Bull of the Day: eBay (EBAY)

eBay Inc. (EBAY) is an online shopping platform that is well-positioned in the digital marketplace space. Over the years, the company has evolved from a relatively small community user-based auction site to an e-commerce giant. eBay also uses structured data initiatives to better understand, organize, and leverage the inventory on its site, as well as to deliver more personal user experiences.

Orders Surge During Pandemic

Like many online retail shops, eBay saw—and is still seeing—major strength during the pandemic.

The company said in a press release earlier this month that business is performing “significantly” better than they anticipated. For April and May, eBay added 6 million new and reactivated buyers.

Categories like Home & Garden, Electronics, Fashion, Auto Parts, and Collectibles all experienced a surge in demand.

Looking ahead, the company anticipates an even better second quarter than originally expected.

Revenue is now projected to fall in the range of $2.75 billion and $2.8 billion (compared to the prior forecast of $2.38 billion to $2.48 billion), representing 13% to 16% year-over-year growth. Non-GAAP EPS should fall between $1.02 to $1.06 per share, well above the previous range of $1.73 to $0.80 per share.

Gross merchandise volume (GMV) is also expected to continue to be strong in the second quarter, up between 23% to 26%.

If eBay hits the high end of the updated earnings guidance, its bottom line would grow 60% year-over-year.

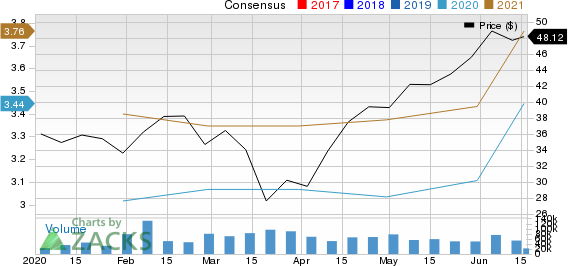

EBAY is Rallying

Year-to-date, shares of EBAY are up over 35% compared to the S&P 500’s 3.3% decline. Earnings estimates have been rising too, and eBay is a Zacks Rank #1 (Strong Buy) right now.

For the current fiscal year, 12 analysts have revised their bottom-line estimate upwards in the last 60 days, and the Zacks Consensus Estimate has moved up 44 cents to $3.45 per share; earnings are expected to increase almost 22% compared to the prior year period. 2021 looks strong as well, with nine analysts boosting their estimate for the year.

eBay believes it has a really good chance that it will exceed its full-year outlook, but like many other companies, it has yet to update its full-year forecast. Investors can expect a more detailed 2020 outlook when the company reports Q2 results next month.

If you’re an investor searching for a tech stock to add to your portfolio, make sure to keep EBAY on your shortlist.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance