BT's move to cut workers' pensions has implications for millions

Thousands of pensioners face the prospect of sharply reduced retirement incomes as major British companies attempt to alter the terms of ruinously expensive pension pledges.

Telecoms giant BT has written to current and former workers informing them it is going to court to determine whether it can reduce the annual increases applying to pensions paid to its employees.

BT is far from the only business seeking to argue that previous promises made to staff are today unaffordable, and that they should be allowed to “water down” some of the benefits.

On Wednesday, data showed that as many as three million workers with “final salary” type pensions had a 50:50 chance of losing a fifth of their promised income – because companies could not afford to pay.

The figures, from the Pensions and Lifetime Savings Association, are the latest in a series of reports highlighting a crisis in company pensions.

In the case of BT, the proposed move would mean many of the 80,000 current and former staff needing to find other sources of income to bridge the gap.

Figures produced by Prudential, the insurer, for Telegraph Money, suggest the average pensioner could lose well over £100,000 over a typical 25-year retirement under the sort of changes BT has outlined.

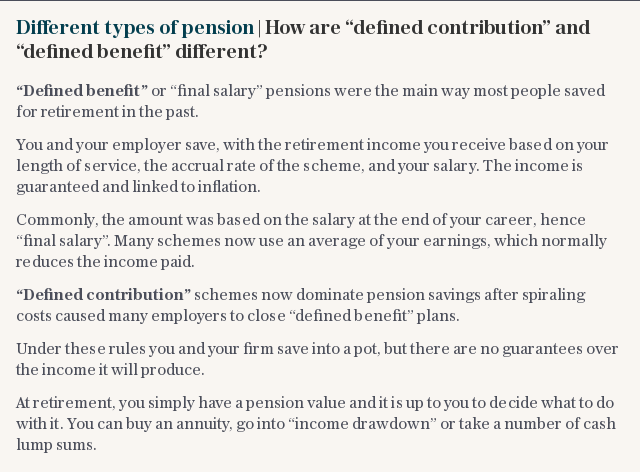

By law “final salary” or “defined benefit” pensions – which until the late Nineties were commonplace – must be increased annually to protect incomes from falling behind the cost of living.

At the moment, the BT savers affected (members of the pension fund’s “C” plan) have their retirement income increased by the retail prices index (RPI).

Where they can, the companies that pay into these types of pension funds have switched to using an alternative inflation measure, the consumer prices index (CPI).

In almost all years CPI is lower than RPI, often by around one percentage point, meaning pensioners in schemes using this index see their pensions rise more slowly. The move can save the “sponsoring” companies – in this case BT – a great deal of money.

The BT scheme’s other sections, “A” and “B”, are mainly for staff who joined the company before it was privatised in the Eighties. They have already been switched to CPI. Although the scheme closed to new entrants in 2001, more than 300,000 existing members continue to build up their entitlements.

In the letter sent to members, and seen by Telegraph Money, BT revealed it had applied to take the matter to court to “seek a decision as to whether it would be possible to change from RPI to another index”. It admits that the court’s decision “may affect the future increases applied to pensions in payment”, but nowhere does it explicitly warn that pensions are likely to be cut as a result.

“The way they have gone about this stinks,” said Charlotte Annandale, 60, who worked at BT for 20 years before retiring early to look after her mother, who suffered from dementia.

“We’ve been told we can write to the lawyers, but I doubt that will get us anywhere.

“I’ve spoken to a lot of fellow BT scheme members about this change and very few people understand what it means for their pension. I’m definitely going to be affected by this – and it will only get worse as the years go by.”

A spokesman for BT said the average pension in the scheme was worth £400,000. That equates to a pension paying roughly £20,000 a year.

Prudential modelled two scenarios: one assuming a pension starting at £20,000 and rising by RPI, and the other starting at the same amount but rising by CPI. It assumes both measures stay at current levels, so 3.9pc for RPI and 2.9pc for CPI.

By 2018 the RPI pension would be worth £20,780 a year – already £200 more valuable than the CPI pension. By 2042, some 25 years after retirement, the pension increasing with CPI would be paying £40,870, about £11,000 less than the RPI pension.

Over the entire 25-year period the difference in payouts would amount to a staggering £113,280.

There are around 6,000 final salary pension schemes, each with their own rules. It is thought around 80pc of all pensions “in payment” are linked to RPI.

In many cases scheme rules prevent any other index being used aside from RPI – though that could be about to change. Rising life expectancy, fewer tax breaks and record-low interest rates have meant many funds don’t have enough money.

Employers responsible for the schemes, now almost all closed to new staff, have pumped in billions of pounds to keep them afloat. In a bid to ease the strain, the Government launched a consultation aimed at tackling the “final salary problem” this year.

One of the proposals was to suspend annual increases “where the employer is stressed”. It also suggested allowing an override to let trustees switch to CPI even where that breaks scheme rules. A Department for Work and Pensions spokesman said the Government would officially respond later this year.

BT’s scheme is regarded as Britain’s largest, with around 300,000 members and assets of £40bn.

A 16-year recovery plan is in force to plug the £7bn funding deficit. The company paid £1.5bn in 2015, £250m last year and another £250m in March this year.

A BT spokesman confirmed that the proposed switch to CPI was part of a broader review. A member of the scheme, who is also a BT director, has been appointed to represent staff in court, and BT has appointed and paid for a lawyer to represent savers.

Of the 5,794 final salary schemes across Britain, over 70pc have liabilities that outweigh the value of investments.

If employers backing the funds fail, the schemes fall into the Pension Protection Fund, where in most cases savers will get 90pc or more of their promised pension.

Yahoo Finance

Yahoo Finance