Brokers Are Upgrading Their Views On International Petroleum Corporation (TSE:IPCO) With These New Forecasts

International Petroleum Corporation (TSE:IPCO) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects.

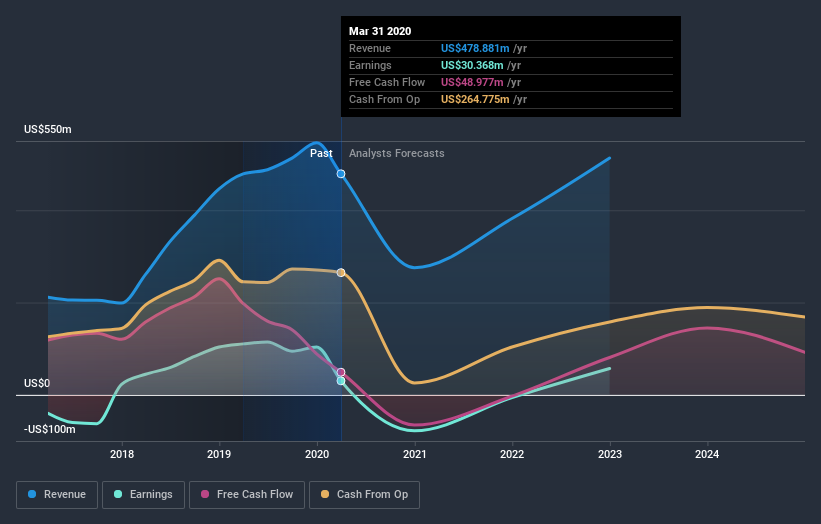

Following the latest upgrade, the two analysts covering International Petroleum provided consensus estimates of US$276m revenue in 2020, which would reflect a stressful 42% decline on its sales over the past 12 months. Following this this upgrade, earnings are now expected to tip over into loss-making territory, with the analysts forecasting losses of US$0.49 per share in 2020. However, before this estimates update, the consensus had been expecting revenues of US$229m and US$0.56 per share in losses. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

See our latest analysis for International Petroleum

It will come as no surprise to learn that the analysts have increased their price target for International Petroleum 210% to US$7.77 on the back of these upgrades. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic International Petroleum analyst has a price target of US$32.29 per share, while the most pessimistic values it at US$2.50. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the International Petroleum's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 42%, a significant reduction from annual growth of 36% over the last three years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 6.2% annually for the foreseeable future. It's pretty clear that International Petroleum's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around International Petroleum's prospects. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at International Petroleum.

Better yet, our automated discounted cash flow calculation (DCF) suggests International Petroleum could be moderately undervalued. For more information, you can click through to our platform to learn more about our valuation approach.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance