Bumble's (NASDAQ:BMBL) Q1: Beats On Revenue But Quarterly Guidance Underwhelms

Online dating app Bumble (NASDAQ:BMBL) beat analysts' expectations in Q1 CY2024, with revenue up 10.2% year on year to $267.8 million. On the other hand, next quarter's revenue guidance of $272 million was less impressive, coming in 2.4% below analysts' estimates. It made a GAAP profit of $0.19 per share, improving from its loss of $0.01 per share in the same quarter last year.

Is now the time to buy Bumble? Find out in our full research report.

Bumble (BMBL) Q1 CY2024 Highlights:

Revenue: $267.8 million vs analyst estimates of $265.5 million (small beat)

EPS: $0.19 vs analyst estimates of $0.07 ($0.12 beat)

Revenue Guidance for Q2 CY2024 is $272 million at the midpoint, below analyst estimates of $278.7 million (adjusted EBITDA also guided below for Q2 CY2024)

Gross Margin (GAAP): 69.6%, down from 70.9% in the same quarter last year

Free Cash Flow was -$381,000, down from $61.25 million in the previous quarter

Paying Users: 4.02 million, up 564,500 year on year

Market Capitalization: $1.30 billion

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

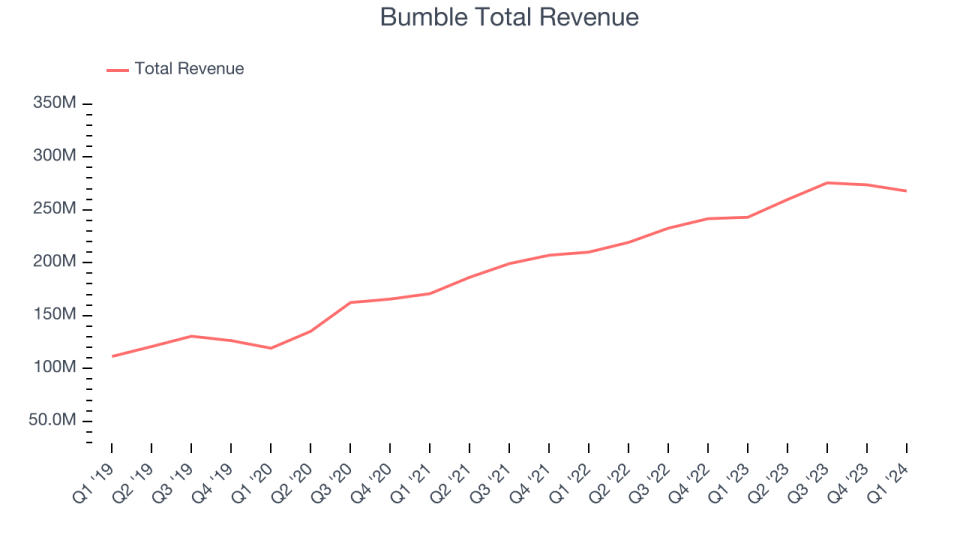

Sales Growth

Bumble's revenue growth over the last three years has been solid, averaging 19.7% annually. This quarter, Bumble reported mediocre 10.2% year-on-year revenue growth, in line with analysts' expectations.

Guidance for the next quarter indicates Bumble is expecting revenue to grow 4.7% year on year to $272 million, slowing from the 18.5% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 9.7% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Usage Growth

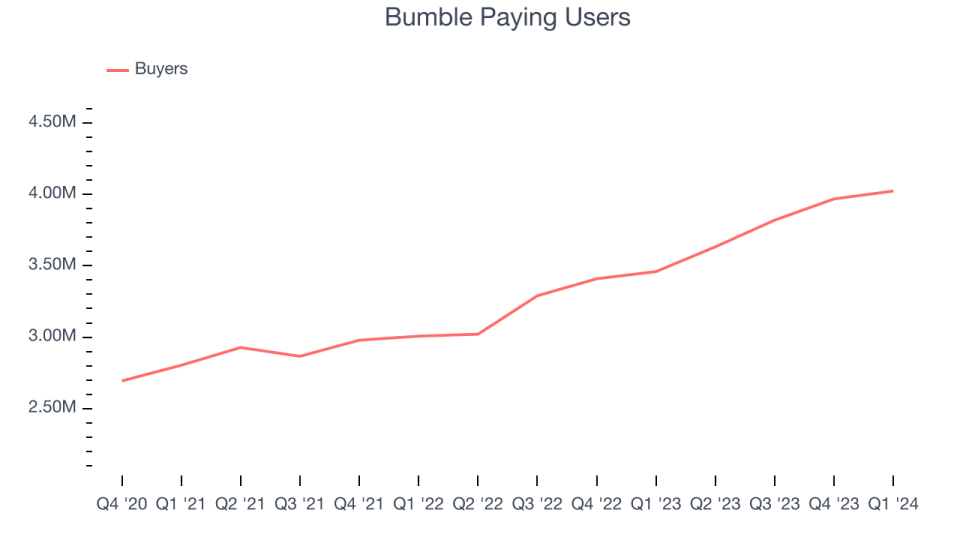

As a subscription-based app, Bumble generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Over the last two years, Bumble's active buyers, a key performance metric for the company, grew 14.6% annually to 4.02 million. This is solid growth for a consumer internet company.

In Q1, Bumble added 564,500 active buyers, translating into 16.3% year-on-year growth.

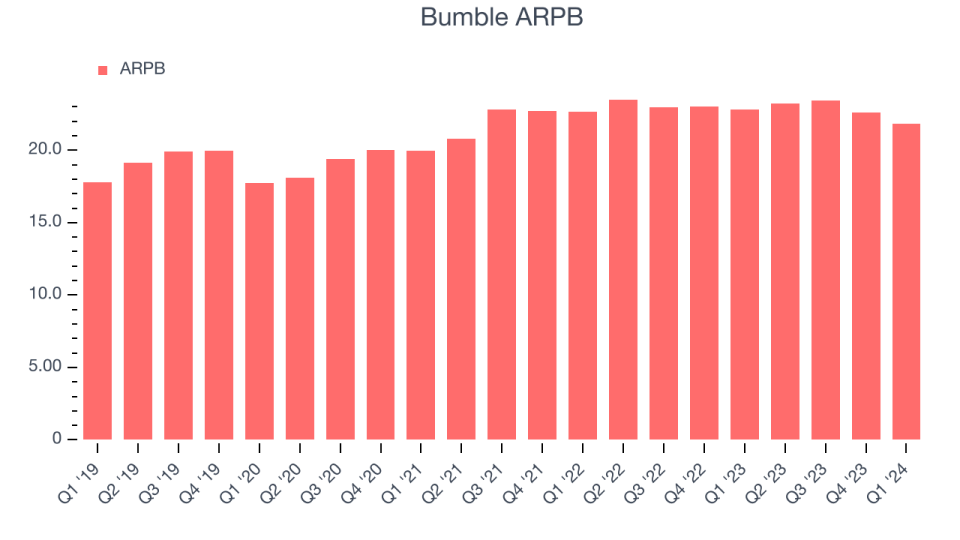

Revenue Per Buyer

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Bumble because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Bumble's ARPB growth has been subpar over the last two years, averaging 1.4%. The company's ability to increase prices while maintaining its active buyers, however, shows the value of its platform. This quarter, ARPB declined 4.3% year on year to $21.84 per buyer.

Key Takeaways from Bumble's Q1 Results

It was great to see Bumble increase its number of buyers this quarter. On the other hand, its revenue and adjusted EBITDA guidance for next quarter missed analysts' expectations and its revenue growth stalled. Looking to the full year, the company still thinks it can hit previously-given guidance and reiterated its revenue and adjusted EBITDA outlook for 2024. Overall, this was a mixed quarter for Bumble. The stock is up 5% after reporting and currently trades at $10.76 per share.

So should you invest in Bumble right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance