Builder Confidence Still Below 50 in September: Will it Regain?

According to the National Association of Home Builders (NAHB)/Wells Fargo’s Housing Market Index (HMI), sentiment among U.S. homebuilders for newly-built single-family homes slipped to the lowest level since May 2020 in September. Barring the readings for April and May of 2020 (when HMI fell to 30 and 37, respectively), the September 2022 reading of 46 marks the lowest level since May 2014.

A score below 50 indicates poor industry conditions in most builders’ view.

Persistent supply-chain disruptions, moderate inventory levels and higher material costs are hurting homebuilders’ confidence levels. As a result, homebuilders are increasing prices regularly, leading to affordability issues.

High home prices, above 6% mortgage rates and back-to-back interest rate hikes make it difficult for entry-level and first-time buyers to indulge in such activity. The Fed is likely to conduct another meeting this week and may announce the biggest interest rate hike. Since March, it has lifted the rate from near zero to 2.25-2.50%, currently.

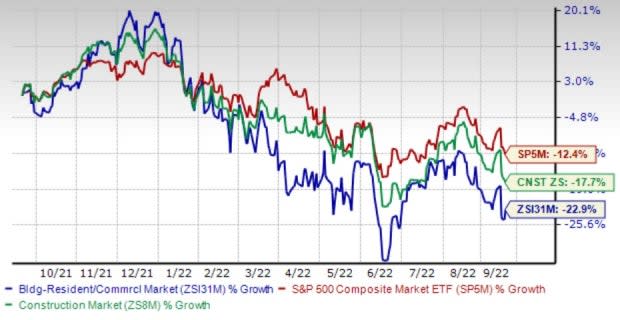

Image Source: Zacks Investment Research

The Zacks Building Products - Home Builders industry has declined 22.9% in a year, underperforming the Zacks Construction sector and the S&P 500 Index’s fall of 17.7% and 12.4%, respectively.

Ninth Straight Month Fall of Confidence, Housing Slowness Persist

For this month, all three HMI components fell sequentially. Current sales conditions decreased three points to 54. Both buyer traffic and sales prediction for the next six months fell one point to 31 and 46, respectively. The HMI gauge of tepid future sales expectation signals slow housing demand this year.

Image Source: NAHB

The three-month moving averages for the regional HMI reading were also down in each region. Northeast dropped five points from the prior month to 51. Midwest fell five points to 44, South fell seven points to 56 and West declined a notable 10-point to 41.

NAHB chairman, Jerry Konter, a home builder and developer from Savannah, Ga, stated, “Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households.” Konter added, “In another indicator of a weakening market, 24% of builders reported reducing home prices, up from 19% last month.”

This year, homebuilders have loosened confidence month over month. Since January, it has declined 37 points now, supporting the signs of a housing recession, thanks to elevated construction costs and an aggressive monetary policy. The declining trend has provoked more than half of the builders to think about incentives like mortgage rate buydowns, free amenities and price reductions to boost sales.

Will Housing Regain Momentum?

Per the market pundits, housing is unlikely to regain this year as the prevailing market condition is not showing signs of recovery. Recently, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey, for the week ending Sep 9, that activity declined to the lowest level since December 1999 from the previous week. Activities will decline more in the future as the 30-year fixed mortgage rate has gone up to 6.02% for the week ending Sep 15, marking the highest reading since 2008 and essentially double the year-ago figure.

In addition to the above-mentioned data, inflation rose 0.6% after adjusting for energy sources, and prices of building materials rose 0.5% in August from July. These factors are enough to setback from housing activities.

Leading homebuilders like Lennar Corporation LEN, PulteGroup, Inc. PHM, KB Home KBH, D.R. Horton, Inc. DHI, Taylor Morrison Home Corporation TMHC, Meritage Homes Corporation MTH and Toll Brothers, Inc. TOL have witnessed lower order and backlog during their last reported quarter and has reduced their expectation for second-half 2022.

Although these stocks have gained 3.54%, 3.33%, 3.17%, 2.77%, 2.61%, 2.38% and 2.11%, respectively on Sep 19, the tepidness persist.

A Brief Outlook of Above-Mentioned Stocks

Lennar, a Zacks Rank #4 (Sell) company, is about to post its quarterly numbers on Sep 21. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For the quarter to be reported, the Zacks Consensus Estimate for LEN’s earnings per share has moved down to $4.77 in the past 60 days. The estimated figure indicates an increase of 45.9% from $4.78 reported in the year-ago quarter. The consensus mark for revenues is pegged at $9.04 billion, suggesting a 30.3% increase from the year-ago reported figure of $6.94 billion.

PulteGroup, which holds a Zacks Rank #3 (Hold), will likely generate 51.1% year-over-year higher earnings and 16.4% stronger revenue this quarter.

However, PHM’s earnings per share have moved down to $2.75 in the past seven days.

KB Home, a Zacks Rank #4 company, is about to post its quarterly numbers on Sep 21.

For fiscal third-quarter 2022, the Zacks Consensus Estimate for KBH’s earnings per share has remained stable at $2.67 in the past 60 days. The estimated figure indicates an increase of 62.8% from $1.64 reported in the year-ago quarter. The consensus mark for revenues is pegged at $1.86 billion, suggesting a 26.8% increase from the year-ago reported figure of $1.47 billion.

D.R. Horton, which holds a Zacks Rank #3, is expected to witness a 41.4% year-over-year improvement in the fiscal fourth quarter’s earnings. Also, revenues are likely to gain 26.2% from the prior year’s levels.

However, DHI’s earnings per share have moved down to $5.23 in the past 60 days.

Taylor Morrison, which carries a Zacks Rank #3, is expected to witness a 90.3% improvement from the year-ago quarter’s earnings. Also, revenues are likely to rise 17.5% from the prior year’s levels.

The Zacks Consensus Estimate for TMHC’s earnings has been upwardly revised to $2.55 per share in the past 60 days.

Meritage Homes, a Zacks Rank #3 company, is likely to generate 25% year over year higher earnings and 31% stronger revenue this quarter.

However, MTH’s earnings per share have moved down to $6.56 in the past 60 days.

Toll Brothers, currently carrying a Zacks Rank #4, has an expected earnings growth rate of 36.1% this quarter. The consensus mark for its revenues is currently pegged at $3.33 billion, up 9.4% year over year.

For the fiscal fourth quarter, earnings have moved down to $4.11 from $4.86 per share in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

Meritage Homes Corporation (MTH) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance