How Brookfield's Acquisition of GGP Looks One Year Later

Brookfield Property REIT (NASDAQ: BPR) is a real estate investment trust (REIT) focused on owning and operating best-in-class retail shopping centers. One year ago the company completed its acquisition of General Growth Properties (GGP), a REIT focusing on master planned communities and retail, for a cool $27.5 billion. This acquisition was bold for reasons beyond its large size. The shopping center industry has gone through a tough time in recent years due to competition from e-commerce, which has led many retailers to close stores and has pushed a few into bankruptcy.

It took guts for Brookfield to make such a big bet on retail at this tumultuous time, but if Brookfield was able to get a good price, perhaps it will come out ahead.

Image Source: Getty Images.

The GGP acquisition

Brookfield Property and GGP announced their deal to merge in late 2017. At the time, GGP was a publicly traded company. In a somewhat complicated transaction, Brookfield Property REIT was created as a new entity by Brookfield Property Partners (NASDAQ: BPY) to consummate the transaction and create a separately traded REIT focused on shopping centers. Brookfield Property Partners is a larger, diversified real estate company with its hands in a variety of property types across the globe. GGP shareholders were given the option of taking an all-cash deal or taking shares in the newly created property REIT.

Brookfield Property REIT is managed by Brookfield Asset Management (NYSE: BAM), which already managed Brookfield Property Partners. Part of the thinking behind the transaction is that there are greater efficiencies to managing a larger pool of assets. The other major strategic point is that the Brookfield universe of companies is well-capitalized and could fund all GGP's redevelopment projects at a cheap cost of capital.

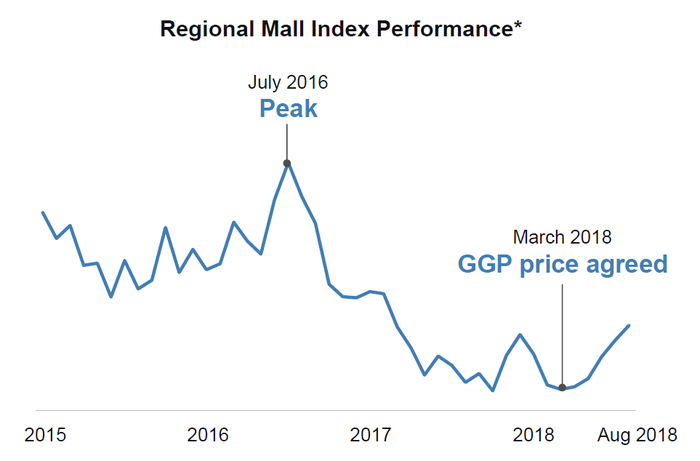

However, the primary reason that Brookfield wanted to acquire GGP was price. The following slide is from Brookfield's 2018 analyst day and shows how the company was able to acquire GGP after the industry as a whole saw stock prices decline in reaction to the troubles in the retail industry.

Image Source: Brookfield Property REIT Investor Presentation.

Brookfield's decision to acquire GGP was clearly a contrarian one given the state of the industry and where stock prices traded. The deal was completed in August 2018, and the newly created Brookfield Property REIT began trading immediately after.

Brookfield Property REIT's stock is down but its financials have held up

This past year has continued to be a difficult time for the shopping mall industry. Several more high-profile retailers have filed for bankruptcy, including Sears Holdings and Bon-Ton. Other retailers, including Ascena Retail Group and Gap, have announced more store closures at an aggressive rate.

As a result, the shopping center stocks have continued to trade lower, and Brookfield Property REIT has not been an exception to this trend.

For what it's worth, Brookfield Property REIT's financial metrics have held up. As of June 30, 2019, the company reported that its portfolio maintained an occupancy level of 95% and that its rental rates for new leases were 7.2% higher than rents on expiring leases. These metrics show that Brookfield's shopping centers are still quite healthy and are continuing to experience rental revenue growth.

Brookfield's healthy metrics can largely be explained by the types of malls it operates. The company focuses on luxury malls, which are generally located in dense urban areas with high foot traffic and in close proximity to high-income households. Luxury malls have outperformed suburban malls because sales per square foot have continued to grow, attracting tenants willing to pay higher rents.

The acquisition of GGP may not have been perfectly timed in the sense that the retail industry continues to endure pain from vacating retailer tenants. But Brookfield's malls have shown an ability to weather the storm and post solid business metrics.

Looking ahead

Brookfield's acquisition of GGP was certainly bold, but only time will tell if it will be lucrative. So far the stock is down, although its business metrics have held up. The company's strategy of focusing on the best-in-class luxury malls looks smart, but that hasn't made it totally immune to pressures from the broader retail industry. The market is clearly anticipating that the troubles faced by suburban malls will eventually hinder luxury malls. However, if the contagion in retail doesn't spread, opportunistically buying Brookfield Property REIT's stock here could be a good bet on a strong player in a recovering industry.

More From The Motley Fool

Luis Sanchez has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Brookfield Asset Management. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance