Bull of the Day: Enphase Energy, Inc. (ENPH)

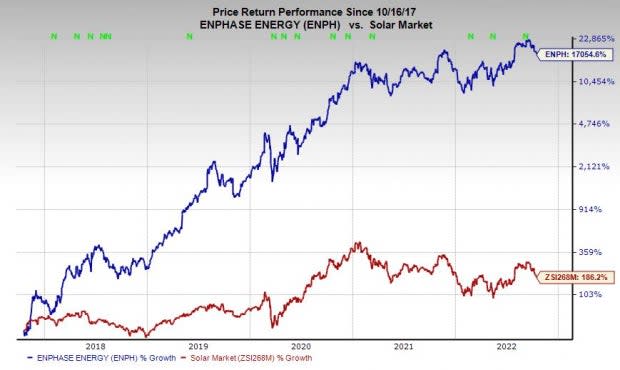

Enphase Energy, Inc. ENPH is a solar energy company that operates in the inverter space, which has been able to sustain far more consistent growth than the broader solar industry. Enphase stock has skyrocketed over the last five years and it’s climbed to fresh highs in 2022 even as the market falls and growth stocks tumble.

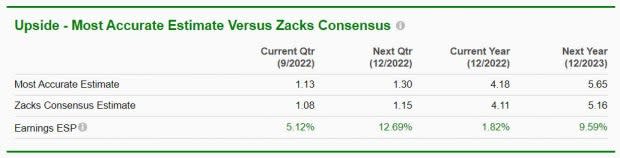

Enphase reports its third quarter results on October 25. ENPH’s most recent analyst estimates suggest it might be poised to post another huge quarter and provide upbeat guidance as the solar energy sector continues to gain momentum in the U.S. and beyond.

Enphase Basics

Enphase is a solar energy firm that’s thrived as the one of largest sellers of microinverter-based solar and battery systems in the world. Inverters are vital high-tech components in the solar energy ecosystem because they convert the DC (direct current) power that solar PV (photovoltaic) panels produce into the AC (alternating current) power used in our homes and businesses.

Enphase has hundreds of patents and patent filings covering various renewable energy technology for the U.S. and beyond. Enphase has thrived in a space alongside others such as SolarEdge Technologies SEDG because its microinverters are designed to work one-for-one with each individual solar module to help generate more consistent power and for production to continue even if one module or panel fails.

Meanwhile, string or central inverters often stop working if just one panel fails. Plus, microinverters help things run smoothly if one or more panels are obstructed by leaves, snow, clouds, or something else because the panels operate independently. Enphase has been perfecting its flagship microinverters since 2008 and they are designed to last up to 25 years to match the length of the panels themselves.

Overall, Enphase aims to connect solar generation, storage, and energy management into one intelligent platform. The company has gained traction within the home solar space, as well as for businesses and installers, working directly with the likes of SunPower, Panasonic, and others.

Enphase has also expanded beyond microinverters into the battery storage segment that allows users to store power, which is crucial given the variability of the sun. And its namesake app aims to help homeowners and businesses effectively and efficiently manage their power usage, storage, and more.

Image Source: Zacks Investment Research

Growth Outlook

Renewables accounted for 20% of the total U.S. electricity generation mix in 2021, to put the growing segment neck and neck with coal. This marks a stark contrast to 2010 when coal accounted for around 45% of electricity and renewables generated 10%—almost all from hydropower.

The U.S. Energy Information Administration projects renewable’s share of the electricity mix will double by 2050, with a bulk of the growth expected to come from solar. Plus, the U.S. and many other governments around the world are spending money and offering tax incentives to spur growth in solar and other alternative energies.

Enphase has ample runway as solar energy expands, with many envisioning a smart-home future where solar panels power homes, electric cars, and even allow consumers to sell electricity back to the grid. The company has relationships with many different solar panel companies and it’s growing its reach outside of the U.S. Enphase announced in early September that it boosted its distribution partnership with German firm BayWa r.e. AG.

The solar industry is just starting to take off. Enphase’s revenue climbed from around $300 million in fiscal 2018 to $1.38 billion in FY21. Zacks estimates call for ENPH’s revenue to surge another 63% on top of last year’s 79% expansion to pull in $2.25 billion in 2022. Enphase is then projected to post another 33% sales growth to reach $3 billion in FY23.

Enphase’s adjusted earnings are projected to climb 71% this year and an additional 26% next year to hit $5.16 per share. Plus, the company has continued to up its bottom-line guidance in the face of rising costs and a global economic slowdown that’s seen the earnings outlook for the S&P 500 fade rather significantly.

ENPH has topped our quarterly EPS estimates by an average of 25% in the trailing four quarter. And its Zacks Most Accurate estimates (most recent) have come in higher than the current consensus, especially for FY23. This bottom-line positivity is a great sign and highlights Enphase’s resilience and growth, and helps it land a Zacks Rank #1 (Strong Buy) right now.

Image Source: Zacks Investment Research

Other Fundamentals

Enphase soared from around $3 per share five years ago all the way to $240 at the moment. This run includes a 900% surge in the past three years. ENPH stock is also up 40% in the trailing 12 months to blow away its Zacks Alt-Energy market’s 13% drop and its Solar industry’s 18% dip. ENPH has also managed to climb 32% in 2022 even as the market tumbles and growth stocks get crushed.

The stock has fallen recently, which should help investors grab a better entry point. Enphase is down 25% since it hit new all-time highs in the middle of September to trade at around $242 per share. In terms of valuation, ENPH is not what anyone would call cheap, but that’s not the kind of stock it is right now.

ENPH trades at 67X forward earnings vs. its Solar industry’s 52X. This is far better than the 120X it traded at this time last year and well off its highs. Wall Street is willing to pay up for its future growth and its 1.5 PEG ratio nearly matches its industry’s average and is directly in line with Tesla TSLA.

Enphase also sports a solid balance sheet, with $1.3 billion in cash and equivalents and $2.4 billion in total assets vs. $480 million in current liabilities and $1.9 in long-term debt, with it taking on more debt in recent years to fuel expansion.

Image Source: Zacks Investment Research

Bottom Line

Enphase’s earnings outlook has climbed steadily higher and higher over the last several years. Wall Street remains rather bullish on the stock given its current standing in a red-hot industry and its ability to continue innovating in the solar market that has decades of expansion ahead.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance