Bull of the Day: Royal Gold (RGLD)

Want to invest in gold and silver? Royal Gold Inc. RGLD is a precious metals stream and royalty company. This Zacks Rank #1 (Strong Buy) is expected to grow earnings by the double digits this year.

Royal Gold acquires and manages precious metal streams, royalties and similar production-based interests. As of Mar 31, 2023, Royal Gold owned interests on 182 properties on 5 continents, including interests on 40 producing mines and 19 development stage projects.

It is not a gold miner.

Investor Day and 2023 Guidance Coming on Apr 20, 2023

On Apr 20, 2023, Royal Gold will hold a Virtual Investor Day from 9:30 am to 12:00 ET where it will give a strategic update of the business. This will include 2023 guidance.

The company will issue a press release detailing the 2023 guidance before the market opens. There will be a live question and answer session during the Investor Day.

It will report first quarter 2023 results on May 4, 2023.

Beat in the Fourth Quarter 2022

On Feb 15, 2023, Royal Gold reported fourth quarter and full year 2022 results and beat on the Zacks Consensus by $0.08. Earnings were $0.91 versus the Zacks Consensus of $0.83.

“Our solid fourth quarter results capped off another very successful year for Royal Gold,” said Bill Heissenbuttel, CEO of Royal Gold.

“We manage our business adhering to a long term strategy that considers adding growth by acquiring high quality assets, funding that growth with limited equity dilution, maintaining a strong balance sheet and liquidity, and increasing our capital return to shareholders," he added.

For the full year, revenue was $603.2 million, with $417.8 million from stream revenue and $185.4 million from royalty revenue.

It saw an average gold price of $1,800 per ounce, an average silver price of $21.73 per ounce and an average copper price of $3.99 per pound. Average prices were weaker than in 2021. In 2021, the average gold price was $1,799 per ounce, the average silver price was $25.14 per ounce and the average copper price was $4.23 per pound.

In 2022, Royal Gold's mix was 73% gold, 11% silver and 12% copper.

Analysts Are Bullish

The analysts are bullish on Royal Gold in 2023. 1 estimate has been raised in just the last week, pushing the Zacks Consensus for 2023 up to $4.02 from $3.77 in the last 30 days.

That's earnings growth of 17.2% as the company made $3.43 last year.

They expect the growth to continue in 2024 as well with the Zacks Consensus at $4.26, or another 6.1% gain.

Royal Gold Joined the S&P High Yield Dividends Index

In the fourth quarter, Royal Gold raised its dividend by 7% to $1.50 per share. That was the 22nd consecutive year it increased its dividend.

That puts it in exclusive company among other dividend aristocrats, who have raised their dividend every year for over 20 years.

The company was added to the S&P High Yield Dividend Index last year. It's dividend is currently yielding 1.1%.

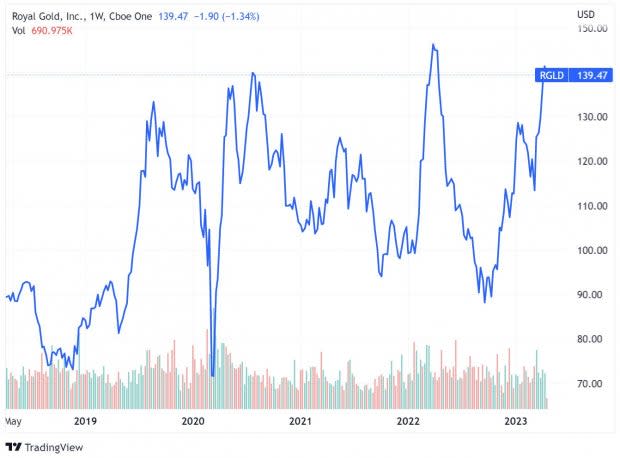

Shares Up Big in 2023

The precious metals are back in favor in 2023 and so are the stocks. Shares of Royal Gold are up 23.7% year-to-date but it's been a wild five year ride.

Image Source: Zacks Investment Research

It's not cheap on a P/E basis, with a forward P/E of 34.6.

But if you're looking at gold and silver this year, Royal Gold should be on your short list.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance