BT's mobile unit wades into 5G battle against Three

BT’S mobile arm EE is preparing to go into battle with rival operator Three over billions of pounds worth of airwaves, amid fears of delays to 5G network upgrade plans.

EE will tomorrow formally threaten the telecoms regulator Ofcom with a High Court challenge over the planned auction of radio spectrum.

The move is designed to head off another legal attack on the sale by Three, the smallest of Britain’s four main mobile networks, which is owned by the Hong Kong conglomerate CK Hutchison. Three’s planned judicial review aims to impose tighter restrictions on the share of the airwaves EE is allowed to buy.

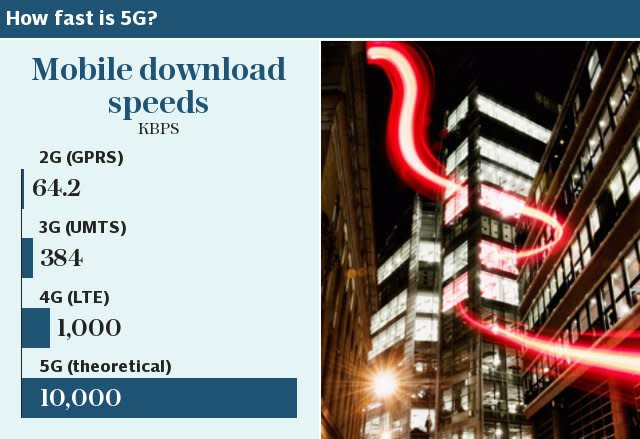

EE now fears any changes to the auction rules as a result of that action could undermine its ambition to take a lead in the roll-out of 5G technology, which promises faster and more reliable mobile internet access.

Amid difficult trading and regulatory upheaval elsewhere in BT, its mobile arm, acquired last year for £12.5bn, is viewed by group chief executive Gavin Patterson as a strong performer with a lead on the competition that should be maintained.

It has a central role in BT’s strategy as mobile and fixed line networks are increasingly expected to combine to provide more seamless internet connections.

EE, the country’s largest mobile provider with 30m customers, had planned to set aside its objections to the auction rules proposed by Ofcom in the hope of securing access to 5G spectrum as soon as possible. Chief executive Marc Allera said Three’s judicial review threat required a counter-stroke.

He told The Sunday Telegraph: “We’re supportive of Ofcom’s goal to release airwaves quickly, and we don’t want this challenge to slow down that process, but Three’s latest action has forced our hand. This is our last resort. We’ve been consistently opposed to the cap that Three is trying to make even more restrictive.

“The UK needs continued 4G investment and a clear path to the introduction of four high-quality 5G networks. We cannot risk being outperformed by countries across Europe.” The gathering storm around the auction threatens to blow off course Ofcom and government plans for Britain to be part of the 5G vanguard.

The sale, already delayed by a failed attempt by Three to buy O2, is scheduled for this year but is likely to be held up for months by High Court wrangling. Delays are likely, though EE’s challenge could be heard at the same time as its rival’s.

Ofcom is due to sell off chunks of the airwaves in two frequency bands. As well as 5G spectrum, which is not expected to be compatible with smartphones until around 2020, it is auctioning a lower frequency that is already used in 4G handsets.

O2, which has the smallest share of the airwaves, is keen to get its hands on that spectrum as soon as possible to guard against a capacity crunch on its network as demand for mobile data skyrockets. It appealed to Ofcom to create a leasing system while potentially lengthy legal battles are fought.

In a show of “pragmatism”, EE, which has the largest share of the airwaves at around 42pc, said it would stand aside if Ofcom were to auction the less contentious lower frequency separately.

Its challenge to the auction rules is focused on the higher 5G frequency, where Ofcom plans to impose a 37pc cap on the overall share of the airwaves an operator is allowed to own.

Three has called for a tighter cap and based its legal challenge on claims the regulator could water down the rules later.

EE now plans to argue in court there should be no cap. It has also urged Ofcom to consider bundling the airwaves into a 5G super-auction alongside other frequencies due to be made available in the next few years.

Yahoo Finance

Yahoo Finance