major global currency that had an upper hand on US greenback as trading session closed last Friday. The Pound Sterling closed for the week above 1.33 price handle and this uptrend movement was influenced by better than expected results in UK’s manufacturing PMI at 54.4 while the previous data for same was at 53.9. Another major factor to pound’s Bull Run was news in market about progress in brexit talks.

GBPUSD Buoyant

While there has been no official confirmation to same there have been rumors and news with headlines indicating that Brexit Secretary David Davis suggested an idea where the country could be given a joint EU and UK status and a buffer zone could be created on its border with the Irish Republic as a possible solution for current Northern Ireland border issue.

On release font, investors are on look out for durable goods and factory orders data release in US market while UK’s calendar is scheduled for UK’s Construction PMI for month of May 2018 and a speech by Bank of England Monetary Policy Committee member Silvana Tenreyro. While she is relatively new to MPC, her speech is expected to shed some light of BOE’s stance for possible rate hike in August 2018. A positive result in today’s construction PMI is expected to help Pound bulls on its way to scale 1.35 price handle while a negative data is expected to push the pair back below 1.325 price level. Technical indicators for Daily candles are finally beginning to rollover into bullish signals. While the 4 hour chart saw the price movement remains well above 20 day SMA for the first time in a month. Current price momentum lacks directional strength but remains in positive zone supportive of continued bullish price growth. Investors are also on lookout for BRC retail sales monitor data which is scheduled to release during North American market hours. Expected support and resistance for the pair are at 1.3290 / 1.3245 / 1.3200 and 1.3375 / 1.3420 / 1.3460 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance