Brits to invest in China after Biden win

British investors were snapping up China and Asian equity funds fast in the two weeks after the US elections, when compared to the previous fortnight, in a sign that they are hopeful of improving US-China relations after Joe Biden’s win.

Data from British financial service company Hargreaves Lansdown’s (HL.L) trading platform revealed that China and Asia Pacific equity fund flows were up 84% in the wake of the election.

“Net flows into the China & Asia Pacific IA sector increased once the outcome of the presidential election was clear, and China-baiting Trump was set to leave the White House,” said Hargreaves Lansdown.

Flows into China equity funds increased by 62%, and flows into Asia-Pacific funds (excluding Japan) increased by 132%.

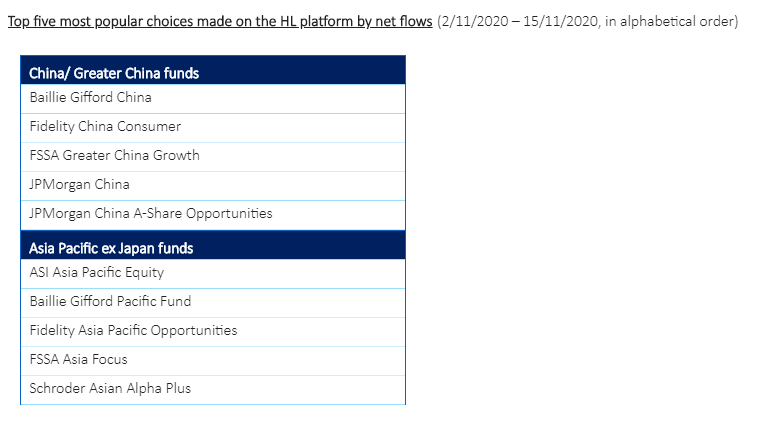

Some of the most popular funds in China included funds run by Baillee Gifford and Fidelity.

“While president-elect Joe Biden has not been explicit about his planned trade policies, he has signalled he will be a more uniting president, both domestically and abroad,” explained head of investment analysis at Hargreaves Lansdown, Emma Wall.

“Evidence of this include his pledge to re-join the Paris Climate Agreement, and stating that he wants the US to be ‘aligned with other democracies’ on trade,” she said.

She added that while “this is not to say Biden necessarily will be soft on China, as some of his detractors have suggested…We can expect a more considered and less inflammatory style, as has been typical of Donald Trump’s foreign policy rhetoric.”

Watch: Why can't governments just print more money?

READ MORE: Trump bans Americans from investing in 'Chinese military-linked' firms

US-China relations have been particularly bad under the Trump administration. Last week, US president Donald Trump signed an executive order banning Americans from investing in Chinese firms the administration says are owned by or controlled by China’s military.

It was the first major policy initiative signed by Trump since he lost the 3 November election to Biden. It is unclear whether Biden, who is set to take office nine days after the order goes into effect will enforce or revoke it.

The world’s biggest economies are already at odds over China’s handling of COVID-19 and its move to impose security legislation on Hong Kong.

WATCH: What does a Joe Biden presidency mean for the global economy?

Yahoo Finance

Yahoo Finance