Building a Defensive Portfolio: 3 Utilities Stocks to Consider

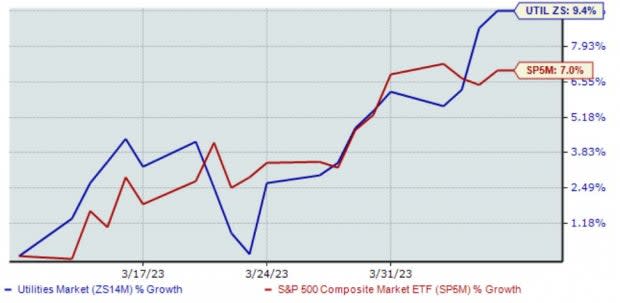

The Zacks Utilities sector has displayed relative strength over the last month, slightly edging out the S&P 500’s 7% gain.

Image Source: Zacks Investment Research

Utilities boast several favorable characteristics for investors. For starters, many reward their shareholders with dividends, providing a passive income stream. Who doesn’t like payday?

In addition, utilities are defensive by nature, as these companies’ essential services generate demand regardless of economic conditions.

Three stocks from the Zacks Utilities sector – American Electric Power AEP, American Water Works AWK, and CenterPoint Energy CNP – could all be considerations for investors. Below is a chart illustrating the performance of all three over the last month, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, both CNP and AWK have outperformed the general market over the last month, with AEP not far behind. Let’s take a closer look at all three.

American Water Works

American Water Works provides water and wastewater services to millions, with its infrastructure efficiently serving an expanding customer base.

It’s difficult to ignore the company’s shareholder-friendly nature, with AWK boasting a 9% five-year annualized dividend growth rate. Currently, AWK’s annual dividend yield stands at 1.7%.

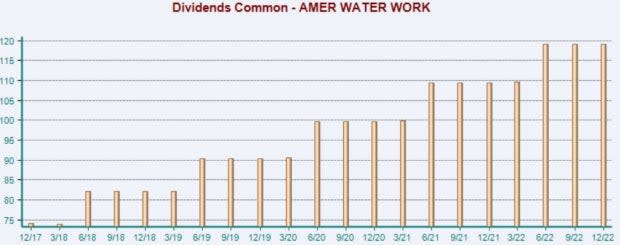

Image Source: Zacks Investment Research

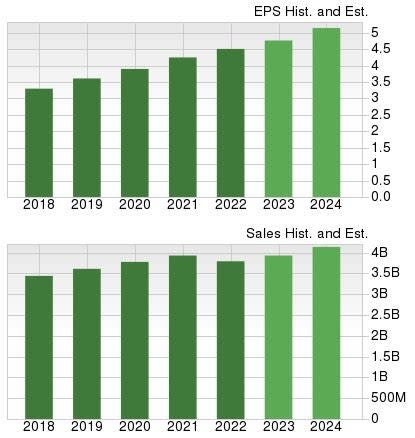

The company continues to grow steadily, with the Zacks Consensus EPS Estimate of $4.77 for its current fiscal year indicating an improvement of more than 5% year-over-year. And in FY24, earnings are expected to improve by an additional 8%.

Image Source: Zacks Investment Research

American Water Works posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS Estimate by nearly 7%. Further, operating income totaled $261 million, growing 18% year-over-year and reflecting improved profitability.

American Electric Power

American Electric Power Company is a public utility holding company that generates, transmits, and distributes electricity, natural gas, and other commodities.

Like AWK, American Electric Power has shown a commitment to increasingly rewarding shareholders, growing its payout by 6% over the last five years.

AEP’s annual dividend presently yields 3.5%, modestly above the Zacks Utilities sector average.

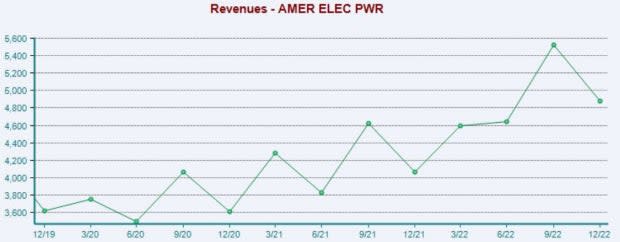

Image Source: Zacks Investment Research

American Electric positively surprised on the top and bottom line within its latest earnings release, with quarterly revenue of $4.8 billion reflecting a sizable 15% beat and improving 20% year-over-year.

Image Source: Zacks Investment Research

CenterPoint Energy

CenterPoint Energy provides electric transmission/distribution, natural gas distribution, and competitive natural gas sales and services operations. The company currently sports a favorable Zacks Rank #2 (Buy).

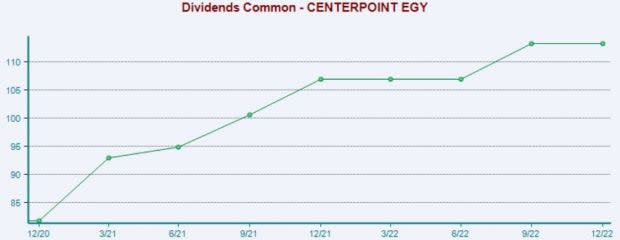

Like the stocks above, CNP is no stranger to rewarding its shareholders; CNP’s annual dividend currently yields 2.5% paired with a payout ratio sitting sustainably at 52% of its earnings.

While the yield is below the Zacks sector average, CNP has grown its payout by nearly 12% just over the last year.

Image Source: Zacks Investment Research

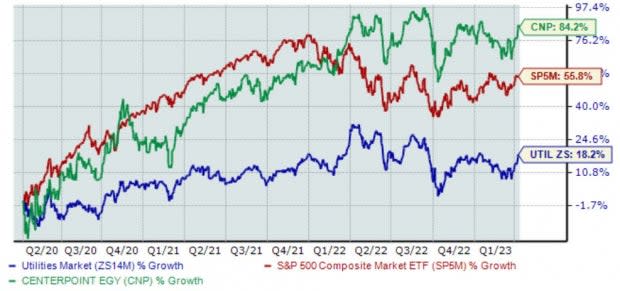

Interestingly enough, CenterPoint energy shares have been notably strong over the last three years, widely outperforming the S&P 500 and the Zacks Utilities sector.

Image Source: Zacks Investment Research

Bottom Line

Utilities can provide a heightened level of defense within portfolios, as the sector is known for its steady and predictable demand.

In addition, many stocks in the realm pay dividends, allowing investors to reap a steady income stream and the potential of maximum returns via dividend reinvestment.

All three stocks above from the Zacks Utilities sector – American Electric Power AEP, American Water Works AWK, and CenterPoint Energy CNP – have seen buying pressure as of late, indicating favorable momentum.

For those looking to take a step back from volatility, all three deserve a watchlist spot.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance