Bulb bailout may cost UK government billions less than feared, says watchdog

The bailout of the bust energy supplier Bulb is expected to cost the government billions of pounds less than originally feared because of a sharp fall in wholesale gas prices, according to the National Audit Office.

The public spending watchdog said the government may end up spending £246m on saving the supplier, which has 1.5 million customers and was acquired by Octopus Energy late last year.

Although this may ultimately be added to customer bills, it represents a far lower cost than the £6.5bn estimate made in November by the Office for Budget Responsibility (OBR).

The NAO said in a report that the gross cost to the taxpayer between Bulb’s collapse in November 2021 and the end of January this year was just over £3bn. It expects Octopus to repay £2.96bn as part of a deal that saw the government take on the cost of buying customers’ energy over the winter. Octopus is not expected to repay these funds until 2024, or even 2025.

The OBR said this month that the government had indicated the bailout would be “fiscally neutral”.

The cost of Bulb’s administration, which was expected to be the biggest government bailout since the rescue of RBS in 2008 during the financial crisis, has been closely watched amid complaints from rivals who have accused Octopus of receiving preferential terms during the bidding process. Octopus denies this was the case.

The cost of bailing out Bulb has hinged on wholesale gas prices, which have soared over the past year after Russia’s invasion of Ukraine squeezed supplies.

The NAO detailed how the government and Bulb’s administrator, Teneo, were faced with a choice of buying energy well in advance or in the day-ahead market. The former strategy would have provided more certainty on budgets but the government preferred not to hedge as it would not benefit from falling wholesale costs, the NAO said.

The watchdog said the decision had reduced the cost to the taxpayer by £240.7m.

“The decision resulted in an unplanned taxpayer benefit from the reduction in wholesale energy prices from the peak in August 2022 to the prices in January 2023. Several risks remain to the recovery of taxpayer funding, which may ultimately be absorbed by household customers,” the NAO said.

“The government has achieved its objectives to maintain supplies to Bulb customers and to complete the sale process.”

It said Ofgem, the energy industry regulator, had advised Teneo and the government to “adopt at least a partial hedging position to manage risk both on price and volume”.

The report shows that the government spent £52.7m on external advisers, including £35.4m on Teneo and £12m on lawyers at Linklaters. Advisers from Lazard, EY and Hogan Lovells also received fees. Octopus paid £113m for the Bulb customer book.

The Guardian revealed in November that the NAO intended to scrutinise the Octopus takeover, which was agreed in October 2022.

Bulb was founded in 2015 by the entrepreneurs Amit Gudka and Hayden Wood as a challenger to the incumbent large energy suppliers. However, a sharp rise in wholesale gas prices left the company struggling and it collapsed in November 2021.

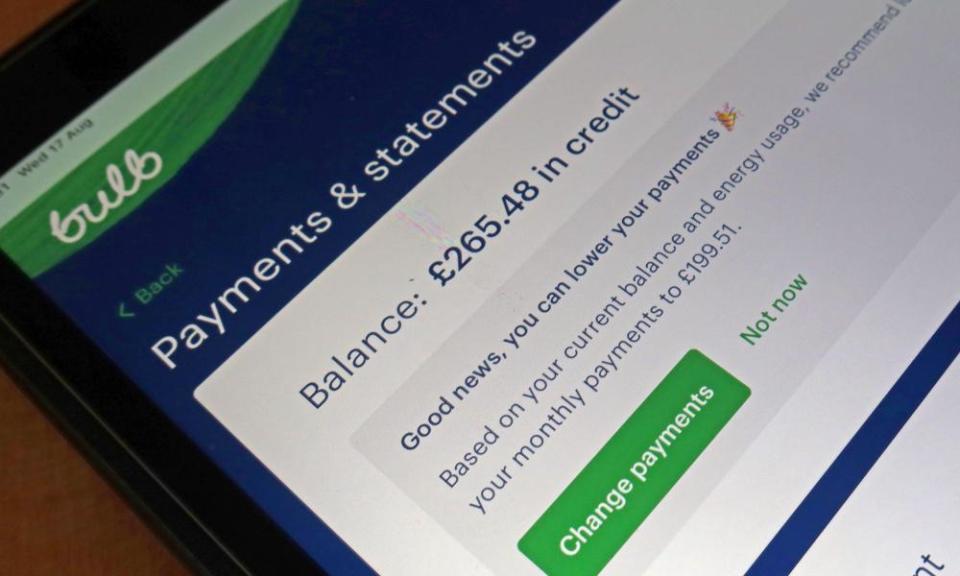

The NAO report said Ofgem had reviewed the deal and that the rapid growth of Octopus had resulted in it “having a weaker financial position than other large suppliers”. Ofgem also “identified risks around Octopus’s low levels of investor support and its over-reliance on customer credit balances for working capital”. Energy suppliers have been accused of hoarding customer funds.

However, Ofgem said Octopus could manage the risks of taking on Bulb, and Teneo concluded that the government would be in no worse position if the administration process was run again.

An Octopus spokesperson said: “Our acquisition of Bulb has ultimately provided the best outcome for everyone. Not only did [the deal] end the government and taxpayer’s huge financial exposure, it has brought certainty to Bulb’s staff and customers, the majority of whom have already transferred to Octopus.”

Yahoo Finance

Yahoo Finance