Bunge Limited (BG) to Report Q4 Earnings: What's in Store?

Bunge Limited BG is scheduled to report fourth-quarter 2022 results before the opening bell on Feb 8.

Q3 Performance

In the last reported quarter, Bunge Limited witnessed a decline in earnings despite higher revenues. The company however beat the Zacks Consensus Estimate on both metrics. BG has a trailing four-quarter earnings surprise of 18.7%, on average.

Bunge Limited Price and EPS Surprise

Bunge Limited price-eps-surprise | Bunge Limited Quote

Q4 Estimates

The Zacks Consensus Estimate for BG’s fourth-quarter total sales is pegged at $18.2 billion, suggesting growth of 9.2% year over year. The consensus mark for quarterly earnings currently stands at $3.19, indicating a decline of 8.6% year over year. The earnings estimate has moved up 2% over the past 30 days.

Factors to Note

The company has been benefiting from efforts to drive operational performance, portfolio optimization and focus on cost management. Favorable commodity prices are likely to have favored the company’s fourth-quarter performance.

The Zacks Consensus Estimate for the Refined and Specialty Oils' revenues is pegged at $4,072 million, suggesting growth of 8% from the year-earlier quarter. The segment's results in the quarter are likely to reflect the ongoing strength in North America, South America and Europe refining, which have been benefiting from strong food demand. The estimate for the segment’s operating income is currently at $201 million.

The Zacks Consensus Estimate for the Milling segment's revenues is pegged at $575 million, indicating an improvement of 11% from the year-ago period. The company’s effective management of its supply chain is likely to have contributed to the segment’s performance. Higher volumes in the United States are likely to get reflected in the segment’s quarterly performance. The estimate for the segment’s operating income is currently at $24.5 million.

The Zacks Consensus Estimate for the Agribusiness segment's revenues is currently pegged at $14,091 million, indicating an improvement of 14% from the prior-year quarter's revenues of $12,324 million. While the segment is expected to have benefitted from the ongoing momentum in North and South America, lower results in Europe due to elevated energy costs are expected to reflect on its results. Results in China will also bear the impact of pandemic-related restrictions.

Overall volumes are thus expected to be lower for the segment. Performance in Merchandising is expected to be down year over year in the quarter considering it was pitted against a very strong performance last year. The segment’s adjusted segment earnings before interest and tax (EBIT) are projected at $560 million, indicating a 6% decline from the last year.

The Zacks Consensus Estimate for Sugar & Bioenergy segment's revenues stands at $59 million, indicating a 26% drop year over year. Lower ethanol prices and increased costs are likely to have hurt the segment’s margins in the quarter under review. The segment’s adjusted EBIT is currently pinned at $12.5 million, indicating a 38% plunge from the $20 million in the fourth quarter of 2021.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Bunge Limited this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Earnings ESP: The Earnings ESP for Bunge Limited is -0.31%. You can uncover the best stocks before they're reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 2. You can see the complete list of today's Zacks #1 Rank stocks here.

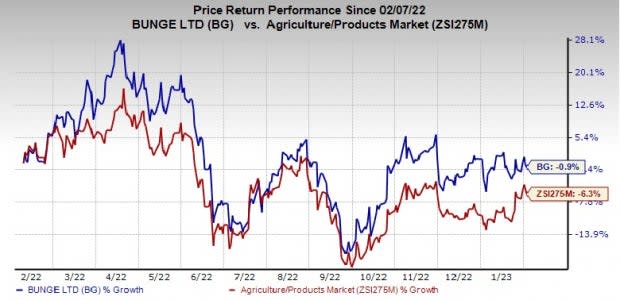

Price Performance

Image Source: Zacks Investment Research

Shares of Bunge Limited have declined 0.9% over the past year, compared with the industry's 6.3% decline.

Other Stocks Poised to Beat Estimates

Here are some Basic Materials stocks, which, according to, our model, also have the right combination of elements to post an earnings beat in their upcoming releases.

Albemarle Corporation ALB, slated to release earnings on Feb 15, has an Earnings ESP of +7.16% and carries a Zacks Rank of 3.

The Zacks Consensus Estimate for Albemarle’s fourth-quarter earnings has been revised 2.6% upward in the past 60 days. The Zacks Consensus Estimate for ALB’s earnings for the quarter is pegged at $7.89.

Royal Gold RGLD, expected to release earnings on Feb 15, has an Earnings ESP of +7.73%.

The Zacks Consensus Estimate for RGLD’s fourth-quarter earnings is currently pegged at 73 cents. The company currently carries a Zacks Rank of 3.

Teck Resources Limited TECK, scheduled to release earnings on Feb 21, has an Earnings ESP of +6.78%.

The Zacks Consensus Estimate for Teck Resources’ fourth-quarter earnings is currently pegged at 93 cents. TECK currently carries a Zacks Rank of 2.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bunge Limited (BG) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Teck Resources Ltd (TECK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance