Brookfield Asset Management Leads Three TSX Stocks Seemingly Trading Below Their Estimated True Value

As central banks in both the U.S. and Canada adjust interest rates in response to evolving economic indicators, investors are closely monitoring the implications for market valuations and investment opportunities. In this context, identifying stocks that appear undervalued relative to their potential becomes particularly pertinent, especially when considering sectors that might benefit from current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$179.35 | CA$313.98 | 42.9% |

Trisura Group (TSX:TSU) | CA$41.23 | CA$80.18 | 48.6% |

Decisive Dividend (TSXV:DE) | CA$7.18 | CA$11.76 | 38.9% |

Kinaxis (TSX:KXS) | CA$156.55 | CA$262.99 | 40.5% |

Kraken Robotics (TSXV:PNG) | CA$1.16 | CA$2.24 | 48.2% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Green Thumb Industries (CNSX:GTII) | CA$16.04 | CA$28.22 | 43.2% |

Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Capstone Copper (TSX:CS) | CA$9.95 | CA$19.60 | 49.2% |

Kits Eyecare (TSX:KITS) | CA$9.04 | CA$15.43 | 41.4% |

Here's a peek at a few of the choices from the screener.

Brookfield Asset Management

Overview: Brookfield Asset Management Ltd. is a real estate investment firm that specializes in managing alternative assets, with a market capitalization of CA$22.35 billion.

Operations: The firm primarily focuses on alternative asset management, with a market capitalization of CA$22.35 billion.

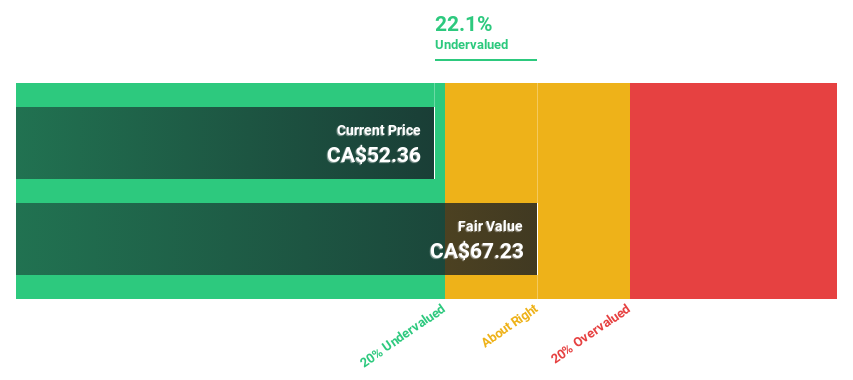

Estimated Discount To Fair Value: 18.5%

Brookfield Asset Management, priced at CA$54.81, is trading below its estimated fair value of CA$67.23, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow by 74.4% annually, outpacing the Canadian market forecast of 14.9%. Additionally, revenue growth is expected at a robust rate of 61.8% per year, significantly higher than the market average of 7.3%. However, its dividend coverage by earnings and free cash flows remains weak, indicating possible financial strain in sustaining dividend payouts amidst aggressive growth pursuits and recent M&A activities like the potential acquisition of Tritax Eurobox plc.

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe with a market capitalization of approximately CA$87.21 billion.

Operations: The company generates its revenue primarily from the Software & Programming segment, totaling CA$8.84 billion.

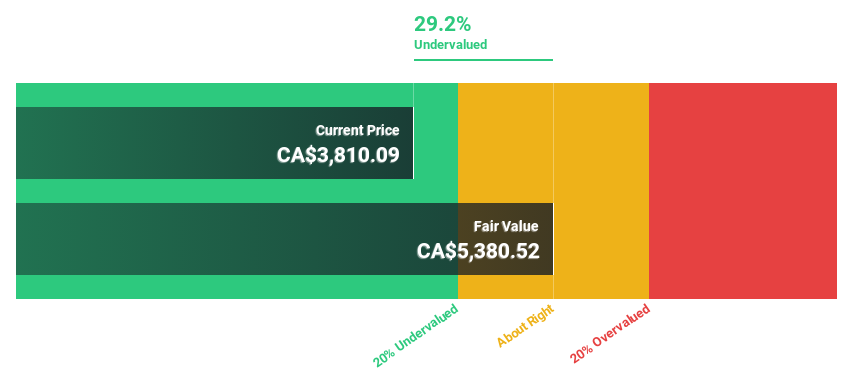

Estimated Discount To Fair Value: 26.6%

Constellation Software, with a current price of CA$4094.45, is trading below the calculated fair value of CA$5579.8, indicating potential undervaluation based on discounted cash flow analysis. Despite a high level of debt and significant insider selling recently, the company's earnings have grown by 13.4% over the past year and are expected to increase at an annual rate of 24.43%. Recent strategic expansions like Omegro and executive changes may further influence its capital deployment and growth trajectory in software sectors globally.

Endeavour Mining

Overview: Endeavour Mining plc, along with its subsidiaries, is a gold mining company operating in West Africa with a market capitalization of approximately CA$7.80 billion.

Operations: Endeavour Mining's revenue is primarily derived from four mines: Ity Mine generates $653.70 million, Mana Mine contributes $292.70 million, Houndé Mine adds $611.30 million, and Sabodala Massawa Mine produces $548.40 million.

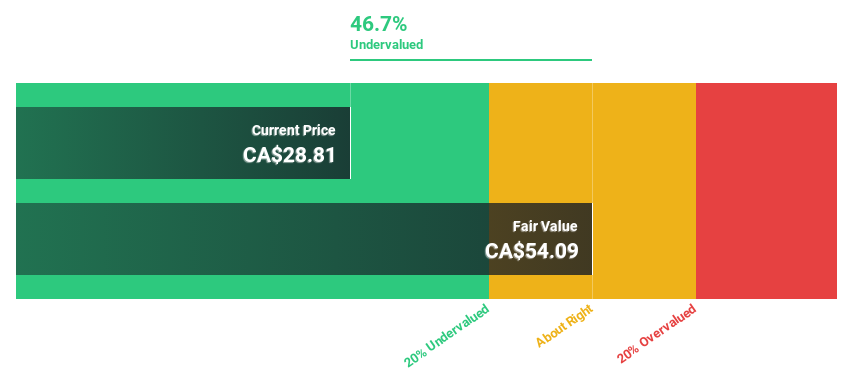

Estimated Discount To Fair Value: 33.3%

Endeavour Mining, currently priced at CA$32.47, is perceived as undervalued compared to its fair value of CA$48.64, primarily based on discounted cash flow analysis. The company's revenue growth rate of 9.8% annually is expected to surpass the Canadian market average of 7.3%. Despite some concerns over significant insider selling in the past three months and a dividend that may not be well-supported by earnings or free cash flows, Endeavour's strategic advancements, such as the successful early launch and operation of the Lafigué mine, position it for potential profitability and above-market profit growth within three years.

Where To Now?

Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 17 more companies for you to explore.Click here to unveil our expertly curated list of 20 Undervalued TSX Stocks Based On Cash Flows.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BAMTSX:CSU TSX:EDV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com