Brits can't afford to buy their first home until 34, study finds

Brits now can’t afford to buy their first home until they are about 34 — a significantly longer wait than in countries like Iceland and Belgium, research suggests.

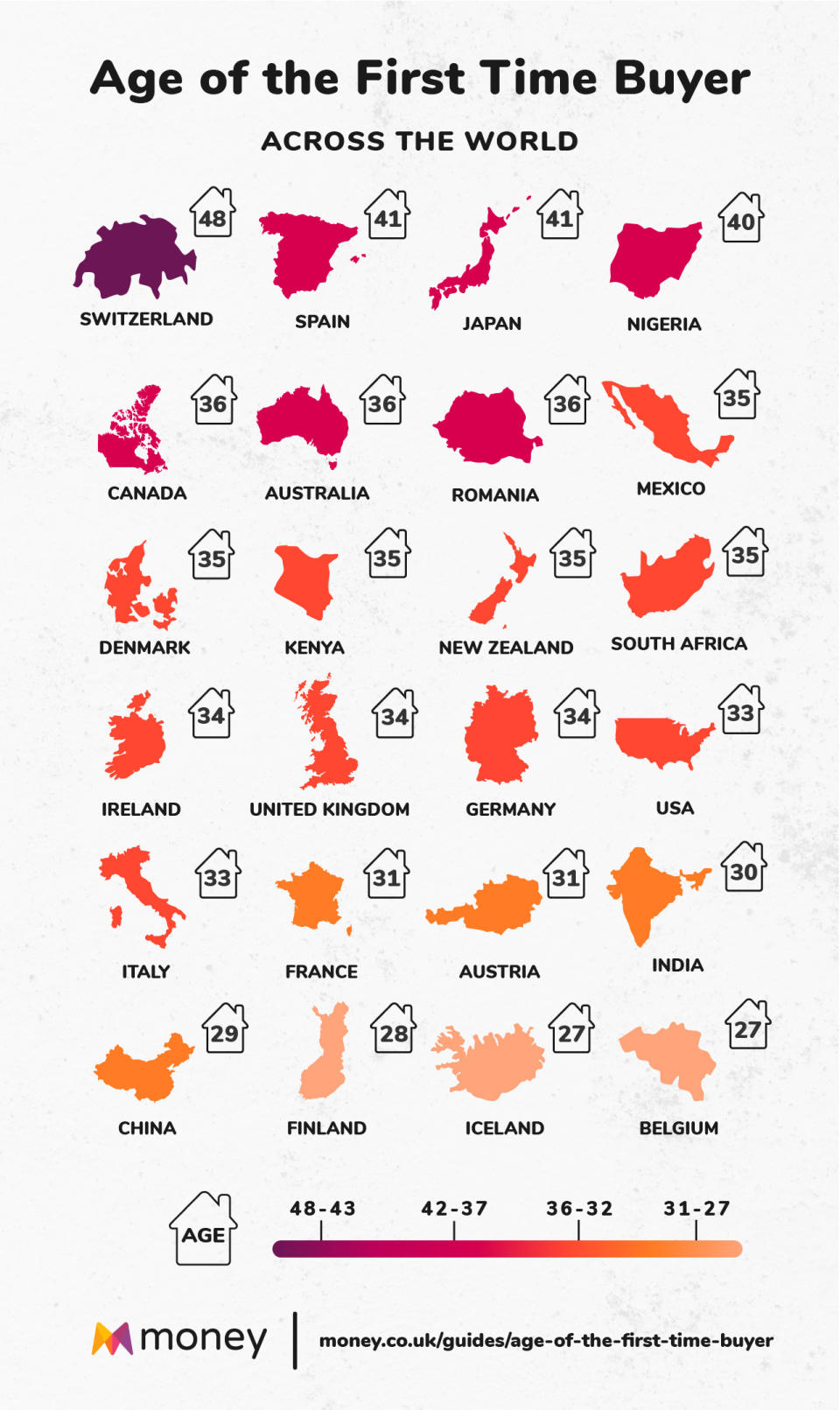

The UK came in at number 11 on Money.co.uk’s first-time buyers index, which ranked 25 countries on the predicted average age — youngest-to-oldest — of their first-time homebuyers.

The factors analysed in the study included each country’s annual salary, budget, property price, difference between property price and budget, deposit needed, and price per square metre.

The average salary is £36,024 ($47,361) a year, and the average budget for a first-time property is £162,108 in the UK, the research found.

READ MORE: UK Help-to-Buy hotspots at risk of disappearing due to price caps

But the price of a two-bedroom flat is about £254,000 — meaning Brits end up with a deficit of about £91,892 when trying to buy their first home.

Meanwhile, some countries jump onto the property ladder a lot sooner, with the youngest first-time buyers — at just 27 years old — being found in Iceland and Belgium.

Icelanders earn the highest annual salary of 25 countries, at £52,433.65 a year, while Belgium follows closely in fifth place, with £42,860.72.

This income allows both countries to be well within budget to buy their first house, as a two-bedroom property only costs around £210,000 in Iceland, and £152,000 in Belglium.

Finland comes in third place, with an average annual salary of £35,233.84, a budget of £158,552.28 and property prices of £241,000 making Finns around 29 years old when they are able to buy their first property.

READ MORE: Rural markets boom as Brits flock to countryside

However, the difference between buyers’ average budget and the average price of a two-bedroom house means Finns will likely find themselves in a deficit of £82,447.72 when buying a home.

Meanwhile, Switzerland has the oldest demographic of first-time buyers, with the average person being 48 years old before purchasing their first home.

Despite earning the highest annual salary out of all 25 countries — £50,777.00 — a two-bedroom flat costs an average of £501,000 in Switzerland, the research found.

And, with a budget of just £228,496.50, the average Swiss buyer would end up in a deficit of £272,503.50 when trying to buy their first home.

Watch: UK’s Johnson Pledges Housing Revolution for Young Buyers

Yahoo Finance

Yahoo Finance