Bumble Inc. (BMBL) Q1 2024 Earnings: Revenue and Earnings Exceed Expectations

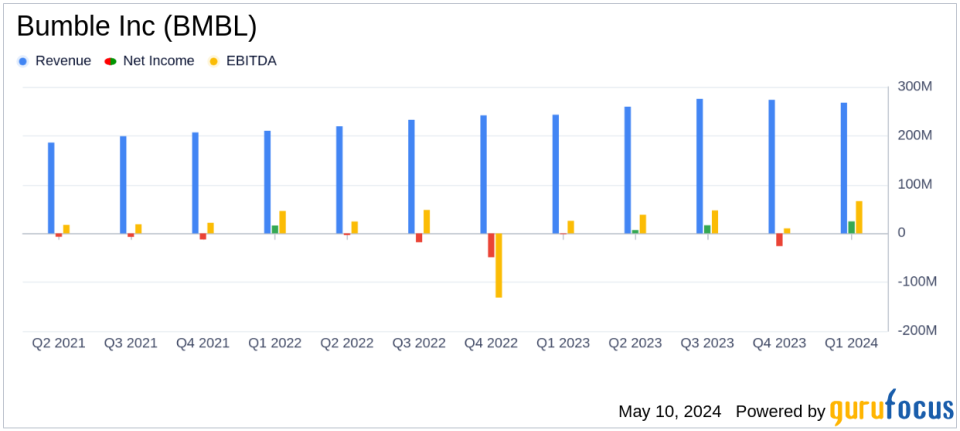

Revenue: Reported at $267.8 million, up 10.2% year-over-year, falling short of estimates of $278.63 million.

Net Earnings: Achieved $33.9 million, significantly exceeding estimates of $17.89 million and reversing a net loss from the previous year.

Earnings Per Share (EPS): Details not provided in the earnings report, comparison to estimated EPS of $0.17 not possible.

Adjusted EBITDA: Reached $74.0 million, representing 27.6% of revenue, an improvement from 24.4% in the prior year.

Paying Users: Increased to 4.0 million from 3.5 million year-over-year.

Average Revenue per Paying User (ARPPU): Decreased to $21.84 from $22.83, indicating a drop in revenue generated per user.

Share Repurchase Program: $84 million in share repurchases conducted, with an increase in the program from $300 million to $450 million.

Bumble Inc. (NASDAQ:BMBL) announced its first quarter earnings for 2024, revealing a significant increase in revenue and net earnings. The company released its financial results through an 8-K filing on May 8, 2024, showcasing a robust performance that surpassed analyst expectations.

Bumble Inc., a leading online dating service provider, operates popular apps such as Bumble and Badoo. These platforms are designed to help users discover new people and forge connections, ranging from romantic relationships to friendships.

Financial Highlights

For Q1 2024, Bumble Inc. reported a total revenue of $267.8 million, a 10.2% increase from $242.9 million in the same quarter the previous year. This performance is particularly noteworthy as it exceeded the estimated revenue of $278.63 million. The Bumble app alone generated $215.8 million, up 11.1% year over year, despite a slight unfavorable impact from foreign currency movements.

Net earnings stood at $33.9 million, a significant improvement from a net loss of $2.3 million in Q1 2023. This translates to a net margin of 12.6%, reflecting efficient cost management and operational execution. Adjusted EBITDA was $74.0 million, or 27.6% of revenue, compared to $59.3 million, or 24.4% of revenue, in the prior year, indicating enhanced profitability.

Operational Metrics and Strategic Developments

The total number of paying users increased to 4.0 million from 3.5 million in the previous year, with the Bumble app's paying users growing by 18% to 2.7 million. However, the Average Revenue per Paying User (ARPPU) saw a slight decline to $21.84 from $22.83, which could be attributed to broader market dynamics and pricing strategies.

CEO Lidiane Jones highlighted the relaunch of the Bumble app as a key step in the company's evolution, aimed at enhancing user experience and engagement. The company's focus remains on innovation and customer-centric features that empower women to make the first move in building connections.

Financial Position and Outlook

Bumble Inc. maintains a solid financial foundation, with $262.7 million in cash and cash equivalents and a manageable debt level of $619.9 million as of March 31, 2024. The company also announced an increase in its share repurchase program from $300 million to $450 million, underscoring its confidence in the business and commitment to delivering shareholder value.

Looking ahead to Q2 2024, Bumble anticipates revenue between $269 million and $275 million and adjusted EBITDA between $69 million and $73 million. For the full year, the company expects revenue growth of 8% to 11% and an adjusted EBITDA margin improvement of at least 300 basis points.

Conclusion

Bumble Inc.'s Q1 2024 results demonstrate a strong start to the year, with significant revenue growth and profitability enhancements. The company's strategic initiatives, particularly the relaunch of its flagship Bumble app, are set to further propel its market position and financial performance. Investors and stakeholders can look forward to continued growth and operational excellence as Bumble navigates the evolving online dating industry landscape.

For detailed insights and further information, you can access the full earnings report here.

Explore the complete 8-K earnings release (here) from Bumble Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance